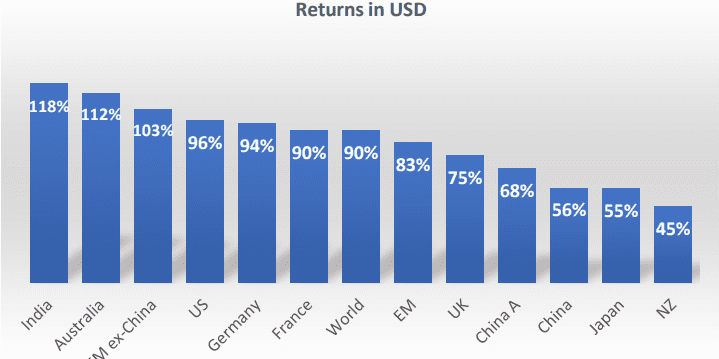

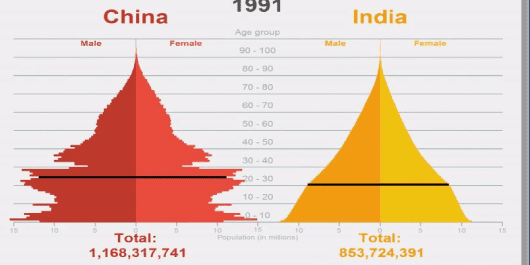

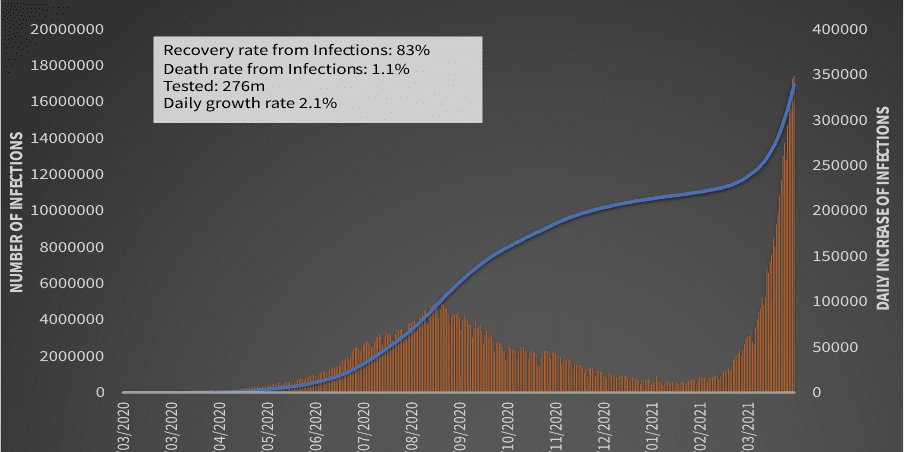

Introduction We entered a far more volatile investment environment due to the pandemic and ensuing supply chain difficulties, disruptive trade, higher commodity prices, war, rising inflation and a corresponding tightening of monetary policy by Central Banks. It is our view that markets will continue to remain volatile until we find the new higher equilibrium interest rate, which strikes a balance between growth and inflation. Given this environment, the last 6 months have been a difficult phase for equity markets. In this context, we thought we would discuss the outlook for India, Indian equities and our investor proposition to harness India’s growth story through the India Avenue Equity Fund. Who we are? India Avenue Investment Management is a boutique investment firm, focused on India as an investment destination. The firm is headquartered in Sydney, Australia and its client base consists of Australian and New Zealand domiciled Family Offices, HNW, Financial Planning clients and Direct investors. The firm’s core investment proposition is a long-only equity fund, with approximately A$65m in assets. The Fund has a Recommended rated from research rating house Lonsec and now has a track record approaching 6 years. The Fund appears on several investment platforms in Australia and New Zealand. Our Competitive Advantages India Avenue’s competitive advantages are being a focused, subject matter expert who can impart knowledge and insights to its clients on the following: Why consider India in a portfolio and the role the allocation plays in that portfolio, Thoughts on investment allocation sizing and timing, The appropriate exposure to the region, and An optimally packaged investment solution, purpose built for investors from this region There is no other investment manager based in Australia who is focused only on India. Our competition either replicate indices or are largely benchmark aware, provide similar exposure to Indian stocks held in Global, Emerging Market or Asia focused funds (mega caps) and tend to focus on other products when India is not in favour or there is investor momentum elsewhere. Our Investment Proposition The proposition of the India Avenue Equity Fund is built from insights of our founder’s multiple years of experience investing in India’s equity markets. India is a high GDP growth region relative to other Developed and Emerging Market economies. It should end the decade close to being the world’s third largest economy and with a market cap of well over US$5tn, likely placing it as the third largest stock market behind the US and China. The underlying fundamentals of India provide a significant backdrop for companies to thrive and offer continuously compounding earnings growth as addressable markets grow at a rapid pace. Equity markets in India are inefficient, providing opportunities for active investors to add value over investing passively or closely replicating a benchmark in the long-term. Typically the growth and quality style of investing in India has provided long-term outperformance relative to market cap weighted benchmarks. Locally based investment managers