Recently a report was released from Hindenburg Research which insinuated logic for shorting the stocks within the Adani Group. This Report was released last week and has had an immediate adverse impact on the share prices of the Group companies as well as other businesses which may have some linkage to the Adani Group.

As a result of the report, the seven listed companies within the Group have lost US$48bnin market value. The report flags concerns about the Group’s debt levels, market manipulation, accounting fraud as well as the use of tax havens. The report claims that there is a web of family controlled offshore entities in tax havens from the Caribbean, Mauritius and the UAE which were used to facilitate corruption, money laundering and taxpayer theft, while siphoning money from the Group’s listed companies.

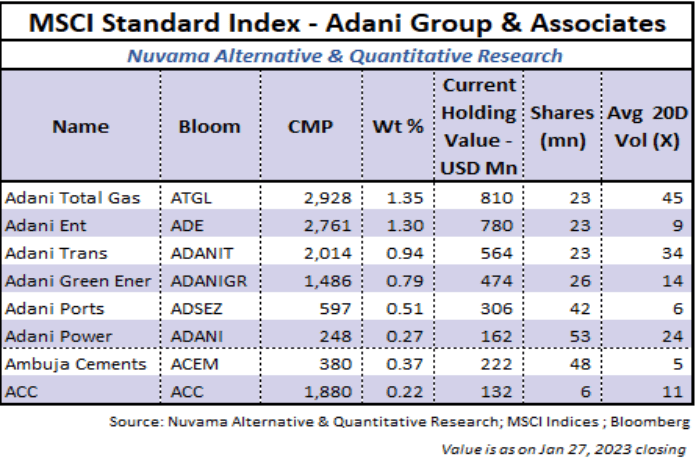

The MSCI India weighting of these companies is collectively 5.75%. The MSCI is currently seeking feedback on whether they will need to take any action. Whilst it may adopt to do nothing post feedback, another option is to exclude the Adani Group and associated companies from the index due to excess volatility.

The Adani Group has refuted the allegations made in the report, stating that it was published on the 24th of January 2023, without making any attempt to contact the company or check facts. They have claimed that the report is a “malicious combination of selective misinformation and stale, baseless and discredited allegations that have been tested and rejected by India’s highest courts”.

It was also stated that the report intentionally aims to undermine not only the Group’s reputation, but also to damage the upcoming US$2.5bn follow-on Public Offering from Adani Enterprises, which was set to be the largest FPO ever in India. The anchor investor component of the offering was oversubscribed, but the market premium demanded prior to the Hindenburg Report has now less than halved. Adani Enterprises have stated that there will be no change to the schedule or issue price of the FPO (27th -31st January 2023).

The Adani Group has risen to prominence over the last 3 years, but was founded in 1988. The company is head quartered in Ahmedabad and was founded by current chairman, Gautam Adani. The Group was founded in 1988 as a commodity trading business, with the flagship company Adani Enterprises. The Group’s businesses include port management, electric power generation and transmission, renewable energy, mining, airport

operations, natural gas, food processing and infrastructure.

In November 2022, Adani Group market capitalization reached top US$280 billion, surpassing Tata Group. The group is responsible for the Carmichael Project in Queensland, which is the operation of a coal mine, producing its first shipment in December 2021.

The Adani Group Companies are approximately 6% of the MSCI India, which is our benchmark.

India Avenue Equity Fund and India 2030 Fund have no exposure to the Adani Group at this time and thus are not affected directly by the fall in value of the shares of the Group. However, generally it has had a negative impact on market sentiment. This can occur as investor try to assess the short-term impacts on businesses which may be linked.

We expect trading in these companies to be volatile and difficult to predict, given the Hindenburg Report and the upcoming FPO for Adani Enterprises. Rather than speculate, we prefer to stay on the sidelines and observe market action. We don’s see this causing any systemic issues related to Indian equities for investors. However, there will be increased market volatility, particularly for the Adani Group companies (7 listed) and associated companies like Ambuja Cements and ACC in the short-term.

The strength in the AUD since October 2022, relative to the INR and the general market volatility caused by the Hindenburg report may present an opportunity for long-term investors seeking to invest in the India growth story.

However, this note is not to be taken as advice. You will need to speak to your financial adviser on your existing portfolio and individual circumstances.

We intend to keep you updated with further relevant information as and when it becomes available.

Our Disclaimer:

Equity Trustees Limited (“Equity Trustees”) (ABN 46 004 031 298), AFSL 240975, is the Responsible Entity for the India Avenue Equity Fund (“the Fund”). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT). The Investment Manager for the Fund is India Avenue Investment Management Australia Pty. Ltd. (“IAIM”) (ABN 38 604 095 954), AFSL 478233. This publication has been prepared by IAIM to provide you with general information only. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Neither Equity Trustees, IAIM nor any of their related parties, their employees, or directors, provide any warranty of accuracy or reliability in relation to such information or accept any liability to any person who relies on it. Past performance should not be taken as an indicator of future performance. You should obtain a copy of the Product Disclosure Statement before making a decision about whether to invest in this product.

The India Avenue Equity Fund Target Market Determination is available. India Avenue Equity Fund’s Target Market Determination is available on our website: www.indiaavenueinvest.com/our-fund. A Target Market Determination describes who this financial product is likely to be appropriate for (i.e. the target market), and any conditions around how the product can be distributed to investors. It also describes the events or circumstances where the Target Market Determination for this financial product may need to be reviewed.