The Global Economy

The structure of the global economy is a complex, interconnected system shaped by production, trade, finance, technology, and governance across nations. It’s not static—it evolves with geopolitical shifts, innovation, and demographic trends. Each country contributes through its GDP, labour force, and resource base.

GDP = C + I + G + (X-M)

The conventional approach for gauging a country’s GDP involves the expenditure method, wherein the total is derived by aggregating expenditure on fresh consumer goods, new investments, government outlays, and the net value of exports.

GDP is generally comprised of Primary (Agriculture, Mining, Raw Materials), Secondary (Manufacturing, Industrial Production) and Tertiary (Services). Increasingly, contributions are also coming from knowledge-based industries like technology, R&D and innovation.

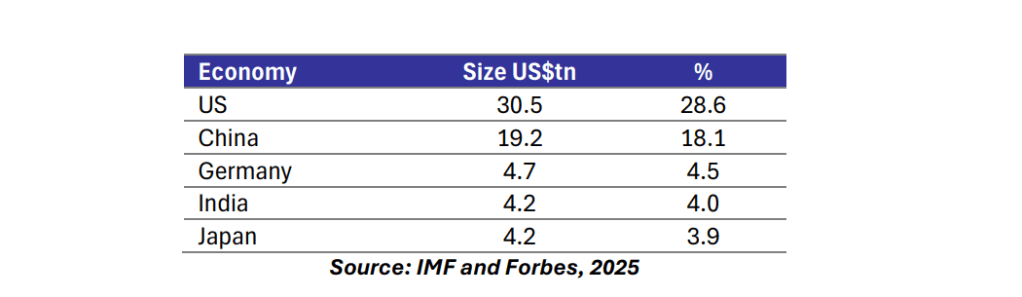

Economies are classified as developed, emerging, or developing, with differing roles in global trade and capital flows. In 2025, the Global economy has reached a size of US$106.5tn, with the dominant economies being:

Global Trade

The overall size of global trade in goods and services is estimated at approximately US$32.5tn annually. Despite the development of “trade wars” through Trump tariffs, global trade continued to expand at a slower rate in Q1 2025 and likely rose further in Q2 (forecast 2% growth for Q2), potentially increasing by

US$300bn in the first half of 2025.

Looking ahead to the second half of 2025, continued resilience in trade will depend heavily on policy clarity, geoeconomic developments, and supply chain adaptability. On the negative side, global economic growth is expected to slow down in many regions, suggesting that international trade may face slower growth. Moreover, the potential imposition of higher tariffs in the United States and the risk of broader trade conflicts pose significant downside risks.

The United States economy has a significant deficit when it comes to Goods Trade. This would increase its focus on reducing deficits (through tariffs or improved negotiation) with countries/regions like China, Europe, Mexico, Vietnam, Canada, Japan and India.

India’s Economy

India’s GDP is driven by services because of a unique blend of historical evolution, demographic advantages, digital infrastructure, and global demand, a path that diverges from the traditional agriculture-to-industry-to-services trajectory seen in many developed economies. Services have a 55% share of Gross Value Added (GVA) for FY25, 27% Industry and 18% Agriculture. There are reasons why this has occurred, which we highlight below:

- – Unlike Western economies that industrialised before scaling services, India transitioned directly from agriculture to services.

- – Manufacturing faced bottlenecks; land acquisition, labour laws, and infrastructure, while services scaled faster with fewer physical constraints.

- – India produces millions of English-speaking, tech-savvy graduates annually.

- – This enabled rapid growth in IT, BPO, financial services, healthcare, and education, attracting global outsourcing demand.

- – Platforms like UPI, Aadhaar, DigiLocker, and ONDC have created a seamless digital ecosystem.

- – Services, from payments to telemedicine, are now accessible across Tier 2 and Tier 3 cities, driving consumption and productivity.

- – India hosts over 1,580 GCCs supporting IT, finance, HR, and analytics for global firms.

- – These centres have moved up the value chain, contributing billions in export revenue and creating high-value jobs.

- – Government initiatives like Digital India, Startup India, and PLI for services have accelerated formalisation and innovation.

- – FDI inflows into services consistently outpace manufacturing and agriculture.

India’s Trade – Navigating the Next Frontier

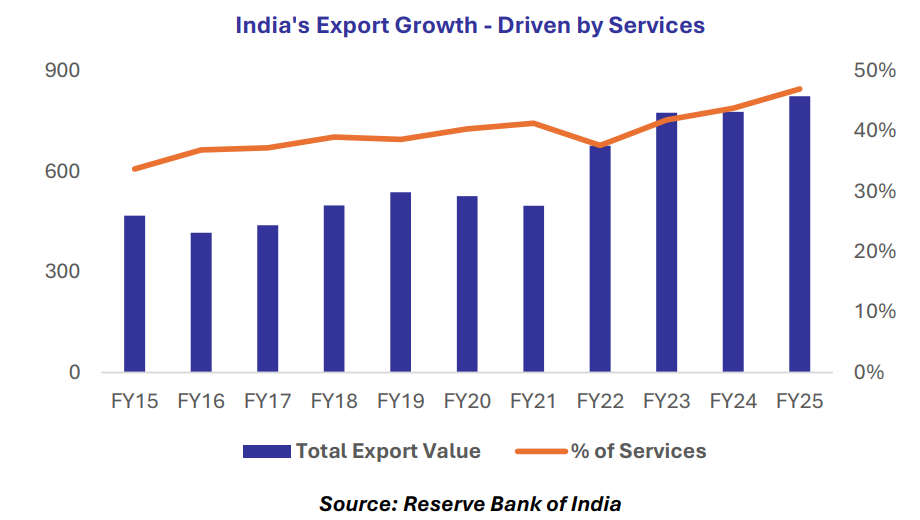

India’s total exports reached $820.9bn in 2024-25, a growth of 5.49% compared to $778.1bn in 2023–24. As per RBI data, India’s exports have nearly doubled from $468bn in 2014-15. India exports goods and services to approximately 200 countries around the world.

Countries like India are not significant when it comes to global trade, with the focus historically on providing for local requirements, particularly in areas like Agriculture and Manufacturing. However, certain industries have continued to evolve over the last 30 years. IT Services has been the leader, with India exporting close to US$400bn in services.

However, India will need to increase its goods exports in areas where it is already building proficiency.

This includes the following areas:

- – Auto and Ancillaries (US$75bn)

- – Refined Petroleum (US$60bn)

- – Electronic Goods (US$39bn)

- – Pharmaceuticals (US$31bn)

- – Textiles (US$16bn)

- – Gems and Jewellery (US$30bn)

- – Chemicals (US$29bn)

India’s Growth Trajectory and Global Ambition

- – The Government of India had boldly set a challenge of US$2tn of exports by FY30.

- – According to McKinsey, India could gain up to $0.8tn to $1.2tn from trade-flow shifts by 2030 and increase the country’s GDP share for manufacturing from 16% in 2023 to 25% by 2030.

- – India’s exports are projected to skyrocket from $770bn to $1.7tn by 2028, covering both services and merchandise, representing a 17% Compound Annual Growth Rate (CAGR). Digitally influenced exports across the top five verticals alone are expected to exceed $100bn by 2028.

Not only would this be a profound development for India’s economy, but it will require a pivot for equity investors who are active, away from more expensive local demand-driven businesses, towards businesses that are at the forefront of export growth and excellence.

Key Drivers for India’s Export Growth

1. Economic Factors

- Growing Wellspring of Innovation and Talent: India is home to approximately one-third of the world’s STEM graduates, who are driving innovations in areas like electric vehicles (EVs) and pharmaceuticals. India is a leading contender for global IT capability centres, with engineering, research, and development (ER&D) sourcing from India projected to increase from $44-45bn today to over $130-170bn by 2030.

- Greater Appeal as a Manufacturing Site: India has increased its share of global exports in several categories. Electronics exports to the United States alone are expected to rise from about $10bn to $80bn by 2030, with global exports potentially reaching $1tn by 2030.6 The “Make in India” and “Atmanirbhar Bharat” reforms are boosting the manufacturing sector, with its contribution to GDP estimated to increase from 15.6% to 21% by 2031, and manufacturing exports expected to double by 2031.

