Exposure to true growth investments are becoming scarce. Given longevity risk, volatility becomes less of an issue and investors should be cognisant of the return needed to keep pace with their end objectives. Understanding the impact of low prospective returns and lack of diversification traditionally provided by bonds on an investor’s portfolio will be crucial. We believe exposure to selective growth investments in an investment portfolio will become increasingly critical as these allocations will drive the bulk of the returns going forward and help achieve the end objective of sustaining wealth. This paper looks at how Indian equities can spice up your portfolio. Click Here To Download The Research Note

2016

I know the India Growth Story, but what am I paying for it?

- admin

- November 17, 2016

- 0 Comments

There is increasing recognition of India’s strong macroeconomic tailwinds of rising GDP growth, falling inflation and increasing foreign reserves, a thriving corporate culture, fuelled by entrepreneurial spirit as well as its pro-reform, pro-business Government, willing to take tough action to fight corruption and bureaucracy. A CORRECTION These are all positives for investors in the India growth story from a long-term perspective. However, in the short term we have witnessed a fall of approximately 10% over the last two months, driven by: Concern over a Trump victory in the US election and the impact this would have on emerging market domiciled company’s Volatility surrounding the Fed’s potential for hiking interest rates. Currently the view held by 92% of economists is that a hike may occur in December 2016. A rising USD, quite often the fallout of interest rate hikes is generally not a friend to emerging market equity returns The Prime Minister of India’s recent “demonetisation” strategy has left the economy starved of liquidity in the short term will have some impact on consumer and infrastructure type companies Our view at India Avenue is that this is potentially a great entry point for a long-term investment in India’s equity market. We feel this is one of the best ways to play the growth story, given liquidity, strong equity market infrastructure and an ecosystem of close to 6,000 listed companies. FOCUSING ON FUNDAMENTALS When we refocus on the fundamentals, then India’s corporate earnings growth of 13-14% per annum over the last 25 years is largely reflective of well managed businesses, driven by well credentialed entrepreneurs, who have thrived in an economic hotspot. However, typically in an economy where companies are generating strong EPS growth, valuations tend to get stretched to reflect the longer-term potential that exists. Quite often this increases the volatility of the market as investors try to time the entry and exit points based on valuation. This is synonymous with behaviour of developed market investors, investing in stock markets of Emerging Market economies. Currently India’s forecast earnings trajectory looks strong using consensus forecasts: TABLE 1: EPS FORECASTS, P/E MSCI India = 961 EPS FY16 (a) EPS FY17 (f) EPS FY18 (f) EPS FY19 (f) MSCI India EPS 46.09 53.76 65.44 78.74 Earnings Growth 3.2% 16.6% 21.7% 20.3% P/E 20.9 17.9 14.7 12.2 Source: Bloomberg, MSCI, India has a fiscal year end of 31 March The key assessment for investors to make is the validity of the earnings forecasts. Even if we slice 20% off earnings then we end up with a 15x multiple for close to 15% earnings growth from FY17-19. LINK BETWEEN VALUATION AND RETURNS When we look back at forward valuations over time and relate that to the experience of investment returns made in the subsequent 3-year period, the relationship is extremely significant (R-squared of 0.91). CHART 1,2: 3 YEAR RETURNS VS P/E 12-MONTH FORWARD Source: Bloomberg, MSCI Whilst this is no rocket science, it reiterates that valuation entry point does play a large role in success of the investment experience. Remember the number in the first chart above are average 3 year returns for each P/E band. Therefore, anything 16x and below has produced a strong entry point for investors to earn on average double digit returns over a 3-year period. Current valuations reflect the long-term average for India of approximately 16.6x forward earnings. However, it’s interesting to note is that earnings have been held back over the last 2 years due to dilution of commodity company earnings (as small as this weight might be in the Index), lack of business investment given low capacity utilisation and weak monsoon conditions (till this year). We expect earnings growth to accelerate in FY18 and FY19. CHART 3: CURRENT VALUATION VS HISTORICAL VALUATION Source: Bloomberg, MSCI POSITIVE OUTLOOK In a low interest rate world, we may question whether these returns are achievable going forward. However, India appears poised for strong corporate earnings growth built on increasing business capital expenditure, infrastructure requirements of over US1 trillion, consumption through falling interest rates, rising wealth, low household debt and high savings. The Government’s action on reforms, initiatives as well as its crackdown on corruption abode well for increasing foreign investment as India’s status as an economic powerhouse increases. Additionally, one of the best ways to mitigate valuation is through active management which can differentiate between stocks which appear cheap relative to their growth profile and stocks where forecast growth is already priced in. Over the first two and half months we have witnessed significant value add through our valuation focused adviser, given current market conditions. It is our view that the recent correction of 10% in Indian equity markets forms a great entry point for investors who believe in India’s long-term growth story.

