Samvardhana Motherson International Ltd. (SAMIL), founded in 1986 in partnership with Japan’s Sumitomo Wiring Systems, has transformed into a significant global manufacturing and engineering business. Headquartered in Noida, SAMIL has built trust with the world’s leading automotive manufacturers by delivering high-quality, safety-critical components—from wiring harnesses and polymer modules to vision systems and integrated assemblies. With operations in over 41 countries and more than 350 manufacturing facilities1, SAMIL plays a vital role in enabling the mobility of millions of vehicles worldwide.

Over the years, SAMIL has proven that it is much more than an auto component supplier. It has strategically diversified into adjacent and high-potential sectors like aerospace, consumer electronics, health technology, and industrial systems. This expansion has not only reduced its dependence on cyclic automotive demand but has also positioned the company to benefit from megatrends such as electrification, digitalisation, and global supply chain realignment. In FY25 alone, SAMIL’s aerospace revenue grew nearly fivefold to NZ$337m1, with growing contributions from semiconductors and consumer electronics manufacturing.

A Business Model Built for Resilience and Relevance

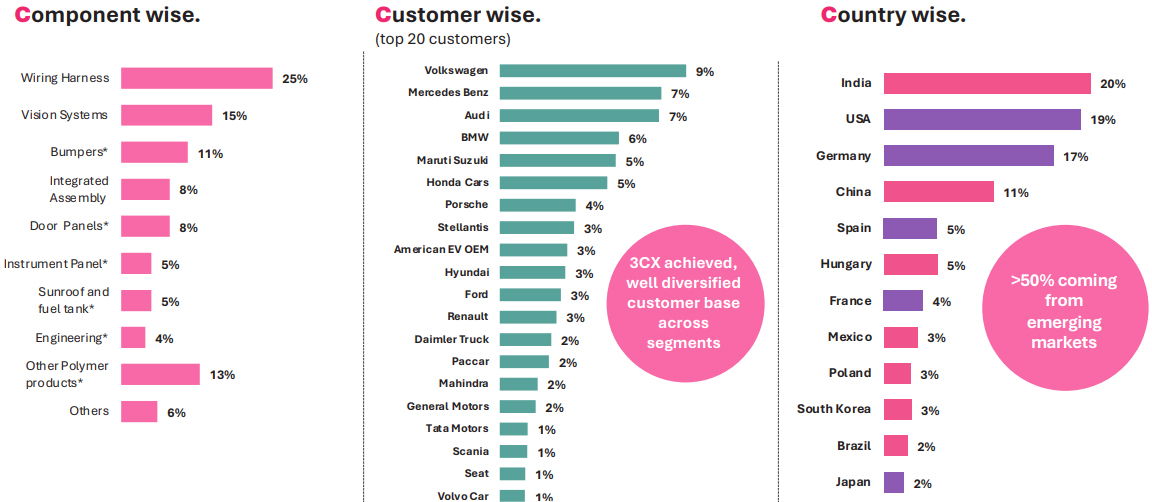

A feature of SAMIL’s model is its diversification. No single customer, component, or country contributes more than 10% of the company’s total revenue1. This structure offers resilience against volatility in any single market or product line. The company serves a roster of global clients—Volkswagen, Mercedes-Benz, BMW, Audi, Hyundai, Tata Motors, and more—while maintaining a balanced presence in India, Europe, North America, China, and other key markets. More than 50% of SAMIL’s revenue today comes from emerging economies1.

SAMIL is stepping up its game by becoming more than just a parts supplier. Its “3CX10” strategy seeks to diversify across Customers, Components, and Countries is helping it spread risk and grow steadily across different markets. The company is now offering bundled systems instead of single components. That means it’s selling more parts per vehicle, boosting revenue every time a car rolls off the line.

As carmakers (OEMs) look to simplify their supply chains and manage growing product complexity. especially with the shift toward electric and smart vehicles, SAMIL is offering complete, ready-to-fit solutions. Its strengths in design, engineering, and manufacturing are giving automakers more reasons to work with it, not just as a vendor, but as a long-term partner.

