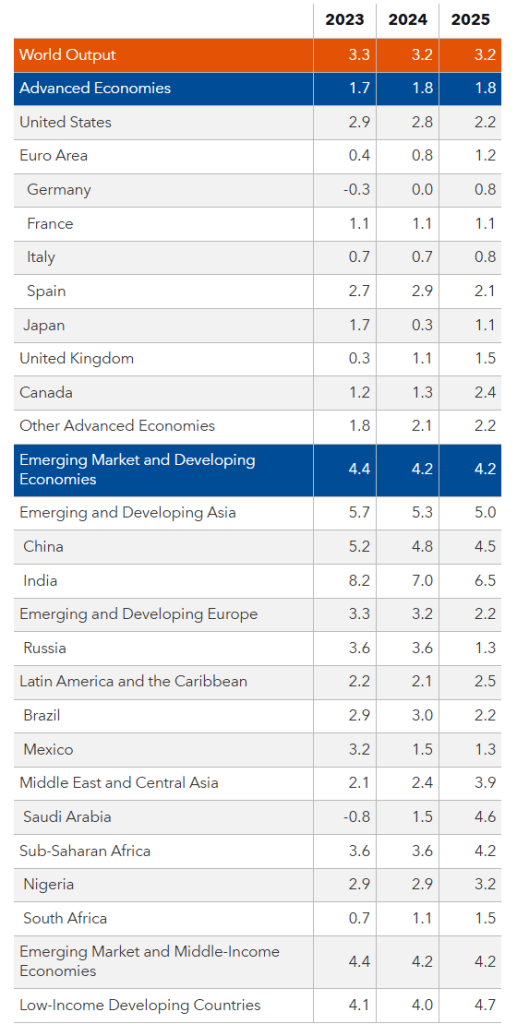

As the world grapples with a “soft landing” in the US and an “economic slowdown” in China, there seems to be a dearth of optimism regarding major economies. Amid such gloomy expectations, India stands out as the only major economy expected to grow at a healthy real GDP growth rate of 7.3% in calendar 2024, compared to China’s growth rate of 4.8% and US’s growth rate of 2.8% (source: IMF).

Note: For India, data and forecasts are presented on a fiscal year basis, with FY 2023/24 (starting in April 2023) shown in the 2023 column. India’s growth projections are 7.3 percent in 2024 and 6.5 percent in 2025 based on calendar year.

The journey began in 1991, when India’s economy was first liberalised under the congress regime – the economy has averaged about 6% annual growth since then. Nevertheless, there was a phase from 2009 to 2014, wherein the country faced a period of policy paralysis with growth dropping below 6 % in 2011 & 2012 (source: IMF). The entrance of the BJP Government in 2014 led to a fresh round of reforms which were pro-growth and pro-business. Whilst the first term of the BJP, under Modi’s leadership, included introduction of significant reforms and some indigestion, the second term saw India ride through a turbulent pandemic and rebound strongly with a positive pivot towards growth via reforms and initiatives around infrastructure, digitisation, financial inclusion, manufacturing and corporate governance. Let’s understand a bit more about some of these reforms.

Infrastructure is the backbone of any economy, and it has been a clear focal area of reforms for the Indian government with visible, measurable progress made over the past 10 years;

- India expanded its National Highways network by 1.6 times.

- The government has operationalised 100 high-speed trains and modernised 1,318 railway stations. It has also achieved electrification of about 94% of its railway network.

- The metro rail network in India has expanded by about four times, and is now available in 23 cities.

- The number of airports has grown from 74 in 2014 to 157 in 2024.

The Indian Government has significantly increased its allocation to infrastructure and is expected to spend a record 11 trillion rupees (about US$132 bn in fiscal 2025). Four years ago this number was less than half at about 4 trillion rupees (fiscal 2021).

The infrastructure boost has supported growth of key sectors such as Industrials, Real Estate and Aviation. The India Avenue Equity Fund has an ‘overweight’ position in these sectors and expects these to benefit from continued structural reforms, improved road, rail and air networks, and sustained increase in demand for real estate. For example, Interglobe Aviation (Indigo Airlines) is amongst the top 10 holdings in the portfolio – a stock whose price has risen by about 4x between 2020 and 2024.