PM Modi’s War on Corruption

- admin

- November 10, 2016

- 0 Comments

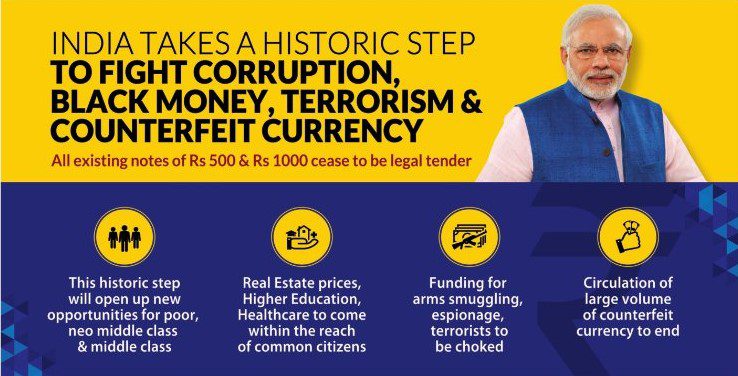

MODI’S ANNOUNCEMENT India’s Prime Minister Mr. Narendra Modi in an unprecedented, surprise and historic move to curb black money announced the scrapping of currency notes of Rs.500 and Rs.1000 denominations effective midnight of 8th November 2016. These denominations account for over 80% of all currency in circulation by value and potentially constitute 40 to 50% of black money in India. Some of the key announcements made by PM Modi were; Currency notes of Rs.500 and Rs.1000 denominations will not be legal tenders beginning November 9, 2016 New notes of Rs.500 and Rs.2000 would be released and circulated from November 10 which will have enhanced security features and will not be easily replicable. Banks and ATMs in India will remain closed on November 9 to transition to the new currency People can deposit/exchange old notes of Rs.500 and Rs.1000 in their banks from November 10 till December 30, 2016. Those unable to deposit notes by December 30, 2016 can change them till March 31, 2017 by furnishing ID proof Cashless fund transfers won’t be affected by the move PM Modi while addressing the nation termed this announcement as an action taken that will have a defining impact on India’s destiny THE MOVE A GAME CHANGER IN THE FIGHT AGAINST CORRUPTION AND COUNTERFEIT CURRENCY NOTES The Narendra Modi government has taken a series of steps since it came to power in its fight against corruption. Some of the steps taken by the Modi government are shown below. Exhibit 1: Steps taken by Modi to curb Unaccounted Money Enacted the stringent Black Money (undisclosed foreign income and assets) and imposition of Tax Act, 2015 to curb illicit wealth abroad Enacted the Benami Transaction (Prohibition) Amendment Act 2016 to curb black money within the country Permanent Account Number (PAN) made mandatory for all transaction above Rs.2 lakh irrespective of the mode of payment Unique Identification Number of everyone were mapped to the PAN numbers of individuals to weed out duplicate PAN numbers. Tightened income tax return forms seeking more details from tax payers earning more than Rs.5 million a year and now Announced one time window for domestic tax evaders to come forward, declare their unaccounted wealth and pay a tax and penalty Scrapped Rs.500 and Rs.1000 notes. All the above steps were progressive in nature, from the initial steps to strengthen the regulatory framework for curbing black money. Next was to seek details of transactions and link it with the unique identification numbers of individual tax payers. Afterwards the government provided a window of opportunity for tax evaders to come clean, declare and pay their tax liability without any question being asked. This window saw declarations of Rs.700 bn (AU$14 bn). And now, the large amount of unaccounted money in India that have commonly been stashed as currency notes have been discontinued. As per the Reserve Bank of India (RBI), there were 15.7 billion Rs.500 currency notes and 6.326 billion Rs.1000 currency