India Avenue Investment Management was registered as a boutique investment firm in 2015, launching its first product, the India Avenue Equity Fund in September 2016. The origins of the firm go back to 2005, when the founders worked together at ING Investment Management in India and Australia.

The firm was built on three key pillars to its investment philosophy.

- India has been a high GDP growth region relative to other countries over the last 30 years. It took over leadership from China in the last decade and is likely to be the GDP growth leader over the next few decades.

Source: IMF World Economic Database

The average from 1981-2023 was 9.0% for China, India 5.9%, Emerging 4.4% and Advanced 2.4%. However, over the next 5 years the IMF forecasts 6.5% for India, Emerging 4.1%, China 3.8% and Advanced 1.7%. India is expected to maintain leadership given its large, youthful, working age population. This should mean a rise in GDP-per-capita over the next 10-20 years as economic growth shifts from being driven by a rising population to rising productivity.

- We also believe that India’s equity market is an inefficient asset class. This means that active managers can provide a better investment experience by outperforming passive market cap weighted investment benchmarks. We believe this is because the number of brokers covering stocks reduces significantly.

The Indian market has over 5000 listed stocks, making it one of the largest stock markets in the world by number of listings. The opportunity set is large in comparison to most regional / country equity markets.

Sell-side broker coverage focuses on the top 150 by market capitalisation, with the number of sell-side analysts covering a company falling as stock market capitalisation falls. This arguably leads to less efficient pricing of stocks, resulting in the market taking longer to adjust to new information and converge to fundamental fair value.

Stocks outside the Top 150 by market cap tend to have a lower ownership by professional / institutional investors, due to their prioritisation of liquidity. Ownership of smaller cap stocks tends to be dominated by retail investors, where outperformance opportunities are more abundant due to mispricing.

Source: IAIM Research, Trendlyne

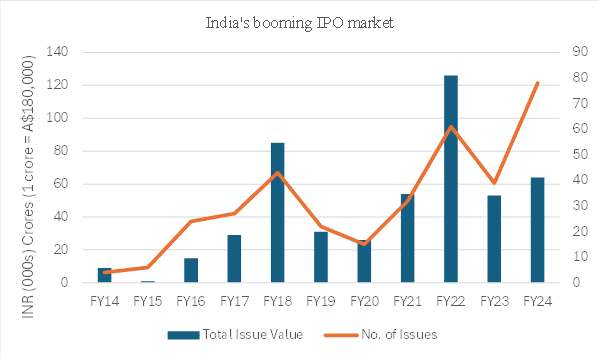

The strong market growth of India’s capital markets coupled with a rapidly emerging IPO pipeline has created an attractive opportunity set that is best understood by local investment professionals. The number of IPO’s continues to over the last 10 years after a brief break during COVID-19.

Unlike most developed markets, professional investors hold a low component of the Indian equity market:

| Private Indian Promoters | 32.7% |

| Foreign Promoters | 8.0% |

| Foreign Portfolio Investors | 17.9% |

| Government | 11.2% |

| Domestic Mutual Funds | 8.9% |

| Banks, Financial Institutions, Insurance | 5.6% |

| Individual Investors | 9.5% |

| Others | 6.1% |

- Finally, we believe that local managers based in India have a deeper understanding of India’s corporate culture, ecosystem and locally listed companies. Over 40% of the Indian stock market is owned by Founders/Promoters. As an investor, if you don’t have a deep understanding of the corporate behaviour of owners and their treatment of minority shareholders, then it can lead to unexpected outcomes.

Local investors have a better chance of grasping this as well as local market regulations, microeconomic conditions and seasonality, local investor behaviour (local investors are now more significant in size that foreign investors in India) and assessing the impact of government initiatives. Additionally, they are also in more regular contact with suppliers, peers, consumers, service providers and competitors of businesses.

Locally based investment firms typically have greater breadth and depth in stock picking, more focused resources and a deeper knowledge of the local ecosystem and its growth opportunities. Externally based funds with a broader country mandate (Global, EM or Asia) tend to prioritise liquidity and relative valuations when identifying opportunity across regions.

Typically, Emerging Market Funds outperform their benchmarks by 1% after fees (based on a study of 15 large EM funds) over the last 10 years. This includes an allocation of 5-25% to India, which focuses typically on large, liquid companies that have institutional owners and broker coverage. Locally based, India focused managers are likely to focus on a broader universe to identify growth companies at reasonable valuations. Therefore, playing the India growth story, rather than focusing more on large constituents of the Indian benchmark. Over the last 10 years local the median manager based in India has outperformed the benchmark by over 5% annualised (a range of flexi-cap funds in India, relative to a broad market cap weighted index).