Digitisation – India’s digital revolution over the past decade has been a game-changer. The much-talked-about Unified Payments Interface (“UPI”, India’s real-time payment settlement system initiated by the RBI and banks’ association) is often referenced as a case study around the world.

- From fiscal 2018 to 2023, the volume of UPI transactions has increased from 0.92 bn to 131 bn transactions – an annual growth rate of about 138%.

- UPI has helped reduce the use of cash and cheques in India, significantly increased the adoption of digital payments, and improved access to financial services.

Financial Inclusion – Another significant milestone in India’s digital revolution was the introduction of the “JAM” (Jan Dhan, Aadhar, and Mobile) trinity, designed to provide direct benefit transfers (straight to accounts) to citizens qualifying for subsidies. It was also a significant step to reduce (if not eliminate) leakages due to corruption and inefficiencies.

- As of this year, there are about 53 bn Jan Dhan account holders, and more than 90% of India’s population possesses an Aadhaar card, making JAM one of the largest financial inclusion initiatives in the world.

UPI and JAM are among the key reforms that have contributed to the emergence of Non-Banking Financial Companies (NBFCs) over the past decade – these companies have leveraged digitization and financial inclusion to reach the mass rural, underserved markets to provide affordable, low cost, micro financial services.

Some of the top holdings in the India Avenue Equity Fund include NBFCs such as Cholamandalam Investments, Shriram Finance & Bajaj Finance, all of which have seen strong business growth and stellar increase in share prices.

Manufacturing – In addition to infrastructure, the Government has implemented incentive-based programs to encourage domestic manufacturing, provide tax breaks, lower land rates, and ensure access to capital for setting up factories.

- These “Production Linked Incentive” (PLI) schemes worth about 2 trillion Rupees (USD 24 bn) have been extended to 14 sectors such as electronics, pharmaceuticals, and textiles.

- The incentive scheme to promote global manufacturing in India has attracted global behemoths such as Apple, Foxconn and Samsung.

- Apple now ships about $6 billion worth of iPhones from India, which now accounts for about 14% of Apple’s global iPhone production. This marks a significant shift away from the previous monopoly of iPhone production in China and represents a major win for Indian manufacturing.

Corporate Governance – The Indian government has made significant efforts to reduce red-tapism and increase transparency & ease of doing business.

- Goods and Services Tax (GST) rules have been simplified, making it easier for businesses to comply and file taxes.

- Initiatives have been taken to recapitalize banks and improve governance to alleviate concerns related to bank balance sheets and non-performing assets.

- Continued support is being provided for startups through tax benefits, easier regulations, and access to capital to drive innovation and entrepreneurship in the country.

- “Atmanirbhar” (self-reliant initiatives with focus on self-sufficiency) – policies aimed at reducing dependency on imports, particularly in key sectors like defence and pharmaceuticals, have been further strengthened.

- Incentives are being provided to drive renewable energy projects and sustainability initiatives that align with India’s global climate commitments.

- The government has relaxed the norms for Foreign Direct Investment (FDI) with changes to thresholds being made across a number of key sectors such as defence, telecoms and oil and gas.

The amalgamation of these reforms creates a favourable environment for foreign companies such as Walmart, Ford, Apple, Amazon, Google and Meta, amongst others, to enter the Indian market and make investments more readily in the region.

The India Avenue Equity portfolio has significant exposure to industries like Pharmaceuticals, Information Technology and Energy Transition – all of these are set to benefit from the supportive regulatory framework and incentive programs outlined by the government.

Overall, the structural story in India is playing out in alignment with delivery of its economic reforms which began in 1991 and continue with fervour in 2024. This is clearly evidenced in India’s 7%+ GDP growth, the only major economy to do so.

The India Avenue Equity portfolio is positioned to capture this growth via its active approach towards stock, sector and fund manager selection. The fund has been a stellar performer with 32% returns over the past 1 year and 17% annualized returns over the past 3 years (as on Sep’24, in AUD terms) – it remains one of the most appealing investment avenues to access the ‘India Growth Story’ for Australian investors!

(sources for this article include – IMF, Economic Survey of India, The Financial Express, Press Information Bureau of India, Reuters, Bloomberg, Baker McKenzie)