notes in circulation. These would amount to Rs.7,850 bn (AU$157 bn) of Rs.500 notes and Rs.6,326 bn (AU$127 bn) of Rs.1000 notes in circulation. Market estimates suggest that 40 to 50 % of these, is unaccounted for, pegging the unaccounted amount of money at Rs.5,670 bn (AU$115 bn) to Rs.7,000 bn (AU$140) bn. The declaration of all the unaccounted money could mean a tax windfall to the government of between Rs. 3,400 bn (AU$68 billion) and Rs.4,250 bn (AU$85 bn). Non-declaration of the unaccounted money could mean a transfer of these funds to the government’s coffers by the RBI which could well be in excess of Rs.5000 bn (AU$ 100 bn). An amount required to fund India’s planned infrastructure investments over the next couple of years. This move will also eliminate the fake currency in circulation and hit a fundamental reset in the economy. As per a study conducted by the Indian Statistical Institute, 250 out of every 1 million notes in circulation are fake. Fake currency is a major source of funding for terror outfits and drug cartels. SECTORAL IMPACT Two sectors real estate and financials will be majorly impacted by this move. Real Estate Real estate companies operating in northern India which accept certain proportion of cash in a transaction will be adversely impacted and may face liquidity constraints in the near term. Financial Services Financial services companies which have funded these real estate companies will be exposed to stress in their assets exposed to the sector. This pain though would be short term for financial services companies and the long-term benefit of availability of higher amount of money will outweigh the short-term negative in the sector. Consumer Discretionary The consumption of higher end consumer discretionary (luxury goods) items could get impacted over the next few quarters due to the plugging of the parallel (unaccounted for) economy. OUR VIEW While the move will create some initial adjustment chaos for households and small businesses, it will be very positive in the long term. This “out of the box” solution implicitly signals that this government is serious about tackling the issue of corruption and unaccounted money in the system. In our view this move by the government will: Lower corruption will increase the ease of doing business in India significantly and enhance India’s perception globally Steer the country towards a cashless economy, which strikes at the root of unaccounted money transactions. According to some estimates, almost 80% of the economy still runs on cash Higher government receipts will boost government expenditure on infrastructure build, providing a capex led boost to the economy. Estimates of 3% of GDP over time windfall[1]. The extra liquidity in the banking system will help further reduce interest rates and boost consumption and the capex cycle further. An increase of around 4% of GDP over the next 3 years1. The move will also have an impact on the political economy in India which is mostly funded by black money. PM Modi’s party may stand to gain in the upcoming state elections in Uttar Pradesh, Punjab and Goa as

