India’s RBI Governor Dr. Rahuram Rajan’s Message:

RBI governor Dr. Raghuram Rajan in his message to RBI staff on June 18, 2016 conveyed his decision to move back into academics after his term ends in September 2016.Dr. Rajan said that “while I was open to seeing these developments through, on due reflection, and after consultation with the government, I want to share with you that I will be returning to academia when my term as Governor ends on September 4, 2016. I will of course, always be available to serve my country when needed.” The message clearly suggested that his action was the result of the ongoing difference of opinion between the ministry of finance and Dr. Rajan on certain economy related issues and the noises created by a section of ruling party in India on his handling of the economy.

What caused the difference of Opinion with the Government?

The differences occurred due to 1) the reluctance of the RBI governor to reduce interest rates for propelling growth despite significant reduction in inflation and 2) The stress generated in the banking system due to tightening of norms by the RBI at a time when the economy was facing headwinds. A section of the ruling party in India is of the opinion that Dr. Rajan, being an appointee of the former UPA government was not aligned with the NDA’s growth agenda. A letter to the Prime Minister Mr. Narendra Modi from a Member of Parliament of the ruling NDA alliance Dr. Subramaniam Swamy (A PhD in economics from Harvard and an ex-professor at one of India’s elite universities, IIT Delhi) suggested that the governor’s shifting of the goal post reduced the possibility of faster interest rate cuts. The RBI had changed the measure of inflation from wholesale to retail inflation (WPI to CPI) just a month ahead of NDA’s election to power. While the political voices suggest dissent, CPI is a better reflector of demand side pressure in the economy as it also captures the inflation in services (excluded in WPI calculations), which accounts for ~60% of India’s GDP and aligns India with global best practice. Besides adopting CPI as the key indicator of inflation, Dr. Rajan initiated the creation of a panel (Monetary Policy Committee – MPC) to set interest rates in India, currently the prerogative of the RBI governor. He also initiated the process of spinning off the RBI’s management of government debt by taking steps to set up a public debt management agency. Dr.Rajan also initiated an Asset Quality Review of public sector banks with the aim of cleaning up their balance sheets. We firmly believe that the measures taken by the RBI with Dr. Raghuram Rajan as its governor were prudent from an economic perspective, despite politically being a different story. Under Dr. Rajan, India’s inflation remained under control, currency remained stable and forex reserves reached a record high of USD 380 billion. The RBI also issued licenses to two universal banks and eleven payment banks during his tenure.

RBI is a Strong & Independent Regulator:

Our View & the way forward:

We believe that the new RBI governor appointed by the NDA government, whilst may not have the same international fan following like Dr. Rajan, would be equally good and well regarded. Some of the names doing the rounds are accomplished Economists, ex-RBI deputy governors, Chairman of Banks, etc., The change in guard at the RBI will not make much of a difference in the monetary policy framework of the RBI, given that the decisions on inflation targets and setting of interest rates will be taken by a monetary policy committee (MPC) in line with global best practices. The MPC constitutes six members (shown as exhibit 1), with three members from the RBI (the governor, the deputy governor in-charge of monetary policy and the executive director in-charge of monetary policy) and three independent directors with domain knowledge, appointed by the government. The search panel for government appointees will comprise the Cabinet secretary, the economic affairs secretary, the RBI governor and three experts in economics or banking nominated by the government. We expect that the directors appointed by the search panel would indeed be experienced and knowledge experts with independent views, making the monetary policy framework much more robust. Governor Dr.Rajan had also expressed his satisfaction on the constitution of the MPC saying that “ I am absolutely on board and happy with it”.

Exhibit 1: Monetary Policy Committee Constituents:

|

RBI Members |

Government Nominated Members |

| Governor[3] | Independent Director selected by a search panel |

| Deputy Governor | Independent Director selected by a search panel |

| Executive Director | Independent Director selected by a search panel |

The R-Exit has been welcomed by a few senior bankers and practitioners affected by the ongoing slowdown in sectors like steel and infrastructure. This implies that the good work started by Dr. Rajan of cleaning up the books of public sector banks in Inddia may take a back seat for some time. Nevertheless, some of the issues relating to non-performing assets will automatically be resolved with the next turn in the economic cycle. One will need to observe how the new governor would tackle the NPA issues, especially in cases wherein the intent of the borrower is suspect.

