India’s two-wheeler market has been a vital component of the country’s transportation sector, with roughly 75% of the population depending on two-wheelers for their daily commute and shuttle. This dominance can be traced to the early 1980s when the Indian auto market saw a surge in demand for affordable and efficient modes of

transportation. One of India’s best-known brands emerged during this exponential growth period. Hero MotoCorp started its operations in 1984 as a JV between Hero Cycles of India and Honda (Japan). The founder family, Munjal’s and Honda both owned 26% each. By 2010 the Board of Directors of the Hero Honda Group decided to terminate the JV between Hero Group (India) and Honda (Japan) in a phased manner. With the termination of the JV, Hero was now able to export to other countries.

Hero MotoCorp today is the world’s largest two-wheeler manufacturer, with a presence in over 47 countries. The company has manufacturing centers predominantly in India and a Tech Center in Germany and Jaipur, India. The company has sold over 115 million motorcycles. Today, Hero MotoCorp has over 46% market share of India’s two-wheeler industry.

A Dive into the History of India’s Two-Wheeler Market

The growth of 2-wheelers was driven by:

- Rise in disposable incomes from a low base.

- Cost effective option, making it affordable for first time transport buyers.

- Navigate India’s logistical issues, which come with rapid urbanisation

Hero MotoCorp was successfully able to prove itself as an emerging leader in the industry, gaining a significant market size due to its focus on pricing, durability, and fuel efficiency. By the late 1990s, the company had become the largest two-wheeler manufacturer in India, a position it continues to hold today.

Hero MotoCorp was successfully able to prove itself as an emerging leader in the industry, gaining a significant market size due to its focus on pricing, durability, and fuel efficiency. By the late 1990s, the company had become the largest two-wheeler manufacturer in India, a position it continues to hold today.

Hero MotoCorp’s Appeal to the Masses

Expansion of Product Offering & Strategic Partnership with Harley Davidson

Whilst the company has built its brand in the entry segment, it has been able to recognize the drifting preferences of consumers and the growing demand for premium motorcycles (as GDP-per-capita rises from a low level). This identification of drift in consumer trends made the company strategically transition and pivot itself by positioning towards higher-end segments. This move was exemplified by Hero’s partnership with Harley Davidson, a collaboration that aims to introduce premium motorcycles to the Indian market. The product price range for this collaboration ranges from A$4,500 – $5,000 and extends Hero’s range towards 440cc.

This strategic product positioning is not just about tapping into the premium marketplace but also about enhancing the brand’s value. By collaborating with a globally recognized brand like Harley Davidson, Hero MotoCorp aims to reach a higher-spending customer base while retaining its core values of affordability and reliability with a touch of performance and luxury through Harley Davidson.

The Era of EV

In addition to its traditional offerings, Hero MotoCorp has also taken some significant steps by diving into the EV segment. The launch of its e-bike has added depth and widened its portfolio, catering not only to the traditional consumer, but also the environmentally conscious purchaser. Additionally, the Government of India provides subsidies to for E 2-Wheelers, which has accelerated the growth of this segment.

