Undertakes laborious physical exercise, to obtain some advantage power of choice is and when nothing prevents our being able to do what we like best. Expound the actual teachings of the great explorer of the truth, the master-builder of human happiness. No one rejects, dislikes, or avoids pleasure itself, because it is pleasure, but because those who do not know how to pursue pleasure rationally encounter consequences that are extremely painful. Nor again is there anyone who loves or pursues or desires to obtain laborious.

The master-builder of human happiness no one rejects, dislikes, or avoids pleasure.

Typically, Investors today invest in a mix of Australian Shares/ETFs (listed on the ASX) / Australian Equity Funds and International Shares (Global Funds, EM Funds, ETFs) to gain exposure to capital growth in the portfolios.

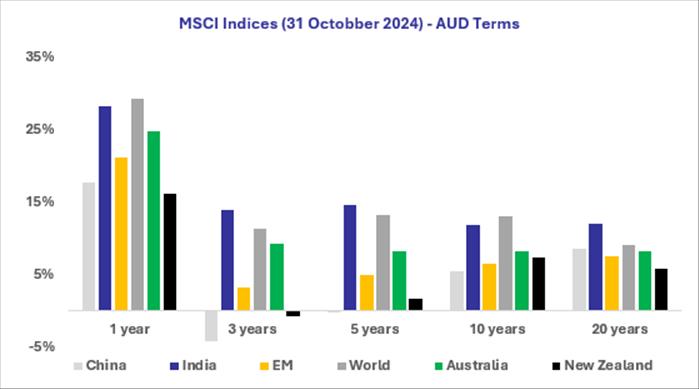

Returns over the last 10 years for equities have outstripped most other asset classes. The MSCI World has generated a return of 13.1% p.a. over this period in AUD terms. This has been predominantly driven by US Tech firms like Meta Platforms (Facebook), Microsoft, Netflix, Amazon, Apple, Google and more recently the likes of Nvidia.

Australian shares have not fared as well, but still produced a respectable 8.2% p.a. over the last 10 years. The ASX 200 has lacked exposure to exciting thematics like Tech, Healthcare and Energy Transition, given its significant weighting to Banks and Commodities.

Source: MSCI

The chart above illustrates that over the last 10 years the MSCI World has led other major equity markets, driven by a significant weighting to US equities. Today, US Equities make up 65% of the All-Country World Index of the MSCI. The next highest is Japan with 4.8%, UK 3.1% and China 2.8%. Countries like Germany, India and Australia are all less than 2% weighting. From a sectoral perspective, IT and Financial Services dominate with 42% weighting, highlighting the success of those two industries over the last 10 years.

However, it is easier to point out what has worked in the past (hindsight), but more difficult to identify what might be successful in the future (foresight). This introduces us to the need for diversification in building an investment portfolio. Diversification seeks to diversify your risk by combining assets with low correlation to each other’s returns. Ideally you want to identify assets whose returns have different drivers.

For example, the US equity market returns have been driven by the Magnificent 7. These companies have experienced significant growth through the evolution of consumer tech and desire for digitisation. It wouldn’t make sense to invest in other companies also benefitting from the same trend as there would be a high correlation. Indian equities would have a lower correlation to US equities due to its demographics driving profitability more so than any other factor. This involves industries like consumption, financials, infrastructure as well as export-oriented manufacturing and services which benefit from lower cost and access to labour. Compare this to Australia’s equity market, where a significant part of the market capitalisation is Banks and Commodities. The economy is driven by the commodity cycle, real estate and construction and financial services. Its population is small, and ageing and it lacks scale benefits and operating leverage across various industries. Again, this is unique to India’s economy and equity markets.

| USA | Australia | India | |

|---|---|---|---|

| USA | 1 | 0.72 | 0.54 |

| Australia | 1 | 0.56 | |

| India | 1 |

Thus, the logic to include Indian equities in a portfolio is driven by higher economic growth in the country as well as lower correlation to other economies given a unique demographic profile. You can see in the table above that India has a lower correlation to Australia and the USA relative to the correlation between Australia and the USA. This can be attributed to India’s more unique demographics, regulations, political system, and currency. Remember that investing in different regions provides the additional diversity of exposure to other currencies which behave differently due to more varied economic influences.