- Historically Low Labour Costs: India has traditionally offered competitive labour costs, which are expected to remain so due to increasing workforce participation and productivity, even if wages rise.

- Expanding Market Boundaries and Affinity for Indian Products: Emerging and developing countries are expected to drive long-term economic growth globally, with Asian and African middle-class households becoming significant. India is experiencing growing demand from new markets like the Netherlands, Brazil, and Saudi Arabia, with increasing exports of handicrafts, leather goods, spices, tea, silver jewellery, and textiles.

- High and Sustained Investment Dynamics: India is witnessing sustained private-equity and venture capital inflows, with government investments in capital infrastructure and innovation indicating strategic bets on key sectors.

2. Government Support and Pro-Business Environment

Pro-Business Policies and Initiatives: The Indian government has reviewed businessrelated laws and is enacting pro-business policies, such as the National Manufacturing Mission, which aims to improve the ease and expense of doing business, workforce development, technology availability, quality products, and support for micro-, small, and medium-sized enterprises (MSMEs). MSMEs contribute approximately 45% of India’s exports but are vulnerable to tariff shocks. India is investing in cluster-based export hubs, digitisation, and credit access to help MSMEs scale and diversify.

Industry-Specific Subsidies: Programs target specific industries, including a 50% capital expenditure subsidy for semiconductor companies building plants in India, with potential for additional state subsidies. The government has allocated $10bn in incentives for the semiconductor industry to reduce reliance on imported chips.

Large-Scale Infrastructure Improvements: India is undertaking major infrastructure improvements and industrial projects, with target expenditures of $1.8tn by 2025, which can enhance productivity and lower supply chain and utility costs.

Streamlined Export Procedures and Funds: Initiatives like the E-commerce Export Hub, Market Access Initiative, and Export Development Fund aim to provide advisory services, professional consultations, training programs, and financial support to MSMEs and first-time exporters, promoting market entry and competitiveness.

Moving up the value chain: India’s export capability outlook is increasingly defined by a strategic move up the value chain, shifting from low-cost goods toward electronics, engineering, digital services, and other high-tech sectors. This allows it to tap into higher-margin global demand pools.

Sectoral Strengthening via VIKSIT Framework: India’s export roadmap is built on the VIKSIT strategy:

a) Value addition and volume-led growth (e.g., electronics, auto, pharma)

b) Inclusive industrial development (MSME clusters, rural manufacturing)

c) Knowledge and capacity building (skilling, R&D)

d) Sustainable supply chains (ESG compliance, circular economy)

e) Infrastructure investments (ports, logistics, industrial corridors)

f) Technology enablement (AI, IoT, smart manufacturing)

3. Technological Advancements and Digital Infrastructure

Digital Connectivity and Automated Trade Processes: Digital connectivity directly impacts trade for emerging economies, increasing domestic trade by 2.1% and international trade by 1.5% for every 1% increase in domestic digital connectivity. Automating border procedures can boost export and import values for MSMEs by 4.5 to 6.5%.

Shift in Digital Trade to Indo-Pacific: The Indo-Pacific region has seen the largest increases in global digital trade share, rising to 18% from 11% in 1995. Digital trade accounted for a quarter of global trade in 2022, growing at 12.5% over the last five years.

Step Changes in Technology and Business Models: Substantial innovation, indicated by increased patent and R&D activity, unlocks new performance curves in sectors, transforming them into “arenas” of high growth and dynamism. India’s 18 identified arenas, including e-commerce, cloud services, and AI software, are expected to generate $1.7-2tn in revenues by 2030.

Exporting Nations – The Evolving Landscape

India’s 10 top export countries in 2024 make up 50% of its total export value, demonstrating high diversity, with the breakdown shown below

Moving forward, India is aiming to further diversify export destinations, reducing reliance on traditional markets such as the U.S. — especially important amid new tariffs and geopolitical disruptions. India is increasingly shifting its export focus toward a broader range of regions, particularly targeting emerging markets in West Asia, Africa, Eurasia, Latin America, and Southeast Asia. This is prompted by government initiatives and private sector interest, indicating these regions will see increased export volumes by weight in the coming years.

• West Asia and Africa

India has strategically expanded its list of priority export destinations from about 20 to 50 countries, with a significant emphasis on West Asia and African nations. This diversification aims to offset risk from higher US tariffs and reduce dependence on a few large markets. Markets in Africa (e.g., Tanzania) are seeing triple-digit growth rates in imports from India, driven by tailored sectoral strategies and the government’s push for geographical balance.

• Central Asia & Eurasia

India is negotiating a Free Trade Agreement with the Eurasian Economic Union (EAEU), which includes Russia, Kazakhstan, and others.

• Latin America

Countries like Brazil have climbed rapidly as important export partners, suggesting India’s policy focus on penetrating new frontiers in South and Central America.

• Southeast Asia

India is pursuing opportunities to boost exports to ASEAN nations, facilitated by trade agreements and their growing consumer demand.

Pharmaceuticals

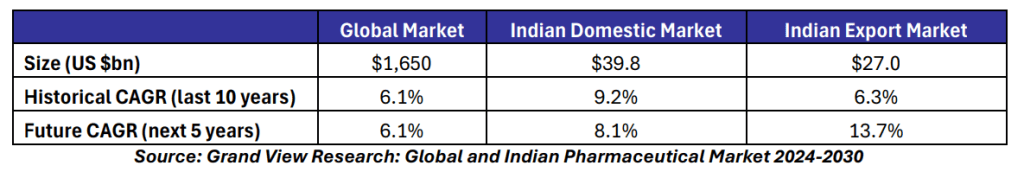

The global pharmaceutical market is valued at US$1,650bn in 2024, with both historical and forecasted growth rates holding steady at around 6.1% annually. Although the industry has grown at a steady pace, this expansion is driven by factors such as the global number of adults aged 65 and older, per capita healthcare expenditure of OECD countries, global R&D funding, global per capita income, and an increase in the prevalence of chronic diseases.

Emerging economies like BRICS (Brazil, Russia, India, China, South Africa) have a middle class population, driving demand for healthcare services and access to medication. These markets are less saturated than developed markets, allowing pharmaceutical companies to establish a strong foothold and capitalise on unmet medical needs.

Indian Pharmaceutical Market

The Indian pharmaceutical market size in 2024 reached US$39.8bn, with a strong CAGR of 8.1%, and is forecasted to reach US$63.7bn by 2030. India makes up around 2.4% of the global market by value, with exports of US$27bn growing at a 13.7% CAGR, more than double the global rate. By volume, India ranks

3rd in the world for pharmaceutical production, supplying around 20% of global generic medicines, earning it the title “pharmacy of the world” as 1 in every 5 generic drugs is produced in India. In terms of revenue, India accounts for 2.4% of the global pharma market in 2024. This is because India is a big

supplier of generic drugs, which have low margins. This underscores the transition from volume-based exporter to a value-driven leader in highly valued products such as biosimilars. Over the past 5 years, pharma exports have grown around 8% per year, primarily propelled by formulations and APIs, which

make up about 90% of total exports.