Understanding the Founder’s Mentality to Generate Outperformance

- admin

- November 10, 2016

- 0 Comments

This year’s portfolio construction forum titled “The long and short of it” saw the overwhelming majority of participant’s state that long term thinking is required when investing. We feel this to be crucial with regards to horizon based investing and riding out volatility, especially when it comes to gaining exposure to the fast growing, but more volatile emerging markets. However, in practice does this really occur? Having worked at some of the big four banks, I know all too well of how business direction can change multiple times within a short timeframe. This can create poor engagement, lack of organisational focus and can be expensive to resurrect. Most importantly it tends to destroy brand and shareholder value. So why does this happen? Well management is often incentivised to make short-term decisions for their immediate personal gain. They are commonly paid in terms of stock options that vest over a short-term period of 1-3 years and cash bonuses for yearly performance. Senior management are therefore not incentivised to make strategic investments that are long term accretive to the business as this incurs immediate expenses while reaping no immediate profits. This is at complete odds to company management often claiming shareholder wealth generation is their ultimate priority. This is often illustrated as the agency problem which differentiates the drive of owners of a business in comparison to management. In the case of founding management, there is naturally a longer term view taken as their company was built through hard work, passion and drive to create something significant. They instinctively and intricately know all facets of the business, its products and its target market, their unique selling proposition and the barriers to entry. They are also continuously looking to innovative, make bolder and more strategic investments and maintain more loyal employees. Chris Zook, partner at Bain & Company’s Boston office wrote a piece in the Harvard Business Review titled “Founder-Led Companies Outperform the Rest — Here’s why”. He and his team at Bain & Company have been studying publicly listed companies globally over the last 25 years in an attempt to identify companies that manage to generate sustainable long-term earnings growth. What they found was that sustainable profitable growth is very challenging and that currently only 1 in 10 companies have been able to achieve this feat over a decade. Interestingly though, when they tracked this globally, a disproportionate amount of companies that met this criterion still had the founder either running the business, involved with the Board of Directors or where the focus and principles used by the founder/s were still in place. After interviewing over 200 founder lead companies, Chris and his team identified three characteristics and underlying attitudes that emerged consistently. They coined this phenomenon “the founder’s mentality” which displayed the following characteristics: Business insurgency – Sharp sense of purpose. Without this the business lacks direction and is uninspiring. According to Bain & Company, 13% of employees worldwide are disengaged. Engaged employees are 3.5 times more likely to engage personal time to innovate compared to unengaged workers. Front-line obsession – The deep understanding of the product/service and the love of detail and curiosity at the front line. These companies are likely to remain in touch with their customers and bureaucracy is less likely to take over. Owner’s Mindset – Take personal responsibility for risk and costs. The company thinks like an owner would. Less complacency, not as slow to act and less risk averse, whilst employing a long-term mindset. A great example is Facebook’s founding CEO Mark Zuckerberg. He made a series of long-term strategic decisions and avoided taking any revenue that went contrary to improving the user’s experience. However, by committing to this vision, he was heavily scrutinised in the short-term by the press and investors. Would a professional CEO have taken these risks and endured such vicious attacks for unproven, long-term benefits? The chart below compares the stock performance of founder lead companies relative to others over the last 24 years. Interestingly, the outperformance of such companies is substantial. FOUNDER-LED COMPANIES OUTPERFORM THE REST BASED ON AN ANALYSIS OF S&P 500 FIRMS IN 2014 Source: Bain & Company So does this mean all founders are CEO material and destined to succeed? Unfortunately, it is not as simple as that. Managing a successful company requires a tremendous amount of ability as well as the right products/services for the ecosystem the company operates in. Whilst nearly all founders exhibit this mentality, not all of them have the skill to successfully implement it. Thus as an investor, when it comes to selecting companies for investment, requires a deep understanding of not only the founder’s mentality, but also their past track record of implementation, strategic thought process/creativity and internal motivations, which are all paramount to generating strong returns. An example is India’s equity market, which is ripe with companies where the founder is still heavily involved in the business. In fact, approximately 45% of the market today is owned by founders of the business. We feel this high level of ownership is the major reason why India enjoys one of the highest rates of return on equity in the world and has exhibited sustainable earnings growth of 14% p.a., with low volatility,over the last 15 years[1]. MSCI Index Std Dev of EPS growth since 2002 Avg ROE growth since 1996 India 13% 18% China 19% 13% Brazil 44% 13% Russia 45% 13% Emerging markets 27% 13% All Country World Index 34% 12% US 33% 15% Developed markets 35% 12% Source: Morgan Stanley research India is an ideal hunting ground for investors seeking to generate strong returns through the successful identification of superior founder lead companies. Local investments experts with inherent and localised market knowledge of these companies and their respective founders, are more likely to decipher which companies are most likely to deliver. One example of this is Sun Pharmaceutical Industries, India’s largest pharmaceutical company. Sun Pharma’s founder, Dilip Shanghvi certainly exhibits the “founder’s mentality”. In fact, he has often been described as a “hands-on manager” who believes

