India Avenue utilises a multi-adviser philosophy to capture the full benefits of investing in India’s equity markets. As articulated in our philosophy, we believe that India is an inefficient market, meaning that active managers can add value by identifying appropriate companies to invest in. Another pillar of our philosophy was our belief that local asset managers in India are more likely to outperform benchmarks, than fund managers based outside of India who have exposure to India, either through Global, Emerging Market or Asia strategies, or even running an India fund from abroad.

Our process seeks to capture these beliefs in our product proposition. The India Avenue Equity Fund is an actively managed long-only equity fund, which seeks to outperform the MSCI India through insightful stock selection. This comes from the well-practised skill set of fund managers operating within India’s economic, regulatory and corporate ecosystem. The output of this skill set can be evidenced in their ability to outperform benchmarks and peers over long-term horizons.

- We identify the universe of investment managers in India, who can act as our advisers. We reduce this to a working list by undertaking due diligence. We are well placed to do this given our experience attained from investing, applying the same methodology over the last 8 years (2016-2024) and previously with ING Investment Management (2005-2012).

- Our due diligence leads to a short list of advisers we can use to construct a portfolio with. We utilise an investment advisory agreement to partner with our advisers (which we design in conjunction with our advice partners). Our advisers then provide advice i.e. what stock to buy or sell (including limit prices) as they seek to construct a portfolio of advice for India Avenue.

- India Avenue then blends a proportion of the various advisory portfolios from our advisers to construct its overall portfolio. However, all advice must pass through our pre-compliance system prior to implementation. We implement the advice of our advisors by trading through a panel of five Indian stockbrokers.

- India Avenue utilises a centralised portfolio management structure for implementing advice. This creates synergies in implementing a multi-adviser philosophy, rather than embedding additional layers of cost.

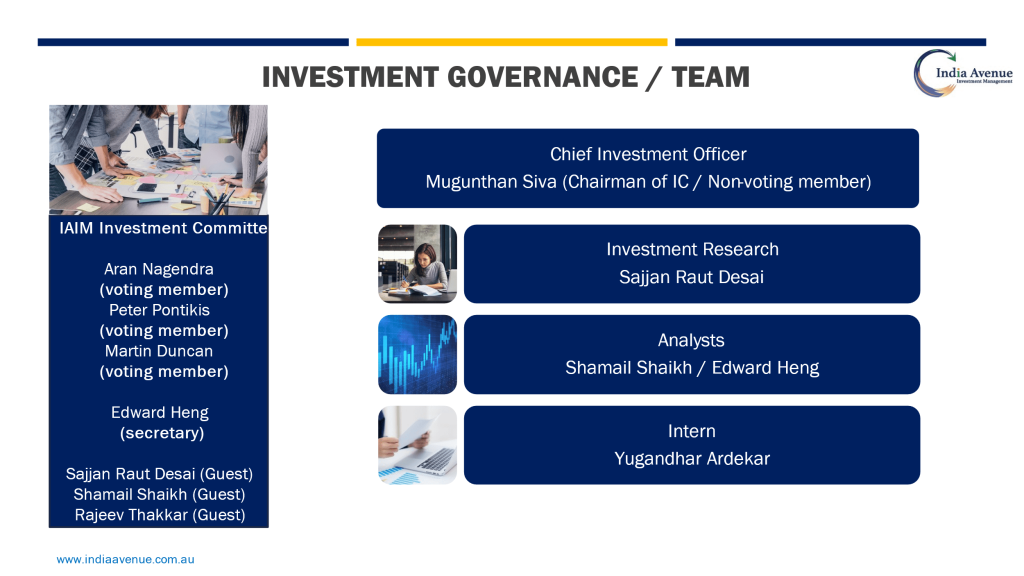

- The last and most important step is monitoring and reviewing the aggregate portfolio for appropriateness given the prevailing macro and microenvironment. This and an outlook for Indian equities is discussed and ratified in the quarterly Investment Committee meetings, which include India Avenue’s Investment Team as well as two independent voting members.

Our careful and painstaking approach to building our product proposition embeds all our knowledge, not only on investing, but also on operations and taxation when investing in a market like Indian equities. For example, use of a local custodian of assets helps us to maintain lower transaction costs, when trading in a market like India.

We believe this comes from our singular focus on India as an investment destination, our significant network in India and the experience of our founders.