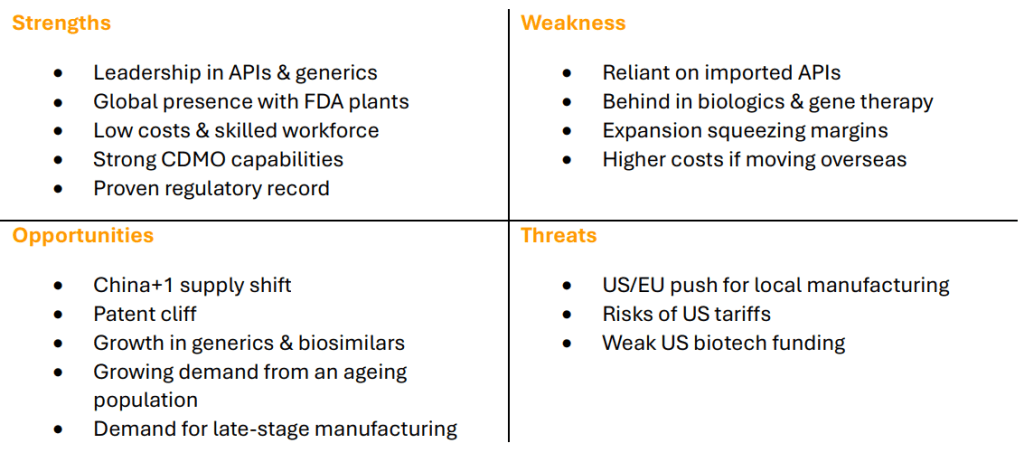

SWOT Analysis – India’s Role in this Industry

Outlook for India’s Pharmaceutical Industry and Export

Key drivers for India’s pharmaceutical industry and export market are:

• Patent cliff

Between 2024-2030, patents on 190 drugs will expire, including 69 blockbusters worth over US$236bn in revenue. Loss of exclusivity will drive generics and biosimilars into the market, forcing original manufacturers to cut prices. India, as one of the world’s largest producers of generics and biosimilars, is well-positioned to capture demand, especially in the US market.

• China+1

Global pharma firms are diversifying supply chains beyond China, creating new opportunities for India. India’s CDMO market has doubled since 2019 to US$20bn in 2023 and continues to grow rapidly. India has a strong regulatory track record, with the largest number of USFDA-approved plants outside the US. There is also a cost advantage of 20-30% vs Chinese CDMOs, which strengthens Inda’s competitiveness. As a leading global API supplier, India stands to benefit from the API market projected to reach US$350bn by 2030.

• Transition to a value-based model

India is transitioning from low-cost generics (currently they export around 90%) to high-margin complex drugs and biosimilars.

11 There is a rising focus on complex generics, injectables and specialty products with higher profitability. R&D investment averages 5% of revenue, with about 1/3rd directed to biosimilars in the US$50bn global market. This pivot is expected to drive export growth at a 13.7% CAGR, boosting margins and global relevance.

Aurobindo’s Role in the Pharmaceutical Market

Aurobindo Pharma is a global pharmaceutical company focused on supplying affordable, high-quality medicines while also producing the active ingredients to branded treatments across lines in generic drugs, offering cost-effective alternatives to branded treatments across critical illnesses, such as cancer, cardiovascular disease and diabetes.

– Largest Indian pharmaceutical exporter to the US

– Global reach with affordable generics in cancer, cardiovascular, diabetes, and other major therapeutic areas

– Emerging market expansion through the acquisition of 17 branded products from Viatris in Indonesia14

– Strong R&D spend with focus on complex generics, injectables and other high-margin specialised products

– The company is expanding its global manufacturing footprint while also investing heavily in biosimilars, a market worth US$50bn

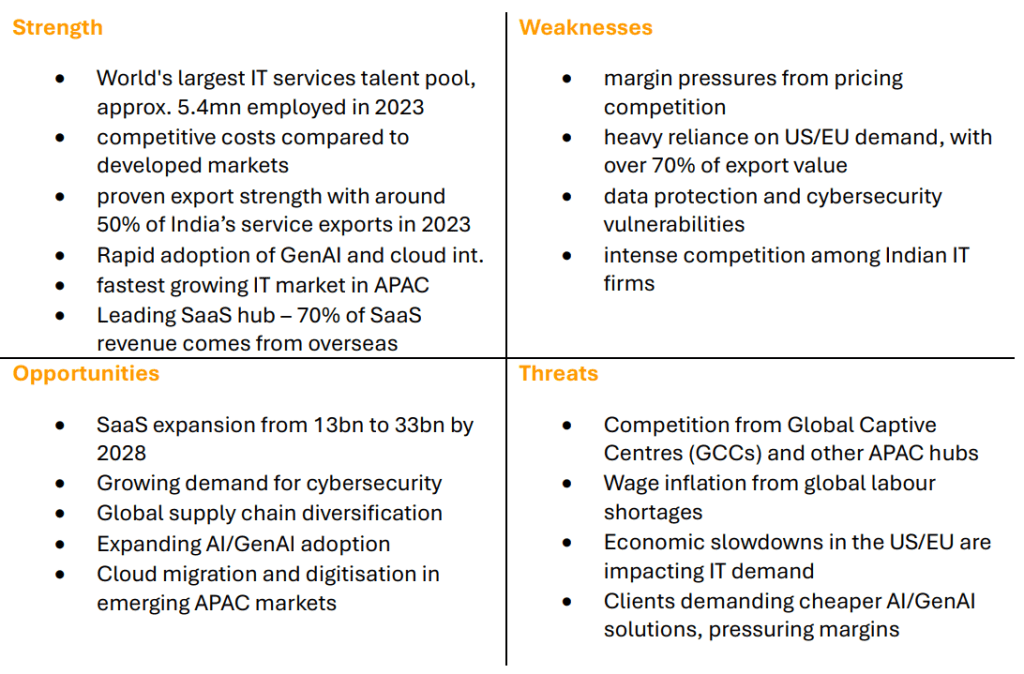

IT Services

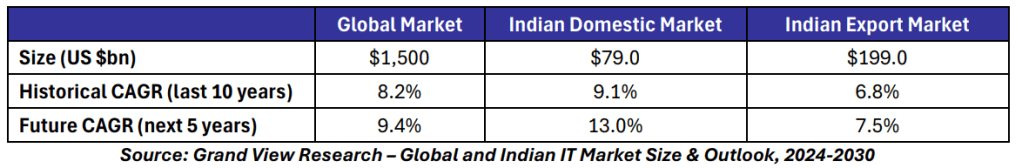

The global IT services market is valued at US$1,500bn in 2024 and is projected to reach US$2,590bn by 2030, with a forecasted CAGR of 9.4%.

15 Historical growth has averaged 8.2% annually, reflecting steady global demand for digital transformation and technology outsourcing.

Industry expansion is being driven by the rapid adoption of artificial intelligence (AI) and generative AI (GenAI), the accelerated migration to cloud platforms, and the rising demand for cybersecurity solutions. Companies are increasingly reliant on data analytics, big data, and IoT connectivity, driving IT spending across all major industries. The global shift toward remote and hybrid work models has also boosted demand for flexible IT infrastructure, collaboration tools, and SaaS platforms, while stricter data privacy and compliance regulations continue to push enterprises to expand IT budgets.

Indian IT Market

The Indian IT services market reached US$79.2bn in 2024 and is projected to nearly double to US$166.4bn by 2030, reflecting a strong CAGR of 13% (2025–2030), well above the global average. India already accounts for 5.1% of global IT services revenue, supported by rapid digitisation, high internet penetration, cloud adoption, and the rise of SaaS exports. This positions India as the cornerstone of APAC’s IT growth and a critical driver of global digital transformation.

Export revenues reached US$199bn in 2024, up from US$126bn in 201818, with exports projected to grow further to US$279bn by 2028.

19 Growth is being driven by SaaS firms and India’s role as a global software hub, with domestic IT demand further strengthened by data localisation policies and competitive talent. SaaS alone generated US$13bn in revenue in 2023, forecasted to expand to US$33bn by 2028, with more than 70% of this revenue coming from overseas markets, underscoring India’s growing importance as both an outsourcing hub and a global innovation centre.

SWOT Analysis – India’s Role in this Industry

Outlook for India’s IT Industry and Export

India’s IT industry is expected to grow at a 13% CAGR between 2024 and 2030, outpacing the global average of 9.4%. Exports, which stood at US$199bn in 2024, are projected to reach US$279bn by 2028, expanding at a 7.5% CAGR, driven by strong Saas and software services performance. Growth is being

shaped by three major themes:

• AI & GenAI Adoption

Projected to grow at a high teens CAGR (15-19%), reaching US$150-170bn by 2028. Indian IT firms are training over 100,000 employees in GenAI and building platforms such as AI Force and AI Foundry to capture global demand. This positions India to lead AI services, helping global clients integrate advanced technologies at scale.