Event Update: India’s decisive action against terror

- admin

- October 2, 2016

- 0 Comments

EVENT: INDIA’S SURGICAL STRIKES AGAINST TERROR CAMPS IN POK Setting aside its normal restraint and the respect for the line of control (Official Border) between India and Pakistan, the Indian army conducted surgical strikes against terrorist camps operating inside Pakistan occupied Kashmir (POK) in the early hours of Thursday 29th September 2016, establishing its right to retaliate against terror attacks. The strike destroyed terror infrastructure and killed terrorists. SURGICAL STRIKES ESSENTIAL TO DEAL WITH TERROR The surgical strikes were conducted by the Indian army based on specific information that some terrorist teams had positioned themselves at launch pads in Pakistan occupied Kashmir with an aim to carry out infiltration and terrorist strikes. The strikes were done as a counter to the 18th September 2016 terrorist attack on the Indian army garrison in Uri (a town in Jammu & Kashmir) which caused the death of 18 Indian soldiers. India had shown considerable restraint in earlier terror strikes against it, expecting that Pakistan would take action against terror outfits operating from its territory, taking cognizance of India’s diplomatic efforts. INDIA’S DIPLOMACY ON TERROR HANDLED WELL On the diplomatic front, India ring-fenced its army action by keeping key countries such as the US in the loop. Diplomats from 25 countries including the US, the UK, France, Russia and China were briefed by India on the surgical strikes. Earlier (post the Uri terror attack) India had launched a diplomatic offensive against the State sponsored terrorism by Pakistan at the United Nations General Assembly. India had said that in Pakistan billions of dollars of international aid gets diverted to training, financing and supporting terrorist groups and it is now a host to the Ivy League of terrorism (global epicentre of terrorism) attracting aspirants and apprentices from all over the world. The fact reckoned by key UN members as many terror trails lead to Pakistan, including the September 11 attack in the US. And many UN designated terrorist entities and their leaders operate from Pakistan. Domestically too, the Modi led NDA government took in confidence all the political parties and the strikes were supported by all political parties in the country. NO FURTHER MILITARY ACTION EXPECTED India has made it clear that this was the only military action for the moment and the action was against terrorists and not against the Sovereign State of Pakistan. The same was communicated by the Director General of India’s Military Operations to his Pakistani counterpart stating that “India had not attacked its army, but had targeted non state actors”. The response from Pakistan has been one of denial, denying that any such surgical strike had taken place and termed the operation as normal cross firing at the line of control, suggesting that Pakistan is not contemplating any retaliatory action. Nevertheless, Pakistan Prime Minister Nawaz Sharif held a cabinet meeting to take stock of the situation and issued a statement that Pakistan is ready to counter any external threat. OUR VIEW: The military action sends a strong message to terror outfits operating out of POK that India will henceforth take decisive action against terror and move beyond the normal diplomatic solutions, which it has been seeking till now. The diplomacy along with the military action has ensured that the world views India’s actions (not a single country except Pakistan condemned the strikes) as necessary to control the global threat of terrorism. Pakistan’s reaction (brushed off as an existential phenomenon) too suggests that it does not wish to escalate the matter any further. While the relationship between India and Pakistan will remain fluid, any further flare-up in the near term looks unlikely, unless there is further provocation from terror groups operating from POK. MARKET IMPACT: As a knee-jerk reaction to the events on the border, Indian equity markets declined and the Indian Rupee weakened. The benchmark Nifty 50 index declined 1.76 per cent to 8,591, whereas the Nifty Midcap 100 index declined by 3.8%. The rupee weakened 0.6 per cent to 66.85 per dollar. Both the Indian rupee and the equity markets had their worst day since June 24, when Britons voted to exit from the European Union. With low possibility of further escalation (reduced event risk) in tension between India and Pakistan, markets are expected to stabilize and once again focus on earnings growth. Risks to markets could emanate from global events. India will continue to remain a destination for global flows, investors seating on the fence climbing the wall of worry though may continue to remain seated on the fence. Table 1: Limited Impact of Kargil War (Last war between India and Pakistan) on Markets Date Event Nifty 50 Return for the period 30th April 99 – 978.20 – 3rd May 99 Pakistani Intrusion in Kargill Noticed 970.75 -0.76% 17th May 99 Indian Army Mobilizes troops from Kashmir Valley to Kargil 1151.90 18.66% 26th May 99 IAF Launches air strikes against the intruders 1135.50 -1.42% 1st June 99 Pakistan steps up attack 1123.80 -1.03% 15th June 99 US President Bill Clinton asks Pakistani Prime Minister Nawaz Sharif to Pull out from Kargil 1120.50 -0.29% 29th June 99 Indian Army Captures two vital posts 1191.30 6.32% 5th July 99 Pakistani PM Nawaz Sharif announces Pakistan army’s withdrawal following his meeting with Clinton 1230.25 3.27% 26th July 99 Kargil conflict officially comes to an end 1326.15 7.80%