have an advantage relative to globally based funds trying to pick stocks in India. The Top 50 stocks in India are amongst the most brokercovered companies in the world (local and global broker research). However, once you go below the top 100 the broker coverage becomes sparse and primary research and localised knowledge of the corporate ecosystem and “founder business ethos” add value over time. Our philosophy on ESG is applied to the Fund at this stage by negatively screening out “harmful sectors” in India, rather than generic rules applied globally. India’s companies and reporting is still nascent, and we look to evolve our process as data transparency improves. A rule has now been passed that the Top 1000 companies must report on ESG parameters across a consistent framework, which allows for more positively based filters to be embedded in future. Indian Market Performance Indian markets have fared relatively well over the last 12 months, 3 years, 5 years and 10 years relative to other regional markets or compared to broad asset classes like Developed Market Equites (MSCI World) or Emerging Market Equities (MSCI EM). The table above illustrates the returns generated in local currency terms by asset class, region and country. India has fared well across most time periods despite experiencing some drawdown thus far in 2022. Typically, during periods where oil and food prices rise, India tends to fare relatively poorly given the more significant impact of these factors on inflation and its impact on the economy relative to other regions. The underlying fundamentals of India continue to drive GDP growth and corporate earnings. The 2010-2019 period saw faltering earnings and weaker GDP growth. However, equity markets produced decent returns as P/E’s rose globally (given lower cost of capital). India established a significant premium valuation to other Emerging Markets due to its fundamentals (refer chart). Outlook for Indian equity markets Over the last 10 years markets were driven higher by low interest rates and abundant liquidity which provided the justification for a rise in P/E’s. However, over the course of the next 3-5 years we are likely to see less liquidity in the system due to a higher equilibrium for interest rates. In this environment, sustainable earnings growth is far more likely to drive markets. At some point in the next cycle India will benefit from taking a greater share of global economic growth. Equilibrium inflation and interest rates will be higher than zero but low on an absolute basis. India in this environment should generate a greater share due to: Increasing productivity through reform and infrastructure, Operating leverage from diversifying supply chains and rising global economic prominence, Greater focus and incentivisation on local manufacturing and export performance, and Local demand driven by financialisation, digitisation and formalisation of the economy. As capacity utilisation rises towards and above 80%, it is likely that capacity is added to meet increasing global demand directed towards India. This should see the emergence of the next capex cycle. Indian companies have used the last 5-7 years to deleverage as capex was kept to a minimum while demand was dormant. Post COVID-19