• Cloud Migration & Cybersecurity

By 2028, approx. 70% of technology workloads are expected to be cloud native, up from 25%.

Cybersecurity spend is projected to grow at a high teens CAGR, with budgets rising from 1-4% of IT spend today to 4-6% by 2030. India, with its cost advantage and global delivery model, is wellpositioned to serve multinationals modernising their IT infrastructure and securing digital operations.

• Saas & Software Exports

India’s Saas market was valued at US$13bn in 2023 and is forecasted to reach US$33bn by 2028. Over 70% of Saas revenue comes from overseas clients, underlining India’s export-driven role. Key segments driving growth are enterprise applications such as CRM, ERP, and BI, with enterprise software holding 41% revenue share within SaaS.

HCL Tech’s Role in the IT Market

HCL Technologies is a global IT leader combining services, enterprise software, and engineering R&D. A frontrunner in AI and GenAI, it has delivered 500+ global projects and built one of Asia’s largest software portfolios. With deep partnerships and a client base including half of the Fortune Global 500, HCL drives India’s IT export growth. By blending scale, cost efficiency, and innovation, it supports global digital transformation and reinforces India’s reputation as a next-gen tech hub.

– Operates in 60+ countries with over 220 global delivery centres

– 3rd largest IT services in India

– Partnered with 100 of the top 250 global R&D spenders, strong capabilities in engineering and product innovation

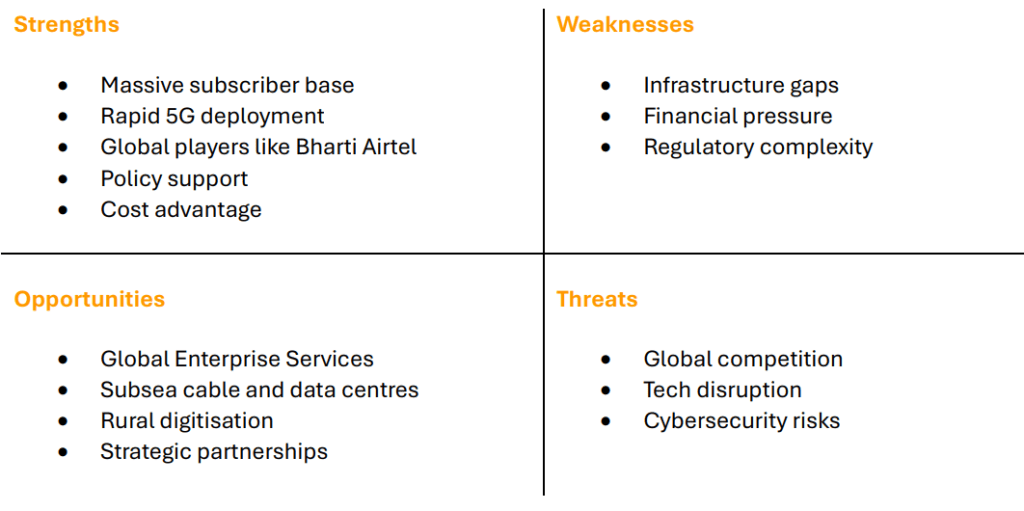

Communications

The global telecom services market is projected to expand from $2.2tn in 2025 to over $4tn by 2035, at a CAGR of 6.4%.

– Telecom Services US$2tn (projection $2.9tn by 2030) includes Mobile Voice, Data, Broadband and Roaming

– Enterprise Telecom Services US$850bn (projection $1.2tn by 2030) includes Cloud, Cybersecurity, IoT and managed services

– Digital Infrastructure (Broadband, Cloud, Data Centres) US$600bn (projected above $1tn by 2030) includes data centres, edge computing and network infrastructure

The expansion of this sector is fuelled by 5G adoption, IoT proliferation, and increased reliance on cloudbased enterprise solutions. Significant global investments are flowing into fibre networks, private 5G, and AI-optimised systems to support future growth. Industries such as Banking, Financial Services &

Insurance (BFSI), healthcare, retail, and IT are increasingly dependent on telecom for secure, uninterrupted connectivity. Telecom is evolving from a utility to a strategic enabler of digital transformation, automation, and global economic resilience.

India’s Global Telecom Services Market

As of 2025, India contributes approximately $52.8bn to the global telecom services market, which places India’s share at roughly 2.8% of the global total. 24 The market is expected to reach US$114bn by 2033 with a CAGR of 8.9% from 2025 to 2033, taking India’s market share to close to 5% by then.

Growth drivers in India are a rapid 5G rollout and smartphone penetration, as well as a surge in mobile data consumption (India ranks #2 globally). This has led to the expansion of fibre and fixed wireless access and rising demand for enterprise telecom and cloud-based services.

India’s telecom sector is punching above its weight in terms of volume, innovation, and digital inclusion and setting it up as a digital infrastructure powerhouse with rising global relevance.

SWOT Analysis – India’s Role in this Industry

Outlook for India’s Telecom Services Industry and Export

India’s telecom services sector presents a favourable long-term trajectory, underpinned by structural drivers such as surging data demand, nationwide 5G deployment, accelerated digital adoption, and supportive regulatory reforms. Industry consolidation has strengthened balance sheets and is enabling

sustained investment in network modernisation, spectrum efficiency, and emerging technologies, including IoT and edge computing. In parallel, Indian operators are extending their reach internationally by exporting telecom and digital solutions, ranging from managed networks to cloud-based communication platforms, positioning the country as a competitive provider of scalable and cost-efficient services in global markets. Some key drivers to the industry include:

-5G Rollout & Pricing Strategy

Aggressive deployment and affordable plans are expanding access.

– Digital India Push

Government-backed initiatives are accelerating rural connectivity.

– Enterprise Demand

Surge in cloud, IoT, CPaaS, and edge computing across sectors.

– FDI & Policy Support

Spectrum reforms, production-linked incentives, and streamlined licensing attract capital.

– Mobile & Internet Penetration

Smartphone adoption and data consumption continue to rise, especially in Tier 2–3 cities.

Bharti Airtel’s Role in India’s Telecom Services Market

The company is a way to capture India’s telecom ascent, blending domestic dominance with global reach. As 5G, enterprise connectivity, and digital infrastructure scale rapidly, Airtel serves over 500mn customers across India and Africa. Its Nxtra data centres, submarine cables, and mobile money platforms position it as a digital exporter. With consistent revenue growth, rising ARPU, and strategic partnerships with hyperscalers, Airtel is enabling India’s transformation into a global telecom hub.

• Operates in 15 countries, including across Africa and neighbouring Sri Lanka and Bangladesh

• Generates 45–50% of consolidated revenue from outside India26

• Owns submarine cable systems, global PoPs, and Nxtra data centres serving international clients

• Rising demand for enterprise-grade telecom exports: cloud, SD-WAN, CPaaS, IoT

• Strategic partnerships with hyperscalers and global MNCs

• Potential to become a regional digital hub for Asia and Africa

• Expected to grow export revenue at 8-9%

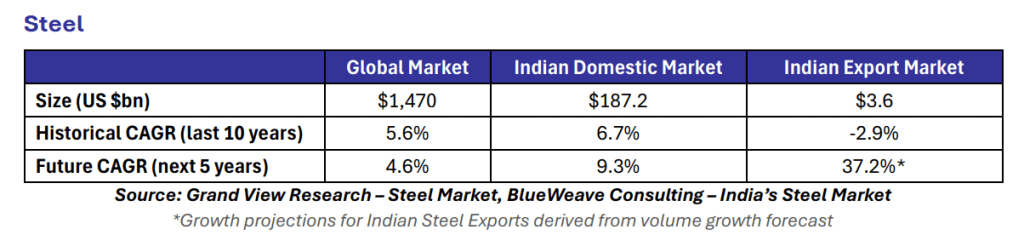

The global steel market size was estimated at US$1.47tn in 2024 and is projected to reach US$1.92tn by 2030, growing at a CAGR of 4.6% from 2025 to 2030.