10 Things You Should Know About India

- admin

- August 25, 2016

- 0 Comments

India is rapidly changing. Perception is often not reality and stereotypes are quickly becoming outdated. In this research note we identify 10 key things that investors ought to know about India. India’s equity market is bigger than you think! Unhedged exposure to the rupee provides no added risk Corporate governance on it’s way to best practice! Strong GDP growth has translated into earnings growth and equity returns India has streamlined it’s foreign investor account opening process Is company reporting in line with best practice? Corruption in India: Perception or Reality? Stock market infrastructure, systems and technology are advanced Indian asset managers moving up the quality spectrum India’s regulator SEBI is highly credible Click Here To Download The Research Paper

One Nation, One Tax: India takes a Giant Step towards Goods and Services Tax (GST)

- admin

- August 5, 2016

- 0 Comments

Modi’s Reform Agenda Gets a Big Push: India’s upper house of parliament, the Rajya Sabha approved on August 3, 2016 the constitutional amendment bill for the Goods and Services Tax.The passage of the bill after more than 18 months of tough negotiations reinforces Prime Minister Modi led NDA governments commitment to reforms, particularly given the fact that the NDA is in a minority in the upper house. The bill was passed in the lower house of the Parliament, the Lok Sabha (where the NDA enjoys a majority) in 2015. GST the Single Biggest Tax Reform: The bill paves the way for implementation of the country’s single biggest tax reform measure first considered about 30 years ago. Once rolled out, it will be driven by the principle of one nation, one tax, doing away with multiple indirect taxes and economically unifying India by transforming it into a single market and a free trade economic zone for producers based inside the country. GST is a destination based tax that subsumes (Exhibit 1) various indirect taxes at the central and the state level including excise duty, service tax, value-added-tax, octroi, entertainment tax, luxury tax and other local taxes. GST is designed to remove the cascading impact of taxes (by making available input credit across the value chain), introducing uniform tax rates across states, simplifying tax administration by having minimal tax slabs and broadening the tax base. Exhibit 1: Taxes to be subsumed Centre Level State Level Central Excise Duty State Value Added Tax Additional Excise Duty Entertainment Tax Central Sales Tax Octroi and Entry Tax Service Tax Purchase Tax Countervailing Customs Duty (CVD) Luxury Tax Special Additional Duty of Customs Taxes on Lottery, Betting and Gambling Central Surcharges and Cesses State Surcharges and Cesses Source: Antique Coverage of GST: GST will cover all goods and services, except alcohol. Currently there will be no GST levy on petroleum products till a date is notified on the recommendation of the GST council. Real Estate and Electricity may also remain out of the purview of GST. Way Forward: Passage of the GST as per Hasmukh Adhia, India’s Revenue Secretary is “the end of a beginning”. The bill will need to be passed by the Lok Sabha again, ratified by 50% of the States and notified by the President of India. Subsequently, a GST council has to be formed comprising the Union finance minister and state finance ministers to decide on the key operational details like rates, inclusion, exclusion, etc. Deciding the tax rate is the next big challenge. The states are looking for a higher rate as compared to the Arvind Subramanian (Chief Economic Advisor of India) committee proposed rate of 17-19% (presently State taxes are at 26-28%) whereas, Congress the main opposition party with a majority in the upper house is pushing for a cap of 18%, considering its impact on everyone. Thereafter, the central GST law and integrated GST law will have to be voted upon by the Parliament, probably in the winter session (Nov-Dec), and a state GST law will have to be voted upon by the State assemblies. These three laws will spell out the fine print of how GST will be implemented in India. Concurrently, the government will also have to get its infrastructure and technology network ready for rollout of the GST. The migration of tax payers registered with central tax agencies to the GST platform is expected to be completed by October 2016 and the migration of State tax payers is expected to be completed by February 2017. If these are achieved within the specified time, the chances of roll out in April 2017 appears realistic. A three to six-month delay in implementation though is possible. Corporate India’s readiness will also be a pre-requisite for the smooth rollout of GST. Our View: The roll out of GST will benefit the economy, Indian corporates, the consumer and the Indian equity market. A National Council of Applied Economic Research (NCEAR) study suggests that GST could boost India’s GDP growth by 0.9-1.7 per cent. Dual monitoring and real time matching of each supplier and purchaser will reduce tax evasion. Withdrawal of various exemptions, presently offered on Central and State government taxes will reduce the annual tax revenue loss to the exchequer of upto ~AU$66 bn. The additional tax revenue will improve India’s tax to GDP ratio and fiscal health significantly. A uniform tax across the country will improve the ease of doing business in India. Competitiveness of manufacturers will increase (providing a boost to the Make in India program) as the cascading effect of taxes will be eliminated and input tax credit will be available across the value chain. Further, lower tax rates will also lead to volume gains. India will be a single market where companies will be able to move and sell their products freely (earlier this was a logistical nightmare) across states, increasing the overall activity in the economy. A study had shown that border checks, result in Indian trucks driving 280 kms per day, which is only 35% of the 800 km that a truck travels in the US. The dismantling of border checks (intra and inter-state) will remove one of the main sources of corruption in the movement of goods. The increase in average distance covered in a day, the reduction in corruption and the doing away of the requirement of multiple warehouses / depots will bring down the logistics cost in India significantly. Currently logistics costs in India are 3 to 4 times the international benchmarks. For consumers, most products are likely to be less expensive over a period of time. However, most services including restaurant bills, mobile bills, travel, insurance premiums, etc., will become more expensive. The rollout of GST will be a very positive development from an equity market perspective. The market will view the development as the ability of Prime Minister Modi led NDA government to push forward important reforms. Whilst the market had to a large extent priced in