Figure 1: SAMIL Presentation on Results Q4 FY25

Disciplined Growth, Strong Financials, and Strategic Capital Deployment

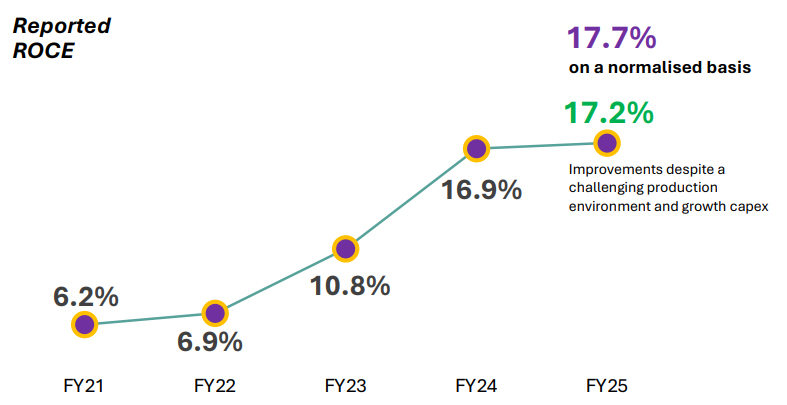

FY25 was a landmark year for SAMIL in terms of financial performance. Consolidated revenue grew 15% year-on-year, EBITDA rose to +17% YoY and profit attributable to shareholders increased by 40% to NZ$733m. The company improved its return on capital employed to 17.2% and maintained a low net debt-to-EBITDA ratio of 0.9x1.

In FY25 alone, the company invested NZ$855m in capital expenditure, with nearly half of it directed toward non-automotive businesses and greenfield expansion in emerging markets. With 14 greenfield projects under development and nine expected to go live in FY26, the company is preparing to serve rising demand across industries—from aviation components in India to integrated electronics in Mexico. Its capex plan of NZ$1bn for FY26 reflects both confidence in future demand and strategic foresight in capacity building.

Figure 2: SAMIL Presentation on Results Q4 FY25

1 statistics above and the diagram are from SAMIL Presentation on Results Q4 FY25

All statistics above and the diagram are from SAMIL Presentation on Results Q4 FY25

An Investment in Growth, Stability, and Transformation

A copy of the PDS for the India Avenue Equity Fund (H Class) can be obtained by writing to India Avenue on IA@indianavenue.com.au or by visiting http://www.indiaavenue.com.au.

Equity Trustees Limited is the Responsible Entity (ABN 46 004 031 298, AFSL 240975) for the India Avenue Equity Fund (H Class).

This Note (‘Note’) has been produced by India Avenue Investment Management Limited (‘IAIM’) ABN 38 604 095 954, AFSL 478233 and has been prepared for informational and discussion purposes only. This does not constitute an offer to sell or a solicitation of an offer to purchase any security or financial product or service. Any such offer or solicitation shall be made only pursuant to a Product Disclosure Statement, Information Memorandum, or other offer document (collectively ‘Offer Document’) relating to an IAIM financial product or service.

This Note does not constitute a part of any Offer Document issued by IAIM. The information contained in this Note may not be reproduced, used, or disclosed, in whole or in part, without prior written consent of IAIM.

Past performance is not necessarily indicative of future results and no person guarantees the performance of any IAIM financial product or service or the amount or timing of any return from it. There can be no assurance that an IAIM financial product or service will achieve any targeted returns, that asset allocations will be met or that an IAIM financial product or service will be able to implement its investment strategy and investment approach or achieve its investment objective.

Statements contained in this Note that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of IAIM. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Additionally, this Note may contain “forward-looking statements”. Actual events or results or the actual performance of an IAIM financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. Nothing contained herein should be construed as granting by implication, or otherwise, any license or right to use any trademark displayed without the written permission of the owner.

Certain economic, market or company information contained herein has been obtained from published sources prepared by third parties. While such sources are believed to be reliable, neither IAIM nor any of its respective officers or employees assumes any responsibility for the accuracy or completeness of such information. None of IAIM or any of its respective officers or employees has made any representation or warranty, express or implied, with respect to the correctness, accuracy, reasonableness or completeness of any of the information contained in this and they expressly disclaim any responsibility or liability, therefore. No person, including IAIM has any responsibility to update any of the information provided in this Note.

Neither this Note nor the provision of any Offer Document issued by IAIM is, and must not be regarded as, advice or a recommendation or opinion in relation to an IAIM financial product or service, or that an investment in an IAIM financial product or service is suitable for you or any other person. Neither this Note nor any Offer Document issued by IAIM considers your investment objectives, financial situation, and particular needs. In addition to carefully reading the relevant Offer Document issued by IAIM you should, before deciding whether to invest in an IAIM financial product or service, consider the appropriateness of investing or continuing to invest, having regard to your own objectives, financial situation, or needs. IAIM strongly recommends that you obtain independent financial, legal and taxation advice before deciding whether to invest in an IAIM financial product or service.