27 In addition, urbanisation and population growth are increasing the demand for housing and commercial buildings, further boosting steel consumption.

Furthermore, the automotive and renewable energy sectors are also significant contributors, with a growing need for high-quality steel products.

The Asia Pacific steel market dominated the global market and accounted for the largest revenue share of 54.8% in 2024. By product, the long steel segment dominated the global steel industry and accounted for the largest revenue share of 54.1% in 2024. By application, the building and construction applications

led the market and held the largest revenue share of 45.5% in 2024.

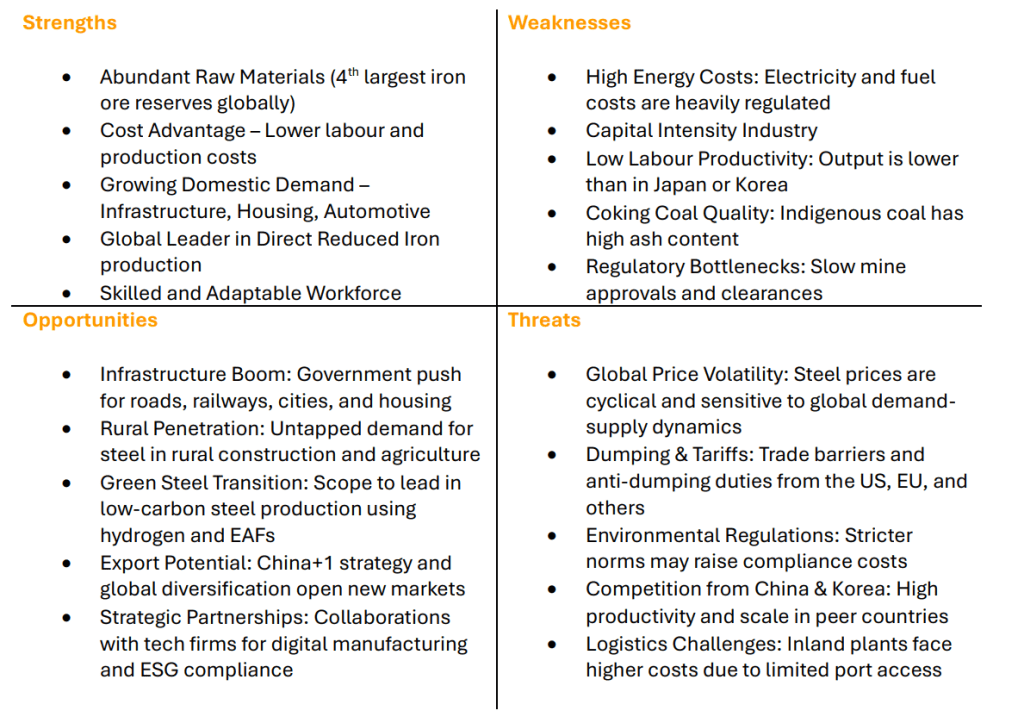

Indian Steel Market

India’s steel market today accounts for 9% of global steel production, second only to China. They produced 152mt in FY25, growing 6.9% over the previous year. India continues to expand capacity aggressively, with projections of 210–220mt of crude steel production by FY2030. The industry’s growth, particularly between 2019 and 2023, has been notable. During this period, India’s steel output expanded at an impressive 6.7% compound CAGR, significantly outpacing China’s 1% and outshining global steel production, which saw a 1% decline.

The past five years have witnessed a global increase in steel capacity by nearly 62mt, with India accounting for 6% of this growth. Notably, ASEAN and India are projected to account for nearly 89% of Asia’s steelmaking capacity additions. As Prime Minister Narendra Modi aptly remarked, the steel industry will play a “vital role” in fortifying the nation’s infrastructure as India pursues its vision of becoming a developed country by 2047. India is not just producing steel; it is crafting a roadmap to reduce import dependency and enhance export competitiveness.

Outlook for India’s Steel Industry and Export

India’s domestic steel market is on a structural growth path, supported by government spending, demographic shifts, and industrial policy. The market in India is expected to grow substantially due to:

• Strong domestic demand: Driven by government-led infrastructure investment in transport, housing, and urban development. With urbanisation below 40%, long-term infrastructure needs remain significant.

• Production growth: India’s output reached 149.6mt in FY2025 (+6.3% YoY), making it the world’s second-largest producer. Output rose 33% between 2019–2024, while global production fell 1%.

• Policy support: Government schemes such as the Production Linked Incentive (PLI) for specialty steel (₹29,500 crore), DMI&SP procurement policy, and protective duties on imports bolster domestic producers.

. Green transition: Integration with the National Green Hydrogen Mission positions India to supply low-carbon steel as ESG requirements tighten.

India’s role as a global steel supplier is expanding, underpinned by surplus capacity, competitive costs, and shifting global supply chains.

• Surplus for export: Expanding capacity outpaces local consumption, creating an exportable surplus.

• Global diversification: “China + 1” supply chain realignment is increasing sourcing from India. India and ASEAN are expected to account for nearly 90% of Asia’s new capacity, reinforcing India’s role as an export hub.

• Sustainability advantage: Rising global demand for “green steel” (expected to grow 2.5x over five years) aligns with India’s push for hydrogen-based steelmaking.

• Cost competitiveness: Lower labour and energy costs, combined with geographic proximity to Asia, Africa, and the Middle East, enhance India’s ability to export competitively.

Tata Steel: A Strategic Gateway to India’s Export Renaissance

India’s drive to become a global manufacturing and export hub is accelerating, with Tata Steel positioned as a leading beneficiary. Its integrated model, cost leadership, global reach, and sustainability investments make it a strong proxy for India’s export renaissance.

• Integrated Operations & Cost Advantage: Owning captive iron ore and coal mines gives Tata Steel a structural edge, insulating it from commodity price volatility and logistics disruptions. This vertical integration enables low-cost, high-quality steel production, strengthening competitiveness in price-sensitive export markets.

• Manufacturing Excellence & Specialty Focus: The Kalinganagar plant—recognised as a World Economic Forum “Lighthouse”—demonstrates Tata Steel’s leadership in automation, AI, and ESG compliance. The company’s focus on specialty segments such as automotive-grade steel, corrosion-resistant alloys, and value-added flat products positions it to capture premium demand globally.

• Global Diversification & Policy Tailwinds: With exports to 79 countries and strong presences in Europe and Southeast Asia31Tata Steel is resilient to regional shocks and trade barriers. Government incentives, including the Production Linked Incentive (PLI) scheme for specialty steel, further enhance its competitiveness in high-grade segments.

• Sustainability Leadership: Targeting net-zero by 2045, Tata Steel is advancing hydrogen-based processes, electric arc furnaces, and carbon capture initiatives. This positions it to meet tightening ESG requirements in markets such as the EU and US, while accessing premium buyers and ESG-linked financing.

• Transformation & Innovation: Capacity expansions, cost transformation in the UK, and over ₹1,000 crore in annual R&D investment strengthen global competitiveness. Investments in digital skills, inclusion, and community initiatives bolster its brand equity and social license, aligning with global stakeholder expectations.

Agriculture & Farming

The global agriculture input ecosystem, including fertilisers, crop protection chemicals, and agri-tech, is projected to grow from US$271bn in 2025 to over US$390bn by 2035, at a CAGR of circa 4.7%. This growth is driven by rising food demand, climate-resilient farming, and precision input adoption across

developed and emerging markets.

Key drivers for global growth in the industry include:

• Global population expected to reach 9.7bn by 2050, requiring a 70% increase in food production

• Depleting arable land and nutrient loss are driving fertiliser demand

• Crop protection demand is rising due to erratic weather and resistance evolution

• GPS-enabled tools, AI-driven advisory, and smart irrigation are improving input efficiency

• Shift toward biofertilisers, controlled-release nutrients, and low-residue crop protection

Agri-inputs now intersect with ESG, food systems resilience, and global trade dynamics and are no longer just commodity-driven. They are strategic enablers of yield optimisation under climate stress, export competitiveness for food-producing nations, carbon mitigation via regenerative practices, and digital

transformation of farming systems.