Indian Technology Sector

- admin

- July 13, 2016

- 0 Comments

Technology is fundamentally transforming businesses in every industry around the world. Advanced software technologies are fuelling the rapid digitization of business processes and information, disrupting traditional business models.For organisations, from an IT perspective, this translates to keeping existing legacy systems relevant, enabling legacy systems for mobile and sensor access, extracting value out of digitized data, harnessing the efficiency of cloud computing while optimizing the cost of building and running technology systems. The rapid pace at which technology is changing are driving businesses to rely on third parties to realise their IT transformation. The increasing need for highly skilled technology professionals and reluctance on part of organisations to expand their internal IT departments is increasing the reliance of organisations on their outsourcing service providers. Organisations are increasingly outsourcing IT solutions to offshore technology service providers due to lower total cost of ownership of IT infrastructure, lower labour costs, improved quality and innovation and faster delivery of technology solutions. India has been one of the main beneficiaries of this offshore outsourcing trend enabled by the availability of a large English speaking pool of IT professionals. High quality global delivery model, proven execution capability to provide comprehensive end to end solutions and service clients across industries at significant cost benefits has contributed to the strong growth of IT and IT enabled services in India. EVOLUTION OF INDIAN IT AND IT ENABLED SERVICES INDUSTRY The Indian IT and IT enabled services industry has grown from approximately USD 1 billion in the 1980’s to USD 143 billion industry in fiscal year 2016. And in this journey, it has transformed itself from a back office service provider to a partner in business transformation. The table below shows the evolution of the Indian IT and IT enabled services industry over the past four decades in terms of various metrics: Exhibit 1: Indian IT and IT enabled services industry Source: Nasscom The Indian IT and IT enabled services industry is divided into four major segments – IT services, Business Process Management (BPM), software products and engineering services and hardware. The table below shows the revenues for each of the above segments Exhibit 2: Segmental Revenue (USD Bn) Source: Nasscom IT services and BPM dominate with a 71% share of the total revenues. IT services provided by Indian companies have transitioned from providing cost arbitrage to managing IT from a business perspective. Services are now more closely aligned and customized to the needs of individual customers in every industry and focused on providing business outcomes. Digitization and automation has enabled IT services companies to provide strategic and transformational solutions. Business process management companies in India leverage global talent pools to manage the outsourced core business processes of their clients. The BPM sector is being driven by greater automation, expanding omni-channel presence and big data analytics. Software products and engineering services which enable automation of business processes are driven by trends around internet of things(IoT) / connected devices and customers demand for disruptive innovations. Overall digital solutions around social media, mobile, analytics and cloud (SMAC) – upgrading legacy systems to be SMAC enabled, greater demand for ERP, CRM, mobility and user experience technologies is driving healthy growth in Indian IT services ENGAGEMENT WITH GLOBAL BUSINESSES Exhibit 3: Indian IT-BPM sector wise exports for FY 2016 The banking, financial service and insurance (BFSI) industry segment (the largest export market sector for Indian IT-BPM companies) is witnessing an increased spend on strategic initiatives like automation, digitisation and simplification. The digital revolution is redrawing the boundaries of financial services and lowering entry barriers encouraging challengers to emerge. As a response, banks are renewing their focus on innovation in product creation, bundling, distribution & servicing. Indian IT-BPM companies are investing in a broad array of offerings in the areas of analytics, biometrics, block chains, artificial intelligence, etc., for enabling BFSI clients to tackle the dynamic environment and stay relevant for the future. Indian IT companies are similarly engaging on opportunities in other industry’s demand on digital products, customer relationship management, product life cycle management, supply chain management, analytics, service quality management, process automation, data monetisation, network management and implementation of next generation technologies to realise their transformation journey. This enables the industry to partner with its clients on large multi-year engagements. India’s IT-BPM has succeeded in creating a worldwide presence – onshore, offshore, nearshore – for its customers. Present in over 78 countries through about 670 offshore development centres, the industry boasts approximately 75 per cent of Fortune 500 enterprises as its customers. Geographically US is the largest market for Indian IT-BPM companies accounting for over 60% of India’s IT export basket followed by UK and Europe. Exhibit 4: Indian IT-BPM country wise exports for FY 2016 India is now the world’s largest sourcing destination for the IT-BPM, accounting for approximately 56 per cent of global sourcing market. India’s cost competitiveness in providing IT services, which is approximately 3-4 times cheaper than the US, continues to be the mainstay of its Unique Selling Proposition (USP) in the global sourcing market. However, the market share in newer transformational services is still less (Exhibit 5). Nevertheless, India is gaining prominence in terms of intellectual capital. Several global IT firms are setting up their innovation centres in India demonstrating the excellence the industry has been able to achieve. Exhibit 5: Market Share of Indian IT-BPM Companies (2015) Indian IT sector growth though has been decelerating since FY 09 after a brief pickup from pent up demand post the downturn. This trend is unlikely to change in the near term, with 11% growth in exports in FY16E likely to be followed by similar or lower growth in FY17E. Exhibit 6 below shows India’s IT-BPM exports and the growth of the industry from FY 01. Exhibit 6: Indian IT-BPM exports and growth INDIAN IT-BPM COMPANIES Several technology solution and service providers have emerged in India over the years, offering different models for enhancing their client’s product and service offerings and user experience. Some of the service lines are

A Prosperous Economy in Waiting

- admin

- July 1, 2016

- 0 Comments

A large part of India’s long term growth potential is driven by its youthful demographics, entrepreneurial culture and significant and growing labour force. This is particularly pertinent given weak global growth and rapidly aging labour force in many developedcountries around the world today. Click here to read the full article