Our Research

What growth investing means to us

- admin

- June 30, 2022

- 0 Comments

Growth Investing Growth investors typically invest in growth stocks i.e. companies whose earnings are expected to increase at an above-average rate compared to their industry sector or the overall market. However, over the last 10 years the definition of growth has had significant overlap with other styles such as Quality, Thematic and Momentum. Additionally, the horizon for growth investing has been extended due to low interest rates i.e. the terminal value has become a larger component of the stocks valuation as the discount rate applied kept falling. In fact in many cases stocks which were unlikely to experience earnings or cash flows at all were classified into the growth style bucket. However, these types of companies are more likely to represent Thematic or Momentum style investing and were often fuelled further by passive investors as market caps grew without having the underpinning of earnings. It is our view that investors will be more discerning in a rising and/or moderate rate environment, in identifying companies likely to grow their earnings above the rate of industry or GDP growth. Whilst market P/E multiples are likely to be challenged, companies with earnings growth visibility are likely to be rewarded. India Avenue Equity Fund Our Fund has encountered a more difficult period relative to its benchmark in 2022 YTD. This has been driven by the Fund’s Growth style bias, which is aligned to our philosophy: India is a high growth region relative to other geographies There are several growing addressable markets in India where investing with the winners in each industry is more likely to produce better long-term results via compounding earnings growth > GDP, market and industry growth. Our Fund is advised by three unique investment advisers located in India. These advisers all have stellar track records as investment firms with strong pedigree for understanding local economics, corporate ecosystem and knowledge of who the winners might be. Therefore we choose to partner with our advisers as a key aspect of our proposition. Over time we expect foreign and local investors in Indian equity markets to seek these faster growing companies which are establishing market share in growth industries. Earnings Growth of the Portfolio Earnings Growth of the Portfolio Portfolio vs Nifty 50 FY22/FY21 Growth % FY22-24 Growth CAGR India Avenue Equity Fund 48% 24% Nifty 50 42% 16% Whilst we expect these earnings growth numbers to fall due to the handbrakes of higher inflation on growth, they are well above the expectations of the top 50 stocks in India (which represent approximately 70% of market cap in India). The Nifty 50 has fallen 16.3% from peak (18th January 2022) to trough (16th June 2022). Assuming zero earnings growth instead of 16% annualised as expected over the next two years, places the Nifty-50 P/E at 19.9x. It is our view that economies like India and China have a far greater propensity to recover (China through stimulus and India through lesser inflation, oil and improving productivity) once inflation is curbed and growth starts to slow globally, with potential recession in parts of the developed world. Portfolio Characteristics vs Benchmark Characteristic IAEF MSCI India Benchmark Revenue Growth (3-yr historical) 15.5% 13.4% EPS Growth (5-yr historical) 16.1% 13.6% Dividend Growth (5-yr historical) 21.6% 16.3% Net Profit Margin 28.5% 17.4% Operating Profit Margin 32.4% 22.1% ROE 21.9% 18.9% The comparison to our benchmark illustrates that the portfolio not only is likely to experience stronger growth relative to its hurdle, but it is also higher quality growth given our focus on businesses which are likely to prosper in adversity and grow their market share given their inherent characteristics. Our Concluding Views Whilst it is impossible to predict market bottoms during times of risk-off sentiment / fear, it is our view that given the following factors, exposure to India in a global equity portfolio with a long-term construct make sense from a risk-return perspective. India has low correlation to other regional markets like Australia, US and China A significant representation of the market in India is from earnings and cash flow generating companies rather than hyper growth stocks fighting for market share, but low on profitability Volatility of earnings growth in India is far lower than cyclical highs and troughs of equity markets like the US, Australia Additions to Indian equity exposure during points of global duress are likely to benefit long-term returns for equity investors i.e. GFC, Taper Tantrum, COVID-19 A growth aligned philosophy (relative to the benchmark) should provide additional return to investing in a passive benchmark over the next 3 years Our Disclaimer: Equity Trustees Limited (“Equity Trustees”) (ABN 46 004 031 298), AFSL 240975, is the Responsible Entity for the India Avenue Equity Fund (“the Fund”). Equity Trustees is a subsidiary of EQT Holdings Limited (ABN 22 607 797 615), a publicly listed company on the Australian Securities Exchange (ASX: EQT). The Investment Manager for the Fund is India Avenue Investment Management Australia Pty. Ltd. (“IAIM”) (ABN 38 604 095 954), AFSL 478233. This publication has been prepared by IAIM to provide you with general information only. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. Neither Equity Trustees, IAIM nor any of their related parties, their employees, or directors, provide any warranty of accuracy or reliability in relation to such information or accept any liability to any person who relies on it. Past performance should not be taken as an indicator of future performance. You should obtain a copy of the Product Disclosure Statement before making a decision about whether to invest in this product. Click here to read the full article

India’s secular fundamentals driving equity market performance

- admin

- May 30, 2022

- 0 Comments

Click here to see the full article

India in Global Equities Portfolio

- admin

- September 17, 2021

- 0 Comments

Click here to read full article

- +61 2 9071 0124

- IA@indiaavenue.com.au

- India Avenue Investment Management Pty. Ltd. AFSL 478233 | ABN: 38 604 095 954 Level 4, 261 George Street, Sydney NSW 2000, Australia.

Quick Links

Subscribe

Get our monthly research and updates on our offerings that bring you valuable insights, opinion, and education.

© 2025 India Avenue Investment Management Australia Pty. Ltd. . All rights reserved.

Design and Developed by Aniktantra