India’s Agriculture Market

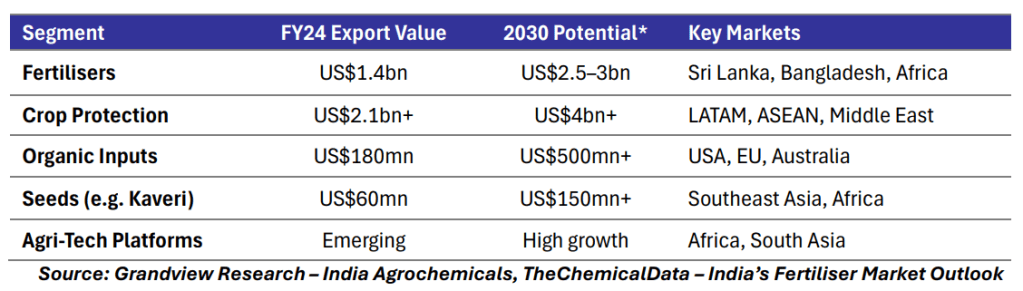

India’s agriculture sector remains a cornerstone of the economy, contributing over 15% of GDP and employing close to 45% of the workforce. The combined market for farming inputs, fertilisers, crop protection, and agri-tech is projected to grow from US$65bn in 2025 to over US$110bn by 2035, driven by

rising food demand, sustainability imperatives, and digital transformation.

Growth drivers for India include a large population, requiring higher crop yields and efficient land use. This includes increasing climate-smart agriculture and digital integration. This is supported by government subsidies, with fertiliser subsidies (especially for urea and DAP) remaining among the largest globally,

supporting affordability. India is a net exporter of crop protection chemicals and organic inputs, with rising demand from Asia, Africa, and Latin America. It ranks as a top 5 exporter of agrochemicals and organic inputs. India exported over US$1.4bn in fertilisers in FY24, with crop protection exports also rising

due to demand for sustainable pest management solutions.

SWOT Analysis of India’s Role in this Industry

Outlook for India’s Agriculture/Farming Sector and Export

Key drivers for India’s agriculture sector and export market are:

• Competitive Manufacturing Base

India is the second-largest fertiliser consumer globally and a top producer of urea, DAP, and NPK blends. Crop protection exports, led by firms like UPL, already reach 130+ countries, with strong demand for post-patent molecules and biosolutions.

• Cost Advantage

Indian agri-inputs are priced competitively due to lower production costs, making them attractive in emerging markets across Africa, Southeast Asia, and Latin America.

• Policy & Infrastructure Support

Government initiatives such as the Agriculture Export Policy, PLI schemes, and CBAM readiness are improving export logistics, compliance, and market access. Investments in nano-urea, biofertilisers, and digital agri platforms are creating differentiated, ESG-aligned export offerings.

• Global Demand for Sustainable Inputs

Rising global interest in organic farming, low-carbon fertilisers, and precision crop protection aligns with India’s capabilities in microbial inputs, nanotech, and digital advisory tools.

India’s export share in global agri-input trade is expected to rise from circa 3.5% in 2025 to 6% by 2035, driven by scale, innovation, and sustainability alignment . India is well-positioned to serve smallholderdominated regions with affordable, scalable inputs, i.e. Africa and ASEAN. Indian exporters are also

preparing for EU carbon regulations, especially for urea and ammonia, which could unlock premium markets. They also have the capability to export bundled solutions, e.g. fertiliser + drone + advisory, differentiating their offering from commodity competitors.

Agriculture/Chemical Companies in the India Avenue Equity Fund

These companies, which form just over 4% of the India Avenue Equity Fund, provide a link to India’s agriculture input and export ecosystem. Each company plays a distinct role across fertilisers, crop protection, seeds, and specialty chemicals, aligning well with the theme of India as a scalable, sustainable agri-input exporter.

Coromandel International

• Operates 18 manufacturing facilities across fertilisers, crop protection, and bio-products34

• Strategic investment in upstream integration and agri-tech partnerships (e.g. Yanmar)

• Expanding export footprint in crop protection and specialty inputs

• Strong retail network and farmer engagement support product adoption and brand equity

Kaveri Seeds

• Export revenue grew 42% YoY in FY24: targeting 10% of total revenue from exports by FY2835

• Active in Vietnam, Bangladesh, Nepal, and expanding into Egypt, Ghana, and Southeast Asia

• Region-specific R&D and hybrid seed portfolio tailored for diverse agro-climatic zones

• Subsidiary in Bangladesh and plans for deeper international engagement

UPL Ltd

• One of India’s largest agrochemical exporters; global operations in 130+ countries36

• Biosolutions portfolio includes microbial inputs, seaweed extracts, and anti-stress technologies

• Positioned to benefit from ESG-driven demand for low-residue, sustainable crop protection

• Strategic fit for India’s role as a global supplier of climate-smart agri inputs

Atul Ltd

• Agrochemicals division includes herbicides, fungicides, and intermediates37

• Exports to multiple regions; supports broader chemical supply chain for agriculture

• Plays a complementary role in India’s specialty chemical and agri-input export mix

Auto & Ancillaries

The global automotive market is estimated at US$2.9tn in 202538, reflecting steady expansion with historical growth of approximately 2.1% and a projected CAGR of 2.2%. Production is geographically concentrated, with Asia-Pacific accounting for 45%, followed by Europe at 27% and North America at 21%, underscoring the region’s central role in global output. Traditional gasoline vehicles continue to dominate with an estimated 55% share, while diesel vehicles account for around 30%. However, the market is undergoing a structural shift as electric vehicles (EVs) rapidly gain traction, supported by advances in battery efficiency and charging infrastructure. Industry growth is being driven by rising percapita incomes, an expanding global middle class, and ongoing technological evolution across EVs, hybrids, and autonomous driving. At the same time, input costs and policy frameworks, notably steel and

crude oil prices alongside government incentives for EV adoption, remain key variables influencing both production economics and consumer demand.

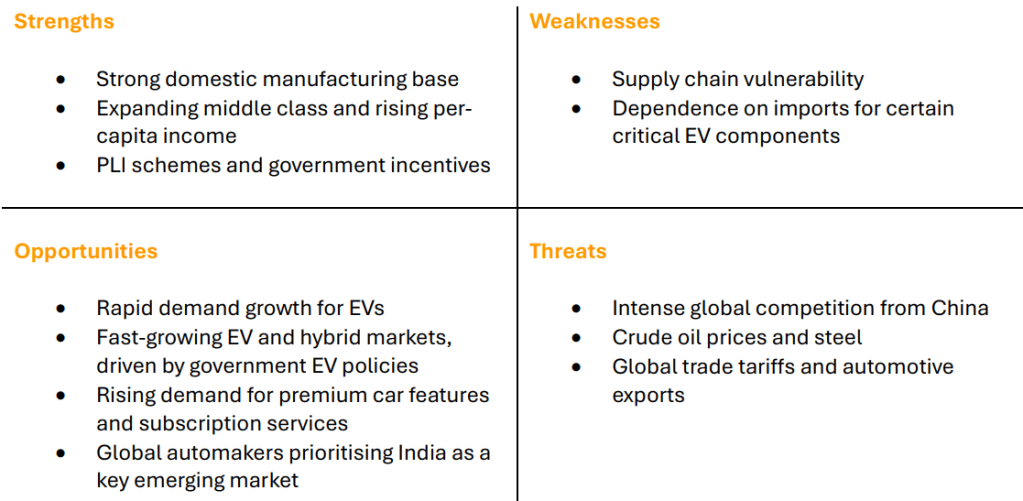

India’s Automotive Market

India’s automotive industry was valued at US$119bn in 2024 and is forecast to expand to US$276.5bn by 2034, reflecting a robust CAGR of 8.8%, well above the global average. India currently accounts for around 8% of global automobile production and is expected to increase this share over the coming

decade as rising incomes and a rapidly expanding middle class fuel demand for personal mobility. The country has established itself as the world’s largest producer of two-wheelers, the second-largest producer of buses, and the third-largest producer of medium and heavy commercial vehicles.