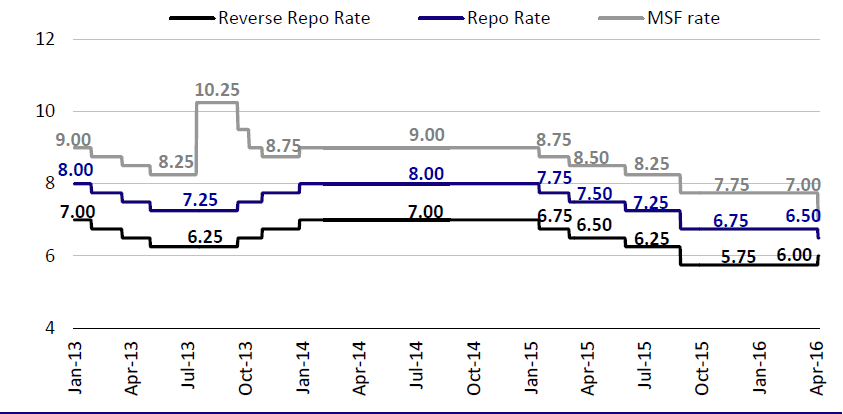

For now, the immediate challenges for Dr. Rajan as well as the new governor will be the transmission of interest rate cuts (exhibit 2) which have already been actioned, handling of the economy moving forward in an ongoing uncertain global environment (Brexit being the immediate area of concern) and outflows of foreign currency non-resident deposits to the tune of AU$27 billion maturing in Sept-Nov 2016. The global uncertainties and outflows could pose some challenges for the RBI in managing forex volatility, an area which Dr. Rajan had managed very well over the last few years. All eyes will be on the next governor as to how well he/she is able to effectively handle such challenges going forward.

Exhibit 2: RBI Policy Actions with Dr. Raghuram Rajan as its Governor (From Sept’ 2013)[4]

Source: RBI

_________________________________________________________________

[1] IOSCO; BIS Report:http://www.iosco.org/library/pubdocs/pdf/IOSCOPD440.pdf;

[2] The RBI was assessed by BIS for principles and responsibilities for financial market infrastructure for implementation of central counterparties, trade repositories, payment systems, central securities depository and securities settlement system.

[3] The RBI Governor would head the monetary policy committee and would have a casting vote in case of a tie

[4] MSF – Marginal Standing Facility is a window for banks in India to borrow overnight money from the Reserve Bank of India in an emergency situation when interbank liquidity dries up.

India Avenue is a boutique investment management firm providing investment solutions that allow our clients to benefit from India’s remarkable growth story.

OUR BUSINESS

2005

The journey towards the “birth” of India Avenue originated in 2005, when ING Investment Management started a business in India as a separate division, utilising a practiced multi-manager philosophy in markets like Australia, and exported it to India. Three of our founders, Mugunthan Siva, Rajeev Thakkar and Sajjan Raut Desai worked together for INGIM (India), building investment strategies and structures, under this philosophy and applying them to Indian capital markets

2011

In 2011 our founders started discussing the possibility of building an investment firm with a capability to provide a focus on India as an stand-alone investment jurisdiction for foreign investors. The founders identified Australia and New Zealand as nascent markets for investing in regional locations, with the potential to accelerate given education and insights which the firm could provide.

2015

By 2015 the group of founders decided to work full-time on this concept to bring it to life. They did this by leaving their existing employment, thus exercising high conviction in the investment region of India as a long-term structural story for investors in Australia and New Zealand. Thus, the firm India Avenue Investment Management was registered and came to life in 2015 in Sydney, Australia.

2016

After building our business for a period of 12 months, our first fund, The India Avenue Equity Fund was launched on 6th September 2016, with strong service provider partners like Equity Trustees (RE), Mainstream (Fund Administrator), KPMG (Fund Auditor) and BNP India (Custodian).

NOW

India Avenue is now a boutique investment business firm, with clients spread across family offices, high net worth individuals, wealth advisers and financial planning firms. Our firm has focused on education and knowledge as a driver of investment behaviour and have taken a long-term approach towards Australian and New Zealand investors contemplating an allocation to India’s growth as part of their portfolios. Our firm has assets in excess of A$50m and the India Avenue Equity Fund is rated “Recommended”* by Lonsec and is available on multiple investment platforms across Australia and New Zealand.