R-Exit: The exit of RBI Governor Dr. Raghuram Rajan

- admin

- June 28, 2016

- 0 Comments

India’s RBI Governor Dr. Raghuram Rajan’s Message: RBI governor Dr. Raghuram Rajan in his message to RBI staff on June 18, 2016 conveyed his decision to move back into academics after his term ends in September 2016.Dr. Rajan said that “while I was open to seeing these developments through, on due reflection, and after consultation with the government, I want to share with you that I will be returning to academia when my term as Governor ends on September 4, 2016. I will of course, always be available to serve my country when needed.” The message clearly suggested that his action was the result of the ongoing difference of opinion between the ministry of finance and Dr. Rajan on certain economy related issues and the noises created by a section of ruling party in India on his handling of the economy. What caused the difference of Opinion with the Government? The differences occurred due to 1) the reluctance of the RBI governor to reduce interest rates for propelling growth despite significant reduction in inflation and 2) The stress generated in the banking system due to tightening of norms by the RBI at a time when the economy was facing headwinds. A section of the ruling party in India is of the opinion that Dr. Rajan, being an appointee of the former UPA government was not aligned with the NDA’s growth agenda. A letter to the Prime Minister Mr. Narendra Modi from a Member of Parliament of the ruling NDA alliance Dr. Subramaniam Swamy (A PhD in economics from Harvard and an ex-professor at one of India’s elite universities, IIT Delhi) suggested that the governor’s shifting of the goal post reduced the possibility of faster interest rate cuts. The RBI had changed the measure of inflation from wholesale to retail inflation (WPI to CPI) just a month ahead of NDA’s election to power. While the political voices suggest dissent, CPI is a better reflector of demand side pressure in the economy as it also captures the inflation in services (excluded in WPI calculations), which accounts for ~60% of India’s GDP and aligns India with global best practice. Besides adopting CPI as the key indicator of inflation, Dr. Rajan initiated the creation of a panel (Monetary Policy Committee – MPC) to set interest rates in India, currently the prerogative of the RBI governor. He also initiated the process of spinning off the RBI’s management of government debt by taking steps to set up a public debt management agency. Dr.Rajan also initiated an Asset Quality Review of public sector banks with the aim of cleaning up their balance sheets. We firmly believe that the measures taken by the RBI with Dr. Raghuram Rajan as its governor were prudent from an economic perspective, despite politically being a different story. Under Dr. Rajan, India’s inflation remained under control, currency remained stable and forex reserves reached a record high of USD 380 billion. The RBI also issued licenses to two universal banks and eleven payment banks during his tenure. RBI is a Strong & Independent Regulator: Having said that, the RBI as an institution is much larger than the individual at the helm, given the institutional framework in place for policy decision making. Hence a change in guard at the RBI is likely to result only in temporary adverse effects. In some of the most testing periods of Indian history, the RBI has remained quite independent, despite the political patronage (appointed by the ruling political party) of its Governors. While Dr. Rajan was exemplary as the governor of the RBI, it would be difficult to imagine significant weakness in credibility going forward, given the institutional framework and processes in place. In fact, the Indian financial market regulator (RBI) is judged to be amongst the best in the world. The International Organisation of Securities Commissions (IOSCO) and the Bank for International Settlements (BIS) has rated[1] India’s regulatory framework for financial market infrastructure at the highest score of ‘4’ for all eight parameters assessed[2] on a scale of one to four along with five other countries including Australia, Brazil, Hong Kong, Japan and Singapore Our View & the way forward: We believe that the new RBI governor appointed by the NDA government, whilst may not have the same international fan following like Dr. Rajan, would be equally good and well regarded. Some of the names doing the rounds are accomplished Economists, ex-RBI deputy governors, Chairman of Banks, etc., The change in guard at the RBI will not make much of a difference in the monetary policy framework of the RBI, given that the decisions on inflation targets and setting of interest rates will be taken by a monetary policy committee (MPC) in line with global best practices. The MPC constitutes six members (shown as exhibit 1), with three members from the RBI (the governor, the deputy governor in-charge of monetary policy and the executive director in-charge of monetary policy) and three independent directors with domain knowledge, appointed by the government. The search panel for government appointees will comprise the Cabinet secretary, the economic affairs secretary, the RBI governor and three experts in economics or banking nominated by the government. We expect that the directors appointed by the search panel would indeed be experienced and knowledge experts with independent views, making the monetary policy framework much more robust. Governor Dr.Rajan had also expressed his satisfaction on the constitution of the MPC saying that “ I am absolutely on board and happy with it”. Exhibit 1: Monetary Policy Committee Constituents: RBI Members Government Nominated Members Governor[3] Independent Director selected by a search panel Deputy Governor Independent Director selected by a search panel Executive Director Independent Director selected by a search panel The R-Exit has been welcomed by a few senior bankers and practitioners affected by the ongoing slowdown in sectors like steel and infrastructure. This implies that the good work started by Dr. Rajan of cleaning up the books of public sector banks in Inddia may take a back seat for some time.

- +61 2 9071 0124

- IA@indiaavenue.com.au

- India Avenue Investment Management Pty. Ltd. AFSL 478233 | ABN: 38 604 095 954 Level 4, 261 George Street, Sydney NSW 2000, Australia.

Quick Links

Subscribe

Get our monthly research and updates on our offerings that bring you valuable insights, opinion, and education.

© 2025 India Avenue Investment Management Australia Pty. Ltd. . All rights reserved.

Design and Developed by Aniktantra