India’s GDP reached US$3.9 trillion as at the end of fiscal 2024 (March), placing it as the world’s 5th largest economy. Both Japan and Germany, which are slightly ahead of India are easily reachable over the next few years, which would carry India to the 3rd largest economy in the world, behind the US and China.

India has the capacity to grow at a faster pace, with its GDP-per-capita currently below US$3,000, whilst the other economies in the top 5 all have a GDP-per-capita above US$30,000, except for China at US$13,000 – still a whopping 4.8x of India!

At the current rate of GDP growth and inflation, it is expected India’s nominal GDP will top US$7 trillion by the end of the decade (around 5-6% of Global GDP). An increase in GDP-per-capita, as India dominates the world’s working age population, will lead to rising consumer spending and increased allocation to discretionary spending.

The India 2030 Fund

- For investors, there are several sectors of the economy expected to participate significantly in India’s growth from here:

- India’s exports should lift from US$400 million per annum to close to US$1 billion by 2030. This will create significant employment, improve India’s economics, and build significant industry expertise and scale. It is expected that

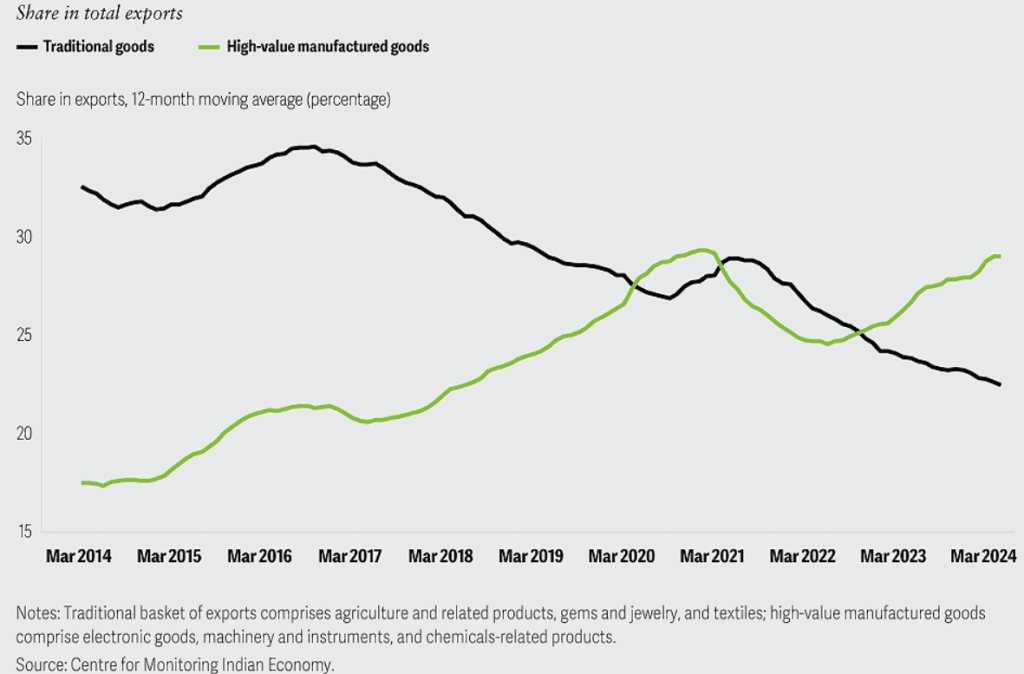

- India’s component of high value manufacturing has been rising relative to its commoditised manufacturing. It is seeking to sit between China’s focus on technology and low-value manufacturing of the likes of Vietnam, Indonesia, Bangladesh and Philippines. Areas like the manufacture of Generic Pharmaceuticals is being dominated by India due to its expertise, scale, low-cost and skilled labour.

- Energy transition will require significant investment (at a rate of US$600bn per annum to help India transition to net-zero by 2050. Significant investment is currently going into Solar, Wind, Hydro and Hydrogen.

- A shift towards a greater allocation of the household budget on premium goods and services as the middle class grows and household wealth rises. The shift is likely to be towards non-food and discretionary. Whilst rural India was deeply impacted by COVID-19 and remains weak, the potential for a recovery creates significant business opportunities – particularly given the digitisation and financialisation of India.

- Corporate earnings growth is more rapid and being driven by digitisation, M&A, exporting and capacity building. In this process resources are being allocated and leadership is being invested in.

This growth is required to lift some 700 million people above the economic empowerment threshold, which means they will be able to participate fully in economic activities and make decisions on their financial well-being.

The newly elected Government in 2024 (Narendra Modi led BJP) will need to focus on improving agriculture productivity, create jobs for young people as well as provide subsidies for Healthcare and Education to not place too big a burden on necessities for the bottom end of the pyramid. This will ease inflationary pressures for rural areas and will lead to increasing consumer spending on a larger consumer base.