Accelerating urbanisation, alongside major infrastructure initiatives such as national highway expansion and dedicated freight corridors, is further driving demand for passenger vehicles and light commercial fleets.

Policy support has become a critical catalyst for growth. The Production Linked Incentive (PLI) scheme for automobiles and auto components, with a budgetary outlay of approximately US$3.1bn, is aimed at localising supply chains, attracting global investment, and accelerating the adoption of advanced automotive technologies such as electric and hybrid vehicles. Together, these structural tailwinds position India not only as a major domestic growth story but also as an increasingly important player in the global automotive supply chain.

SWOT Analysis of India’s Role in this Industry

Outlook for India’s Automotive Industry and Export

India’s automotive export sector has demonstrated strong momentum, with total exports reaching approximately US$35bn in FY24–25, of which auto components accounted for US$21.2bn. Component exports have expanded at a historical CAGR of 4.9%, with growth expected to accelerate to 11.4% by

2030 as global supply chains deepen their engagement with India. Export volumes also reflected a robust recovery, climbing to 5.63mn units in FY24–25, up from 4.13mn units in FY20–21, underscoring resilience and renewed demand in the post-pandemic period.

By segment, two-wheelers remain the dominant export category, rising from 32.8mn units in FY20–21 to 42mn units in FY24–25, led by motorcycles (36.2mn) and scooters (5.7mn). Passenger vehicle exports nearly doubled over the same period, increasing from 0.40mn to 0.77mn units, supported by growing

demand for cars and utility vehicles. Commercial vehicles, including light, medium, and heavy-duty trucks, reached 81,000 units in FY24–25, marking a steady recovery from pandemic lows.

India’s export footprint is well diversified, with major destinations including the United States, Europe, Africa, and Latin America. The United States remains a particularly important market, importing approximately US$6.6bn of auto components in FY24–25. This trajectory highlights India’s growing integration into global automotive value chains and its ability to supply both advanced and affordable mobility solutions across diverse markets.

Hero MotoCorp’s Role in India’s Automotive Market

Hero MotoCorp is the second largest motorcycle manufacturer globally, with a 9.6% share of the global market and leading in unit volumes sold41. The company has built a strong footprint across Asia, Africa and Latin America, where demand for affordable and reliable two-wheelers continues to grow.

Domestically, they are the leader in India’s two-wheeler market, with a dominating 31% market share. Its scale, extensive distribution network and cost-efficient manufacturing capabilities make Hero MotoCorp a key player in India’s automotive sector and a significant beneficiary of the sector’s forecasted growth.

• Largest producer in India in terms of unit volumes sold

• Leading two-wheeler manufacturing globally

• Launched its first electric scooter line under the VIDA brand to tap into the fast-growing EV segment

• Maintains a research and development centre focused on next-generation mobility and EV technology

Key Takeaways forIndia’s Exporting Sectors

• The pharmaceutical sector remains one of India’s strongest export stories. While the global market is valued at US$1.65tn in 2024 and is growing steadily at around 6.1% annually, India’s domestic market of US$39.8bn is expanding at a faster 8.1% CAGR, with exports of US$27bn projected to rise at 13.7% annually. India supplies nearly 20% of the world’s generics, underlining its role as the “pharmacy of the world.” The sector is well-positioned to capitalise on the upcoming global patent cliff, with US$236bn worth of drugs losing exclusivity, and on the diversification of supply chains away from China. A gradual transition from low-margin generics toward high-value biosimilars and complex drugs is expected to boost India’s competitiveness and export margins. Companies like Aurobindo Pharma are leading this evolution, expanding their focus to injectables and biosimilars to tap into high-margin global opportunities.

• The IT services industry continues to anchor India’s role as a global digital hub. With the global market sized at US$1.5tn and forecast to reach US$2.6 tn by 2030, India is capturing a growing share through exports worth US$199bn in 2024, projected to rise to US$279bn by 2028. India’s strength lies in its deep talent pool, competitive costs, and established reputation as the world’s software outsourcing leader. Growth is driven by accelerating adoption of AI and generative AI, cloud migration, and rising demand for cybersecurity solutions, with India’s SaaS exports alone expected to grow from US$13bn in 2023 to US$33bn by 2028, over 70% of which is overseas driven. Companies such as HCL Tech are consolidating India’s export relevance by blending large-scale service delivery with advanced capabilities in AI, engineering, and enterprise software for global clients.

• India’s telecommunications industry is scaling into a major export enabler of digital infrastructure. Globally, telecom services are projected to grow from US$2.2tn in 2025 to more than US$4tn by 2035, fuelled by 5G adoption, IoT proliferation, and demand for enterprise cloud solutions. India’s domestic telecom market is valued at US$52.8bn in 2025 and expected to more than double by 2033, supported by one of the world’s largest subscriber bases and rapid smartphone penetration. The rollout of nationwide 5G and the expansion of fibre networks are enabling Indian operators to export services in cloud connectivity, CPaaS, and managed telecom solutions. Bharti Airtel exemplifies this export trajectory, with a footprint spanning 15 countries and Nxtra data centres that serve multinational enterprises, positioning India as a regional digital hub across Asia and Africa.

• The steel sector is another pillar of India’s export story. The global steel market, valued at US$1.47tn in 2024, is forecast to reach US$1.92tn by 2030, driven by infrastructure and automotive demand. India has emerged as the second-largest producer globally, with 152mt produced in FY25 and ambitions to reach 210–220mt by 2030. Unlike most regions, India has grown output consistently, with production up 33% since 2019 against a global decline. With surplus capacity, a cost advantage, and alignment with the global “China+1” diversification strategy, India is expanding its role as a competitive exporter. Tata Steel exemplifies this transformation with its vertically integrated model, specialty products, and commitment to sustainability through hydrogen-based and low-carbon steel, reinforcing India’s status as a cost-efficient and ESG-aligned supplier.

• In agriculture and farming, India is consolidating its role as a key exporter of agri-inputs at a time when global markets are projected to expand from US$271bn in 2025 to US$390bn by 2035. India’s domestic agri-input market is forecast to grow from US$65bn in 2025 to over US$110bn by 2035, supported by large-scale fertiliser consumption, rising demand for sustainable inputs, and significant policy support. Export potential is strong across fertilisers, crop protection, and organic inputs, with India already among the top five exporters of agrochemicals. By 2035, India’s share in global agriinput trade is expected to rise from 3.5% to 6%, driven by competitive manufacturing, digital platforms, and alignment with sustainability. Companies such as UPL, Coromandel, Kaveri Seeds, and Atul are expanding their export reach in agrochemicals, fertilisers, seeds, and bio-solutions, reinforcing India’s position as a reliable supplier to Africa, ASEAN, and Latin America.

• Finally, the automotive industry is positioned as both a domestic growth driver and an expanding exporter. The global automotive market, worth US$2.9tn in 2025, is being reshaped by EV adoption and consumer demand for connected, premium features. India’s industry reached US$119bn in 2024 and is forecast to more than double to US$276.5bn by 2034, underpinned by a rising middle class, urbanisation, and supportive government policies such as PLI schemes and EV incentives. With India already the global leader in two-wheelers and expanding its share in commercial and passenger vehicles, domestic champions such as Tata Motors and Hero MotoCorp are spearheading exports into markets across Asia, Africa, and Latin America, highlighting India’s growing significance in global automotive supply chains.

KeyRisks to India’s Export Growth Trajectory

• Policy & Regulatory Risks

Recent increases in H-1B visa fees in the US raise costs for Indian IT service exporters, who rely heavily on onsite talent in the US. This could reduce competitiveness and pressure margins in India’s largest export market. Indian IT firms are already shifting towards offshore delivery, nearshore centres

in Latin America and Eastern Europe, and investing in automation and generative AI platforms to reduce dependency on US-based headcount.

