India’s economic growth is likely to be superior, relative to most major economies over the next 20 years.

This transformative growth trajectory is expected to unfold throughout this decade and likely extend well into the next, solidifying India’s position as a key player in global markets.

India’s GDP Projection

Source: IMF WEO Database, data as of 31/10/2024. *Growth based on IMF Forecasts for India’s real GDP Growth plus the addition of RBI target inflation rate of 4%

Since 1991, India’s economic reforms have significantly liberalised its economy, paving the way for modernisation and transforming the nation into a global leader in industries such as technology, pharmaceuticals, and services. With a large, youthful, and ambitious population, coupled with progressive reforms introduced by the Narendra Modi-led BJP government since 2014, the pace of GDP growth has accelerated, particularly following the recovery from the pandemic.

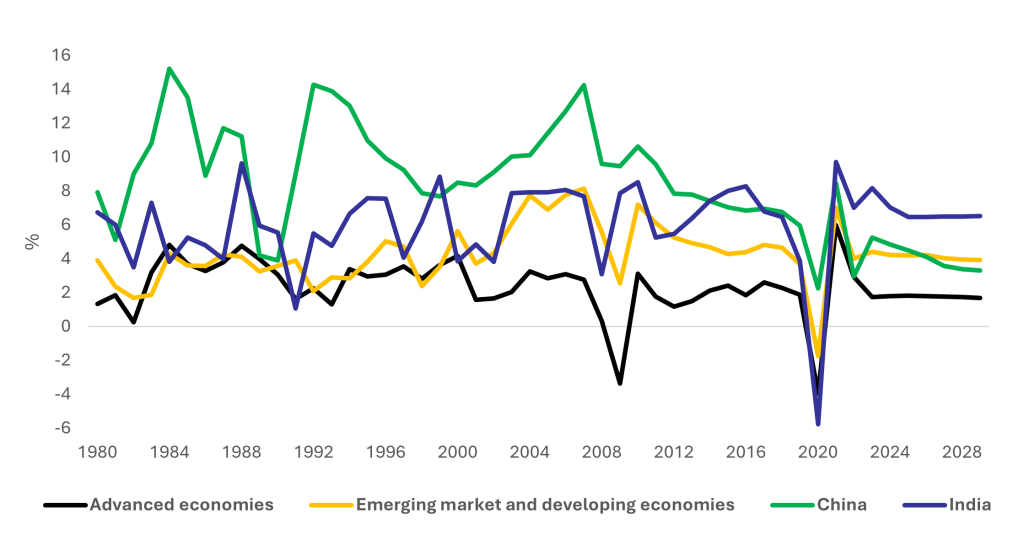

India’s economic resilience is evident in its 6.4% average real GDP growth over the past 25 years. Looking ahead, the IMF projects this robust growth to continue throughout the decade, positioning India as a standout performer within the G20 economies. This optimistic outlook is underpinned by ongoing reforms and incentives, the country’s expanding role in the global workforce, and the steady rise of urbanisation.

India’s GDP growth superiority over China, EM and DM

Source: IMF WEO, data as of 31/08/2024

The political landscape of India is conducive to growth and wealth creation

India’s economic growth has been driven by both the public and private sectors, which is made possible by a political backdrop that promotes sustainable development.

- The political regime is democratic, which has legal protections, transparency, economic stability, and social investments making it more conducive to higher equity returns.

- The Government of India has undertaken significant economic, regulatory and market reforms since 2014 such as Demonetisation, the implementation of the GST, the application of the Insolvency and Bankruptcy Act, the Real Estate Act, Production-Linked Incentive scheme which has streamlined processes, improved the business environment and provided greater protection for asset owners and as a result, attracted foreign investment (by the likes of Walmart, Google, Facebook, Amazon, Suzuki, Ford, Hyundai, Pfizer etc.).

- Foreign Direct Investment into India has risen from US$36bn in FY2014 to US$71bn in FY2024, with rising foreign ownership permitted.

India’s growth is structural

India’s GDP growth stands out not only for its rapid pace but also for its lower variability, underscoring its status as a structural, long-term growth story. This stability is driven by the region’s favourable demographics, which fuel rising demand for goods and services, along with India’s growing integration into global supply chains. Additionally, India has emerged as the highest-growth region globally, reinforcing its secular growth narrative. The combination of high GDP growth and low volatility is further illustrated below.

Full article can be found at https://www.livewiremarkets.com/wires/harnessing-india-s-growth