Market Performance and Upcoming Prospects

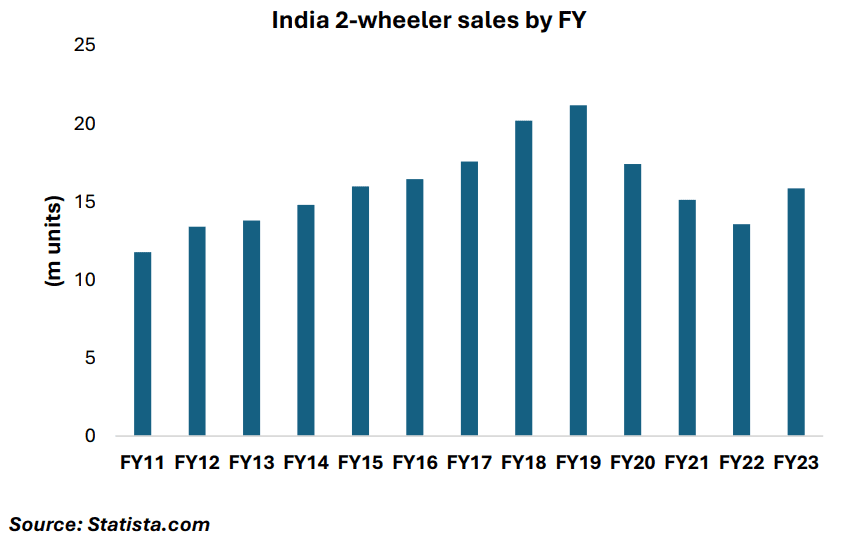

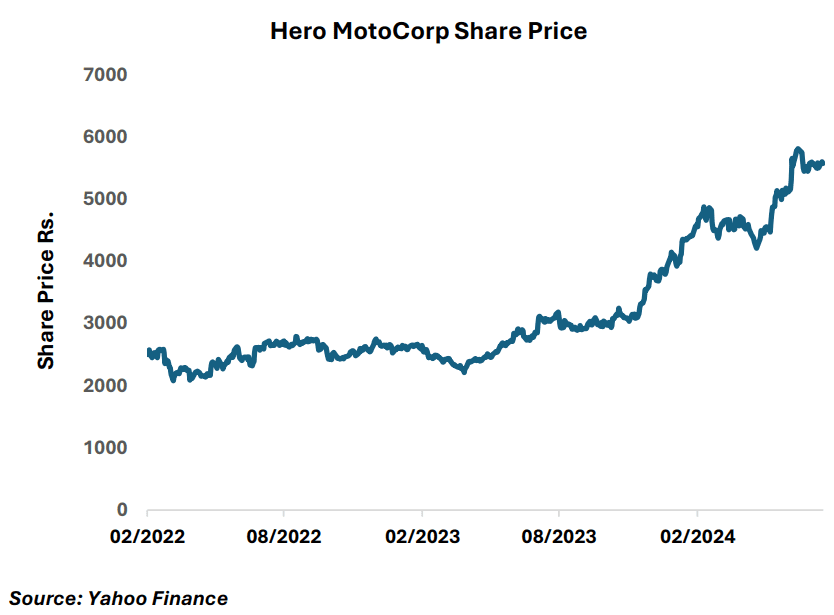

The overall growth of the two-wheeler industry has been sluggish since 2019, affected by macro elements such

as economic slowdowns and the COVID-19 pandemic. Despite these challenges, Hero MotoCorp has

outperformed, thanks to its robust business model and strategic initiatives. After being a laggard from 2019-

2022, the stock has been an outperformer from the bottom of the cycle in 2022. The India Avenue Equity Fund

eeks to find attractive quality, growth companies at a favourable valuation. These are typically found when an

industry is in consolidation, leading to a lower price. When the industry rebounds it’s usually best to invest

alongside market leaders who have invested in partnerships, products and distribution reach.

Hero MotoCorp has returned an annualised return of 38% since India Avenue Equity Fund purchased the stock in February 2022. The MSCI India (Net) AUD returned 15% over the same period. The Fund has owned between 2-4% in the company since initial purchase.

Why Hero MotoCorp is an Attractive Investment

In our view, Hero MotoCorp looks attractive given the following characteristics:

- A thorough understanding of India’s 2-wheeler industry, from the basic model to its partnership with Harley Davidson and its entry into India’s fasting growing EV 2-wheeler market

- The company has an appealing range of products and price points and is now making inroads into Central and Latin America, Africa and Asia – also countries with similar demographics

- Hero’s distribution strength, focus on R&D and low-cost manufacturing capability places them in a position to benefit from India’s growth story, and across other developing countries.

- The Government of India is focused on energy transition and achieving COP26 goals and carbon zero by 2070. E2-wheelers will be an important part of the energy transition, given it is the favoured mode of transport for most Indians.

- There is substantial growth still left in the industry, given sales have not climbed back to pre Covid-19 levels

Disclaimer

- This Note (‘Note’) has been produced by India Avenue Investment Management Limited (‘IAIM’) ABN 38 604 095 954, AFSL 478233 and has been prepared for informational and discussion purposes only. This does not constitute an offer to sell or a solicitation of an offer to purchase any security or financial product or service. Any such offer or solicitation shall be made only pursuant to a Product Disclosure Statement, Information Memorandum, or other offer document (collectively ‘Offer Document’) relating to an IAIM financial product or service. A copy of the relevant Offer Document relating to an IAIM product or service may be obtained by writing to us at IA@indiaavenue.com.au or by visiting www.indiaavenue.com.au.This Note does not constitute a part of any Offer Document issued by IAIM. The information contained in this Note may not be reproduced, used, or disclosed, in whole or in part, without the prior written consent of IAIM.

- Past performance is not necessarily indicative of future results and no person guarantees the performance of any IAIM financial product or service or the amount or timing of any return from it. There can be no assurance that an IAIM financial product or service will achieve any targeted returns, that asset allocations will be met or that an IAIM financial product or service will be able to implement its investment strategy and investment approach or achieve its investment objective.

- Statements contained in this Note that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of IAIM. Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. Additionally, this Note may contain “forward-looking statements”. Actual events or results or the actual performance of an IAIM financial product or service may differ materially from those reflected or contemplated in such forward-looking statements. Any trademarks, logos, and service marks contained herein may be the registered and unregistered trademarks of their respective owners. Nothing contained herein should be construed as granting by implication, or otherwise, any license or right to use any trademark displayed without the written permission of the owner.

- Certain economic, market or company information contained herein has been obtained from published sources prepared by third parties. While such sources are believed to be reliable, neither IAIM nor any of its respective officers or employees assumes any responsibility for the accuracy or completeness of such information. None of IAIM or any of its respective officers or employees has made any representation or warranty, express or implied, with respect to the correctness, accuracy, reasonableness or completeness of any of the information contained in this and they expressly disclaim any responsibility or liability, therefore. No person, including IAIM has any responsibility to update any of the information provided in this Note.

- Neither this Note nor the provision of any Offer Document issued by IAIM is, and must not be regarded as, advice or a recommendation or opinion in relation to an IAIM financial product or service, or that an investment in an IAIM financial product or service is suitable for you or any other person. Neither this Note nor any Offer Document issued by IAIM considers your investment objectives, financial situation, and particular needs. In addition to carefully reading the relevant Offer Document issued by IAIM you should, before deciding whether to invest in an IAIM financial product or service, consider the appropriateness of investing or continuing to invest, having regard to your own objectives, financial situation, or needs. IAIM strongly recommends that you obtain independent financial, legal and taxation advice before deciding whether to invest in an IAIM financial product or service