• Global Trade Barriers & Protectionism

Rising tariffs, local manufacturing mandates (notably in US/EU pharma and steel), and potential antidumping actions could limit India’s export penetration. Indian corporates are diversifying export destinations (Africa, ASEAN, LATAM) and moving up the value chain to specialty products (e.g., biosimilars in pharma, specialty steel, agri bio-inputs) that face less commoditised competition. Strong domestic demand also provides a buffer against external shocks.

• Geopolitical & Supply Chain Vulnerabilities

Heightened geopolitical tensions, disruptions in Red Sea/Suez or Indo-Pacific routes, and dependency on imported raw materials (e.g., APIs, coking coal, fertiliser inputs) pose risks to export continuity. Indian companies are actively pursuing backward integration (e.g., captive mines for steel, domestic API manufacturing), expanding warehousing and port infrastructure, and leveraging “China+1” realignments to gain from global diversification of supply chains.

• ESG & Compliance Pressures

Stricter global ESG norms, including the EU’s Carbon Border Adjustment Mechanism (CBAM), may raise costs for Indian steel, fertiliser, and chemical exports if compliance lags. Non-compliance risks loss of access to premium markets. Indian corporates are investing in green steel, renewablepowered manufacturing, and low-residue agri-chemicals. Early alignment with ESG-linked financing and export policies positions India to benefit from the global shift to sustainable trade.

• Global Demand Cyclicality

India’s export-heavy industries (IT, auto, steel, chemicals) are sensitive to US/EU economic slowdowns. Weak biotech funding in the US, slowing IT spends, or auto demand volatility could reduce export revenues. Companies are diversifying end-markets, with rising focus on emerging economies (Africa, SE Asia, LATAM) and domestic growth drivers. They are also broadening product portfolios—e.g., SaaS for IT, electric vehicles for autos, biosimilars for pharma—to capture structural demand even in downturns.

India Avenue Equity Fund

When investing in India’s growth stories, many investors tend to favour local demand-driven industries to benefit and leverage from the region’s attractive and unique demographics. However, the demographics are also driving India’s export prowess as it builds scale economics across industries, through its large, aspirational, English-speaking and youthful workforce.

The India Avenue Equity Fund companies now have approximately 29% of their revenue generated offshore (market cap weighted basis).

Investing in Samsung or TSMC exposes you to global cycles, not necessarily South Korea or Taiwan’s domestic demand. However, India’s exporters are not global businesses – they are powered by the same demographics that benefit local demand-driven businesses. As an investor, you are still buying the India

growth story through these companies.

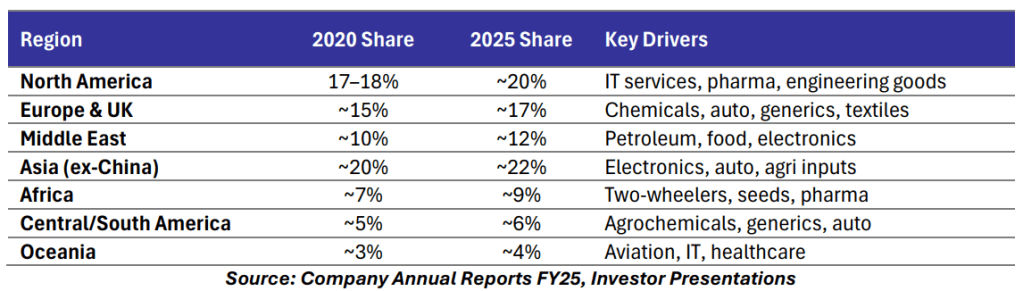

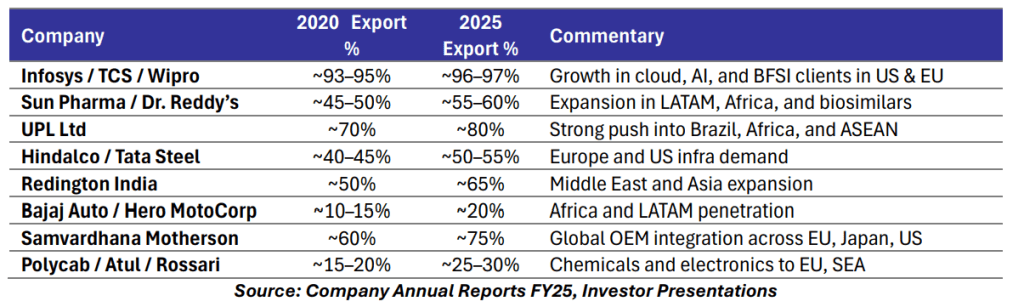

The industries that have a significant impact are IT Services, Pharmaceuticals, Autos & Ancillaries, Agri, Farming and Chemicals, Metals and other Industrials. The export revenue breakdown by region and company has undergone significant evolution over the past five years (2020–2025), driven by global realignments, supply chain diversification, and India’s own export push.

• Services exports (IT, consulting, healthcare) have grown faster than merchandise exports

• Engineering goods, pharma, electronics, and chemicals led merchandise growth

. PLI schemes and FTAs helped diversify export destinations

Over the last five years, the push into regions like Asia ex-China, Africa and the Middle East has been significant. However, North America’s share has also grown due to accelerating needs for IT Services and Generic Pharmaceuticals, as well as Auto ancillary parts. It is evident that India’s economic scale is

leading to greater exporting opportunities globally, rather than a few select regions

Export initiatives undertaken by companies in the India Avenue Equity Fund reflect their strategic expansion, global competitiveness, and alignment with India’s manufacturing and innovation edge. These examples reinforce the fund’s exposure to globally relevant businesses rooted in India’s domestic strengths:

Conclusion

India’s export renaissance is reshaping its economic identity, positioning the nation as a manufacturing and services powerhouse integrated into global value chains. The scale of opportunity, US$2tn in projected exports by 2030, reflects both structural reforms and the demographic dividend at play. Sectors such as IT, pharmaceuticals, autos, steel, agri-inputs, and telecom are set to benefit disproportionately, with domestic champions already expanding into new geographies and higher-value segments.

For investors, the implications are clear: India’s export growth is no longer a peripheral theme but a core driver of long-term equity performance. Passive strategies tied to broad indices risk overweighting expensive, domestic-demand businesses, while underrepresenting the dynamic companies powering

India’s global rise. India Avenue Equity Fund provides investors with a differentiated edge to identify and allocate capital to exporters positioned at the forefront of structural change, ESG alignment, and global competitiveness. By leveraging deep local insights and a forward-looking framework, the India Avenue framework enables investors to position ahead of the curve and capture India’s export-driven growth story as it scales into one of the world’s most important trade hubs

Disclaimer:

• Certain economic, market or company information contained herein has been obtained from published sources prepared by third parties. While such sources are believed to be reliable, neither IAIM nor its respective officers or employees assume any responsibility for the accuracy or completeness of such

information. None of IAIM or any of its respective officers or employees has made any representation or warranty, express or implied, with respect to the correctness, accuracy, reasonableness or completeness of any of the information contained in this and they expressly disclaim any responsibility or liability, therefore. No person, including IAIM has any responsibility to update any of the information provided in this Note.

• Neither this Note nor the provision of any Offer Document issued by IAIM is, and must not be regarded as, advice or a recommendation or opinion in relation to an IAIM financial product or service, or that an investment in an IAIM financial product or service is suitable for you or any other person. Neither this Note

nor any Offer Document issued by IAIM considers your investment objectives, financial situation, andparticular needs. In addition to carefully reading the relevant Offer Document issued by IAIM you should, before deciding whether to invest in an IAIM financial product or service, consider the appropriateness of iinvesting or continuing to invest, having regard to your own objectives, financial situation, or needs. IAIM strongly recommends that you obtain independent financial, legal and taxation advice before deciding whether to invest in an IAIM financial product or service.

• This Note does not constitute a part of any Offer Document issued by IAIM. The information contained in this Note may not be reproduced, used, or disclosed, in whole or in part, without prior written consent of IAIM.