There is little debate these days on India’s growing significance economically, politically, and now even on sustainability. It has been a bumpy ride for the Indian Government, and it has taken at least a decade, if not more, of sustained efforts to finally be able to see some tangible results: India’s total electricity generation capacity reached 453 GW* in 2024 – about 46% (201 GW) of this is now generated from renewable energy sources. Solar energy contributing about 91 GW. Hydro-based power accounting for 52 GW. Wind energy generating 47 GW. These numbers indicate a marked improvement in India’s shift away from its traditional reliance on fossil fuel-based energy sources. For its part, the Government of India has implemented a series of initiatives to achieve its truly ambitious target of achieving 500 GW of electric capacity from non-fossil sources by 2030. Key programs include: The National Green Hydrogen Mission – targeted initiatives for energy generation based on improved Hydrogen production. PM KUSUM – attempt at ‘de-dieselization’ of the Indian agricultural sector with Incentives to farmers to adopt solar based irrigation equipment. PM Surya Ghar – scheme to subsidize households for installing solar panels. Production Linked Incentive Schemes for Solar PV modules. Green Energy Corridors – project to integrate and connect wind and solar power sources with India’s national power grid. Another major ‘Sustainability’ initiative launched by the Government (in 2015) was the Smart Cities Mission (SCM), which was targeted at improving and urbanizing the lives of resident of 100 selected cities. The endeavour was to: Promote inclusive and sustainable urban development. Provide access to adequate water & electricity supply. Afford urban mobility & efficient public transport system. Leverage technology to improve lives. As per a recent update from the Government bureau, more than 90% of the total project undertaken under the SCM banner have been completed, with the balance 10% expected to be finished by March 2025. The total project investment outlay for SSM projects has been about 20 billion dollars. It was only a matter of time till India also caught up with the global ‘Electronic Vehicle’ phenomenon. In 2022, India surpassed Germany to become the 4th largest global automotive market. It now plans to transition 30% of its vehicles to ‘electric’ based by 2030. Under a key policy announcement in March this year, an automaker investing at least $500 million to manufacture EVs in India (with the caveat of sourcing 50% of components locally), will be entitled to reduce its import taxes from (as high as) 100% to 15% for up to 8,000 electric cars manufactured per year. In May of this year, electric vehicle sales in India increased by 20.88% to clock about 1.4 million units. Further, the Indian EV market is forecasted to expand from 3.2 billion dollars in 2022 to about 114 billion dollars by 2029 (as per IBEF and Fortune Business Insights). If all (or even most) the above ambitions and goals are to be realized for India, it will require significant investments dollars (or rupees). There is a clear long-term opportunity across different spectrums – energy storage, transmission, EVs, charging infrastructure and urban waste management. Capital raising has continued unabated from different sources, local and global. It is estimated that around 75 billion^ dollars have been invested in Indian renewables, with more than half coming from global investors such as Macquarie, KKR, BII, ADIA and GIC. About 1.2 billion dollars’ worth of green bonds were made available for potential inclusion in JP Morgan’s EM Debt Index. In September this year, India secured about 387 billion dollars’ worth of renewable energy investment pledges by 2030 from Banks, Developers and States. Shares of the renewable arm of NTPC (India’s top power producer) raised about USD 1.2 billion dollars at its recent public offering – the share rose by 13% on listing. Ford is now in talks to setup facilities in the southern state of Tamil Nadu in India – this is likely for manufacturing EVs. Ford joins Tata Motors and Vietnam based VinFast Auto as some of the latest entrants to setup manufacturing plants in the region. India has committed to reach to Net Zero by 2070, meet 50% of its energy needs from renewal sources by 2030 and reduce its emission intensity by 45% by 2030 (based on 2005 levels). As per a recent EY report, it is envisaged that India will need about 10 trillion dollars to achieve its 2070 goal. There is likely to be a 30-40% shortfall to this number, should the government rely largely on conventional financing means. This opens up a large opportunity for international funds to tap into the India ‘Sustainability’ story, be it through Foreign Direct or Portfolio Investments, Strategic Partnerships, Green Bonds or Venture Funds & Private Equity. * GigaWatt (Source: asiafinancial, REN21 global status report, Press Information Bureau of India, The Hindu, ^OMFIF, Bloomberg, Economic Times, Reuters, IBEF, Fortune Business Insights, EY)

2024

Investing in India’s Sustainable Future: Opportunities in Green Energy & Smart Infrastructure.

- admin

- December 17, 2024

- 0 Comments

Impact of India’s economic reforms on our investment portfolio

- admin

- November 15, 2024

- 0 Comments

As the world grapples with a “soft landing” in the US and an “economic slowdown” in China, there seems to be a dearth of optimism regarding major economies. Amid such gloomy expectations, India stands out as the only major economy expected to grow at a healthy real GDP growth rate of 7.3% in calendar 2024, compared to China’s growth rate of 4.8% and US’s growth rate of 2.8% (source: IMF). Note: For India, data and forecasts are presented on a fiscal year basis, with FY 2023/24 (starting in April 2023) shown in the 2023 column. India’s growth projections are 7.3 percent in 2024 and 6.5 percent in 2025 based on calendar year. The journey began in 1991, when India’s economy was first liberalised under the congress regime – the economy has averaged about 6% annual growth since then. Nevertheless, there was a phase from 2009 to 2014, wherein the country faced a period of policy paralysis with growth dropping below 6 % in 2011 & 2012 (source: IMF). The entrance of the BJP Government in 2014 led to a fresh round of reforms which were pro-growth and pro-business. Whilst the first term of the BJP, under Modi’s leadership, included introduction of significant reforms and some indigestion, the second term saw India ride through a turbulent pandemic and rebound strongly with a positive pivot towards growth via reforms and initiatives around infrastructure, digitisation, financial inclusion, manufacturing and corporate governance. Let’s understand a bit more about some of these reforms. Infrastructure is the backbone of any economy, and it has been a clear focal area of reforms for the Indian government with visible, measurable progress made over the past 10 years; India expanded its National Highways network by 1.6 times. The government has operationalised 100 high-speed trains and modernised 1,318 railway stations. It has also achieved electrification of about 94% of its railway network. The metro rail network in India has expanded by about four times, and is now available in 23 cities. The number of airports has grown from 74 in 2014 to 157 in 2024. The Indian Government has significantly increased its allocation to infrastructure and is expected to spend a record 11 trillion rupees (about US$132 bn in fiscal 2025). Four years ago this number was less than half at about 4 trillion rupees (fiscal 2021). The infrastructure boost has supported growth of key sectors such as Industrials, Real Estate and Aviation. The India Avenue Equity Fund has an ‘overweight’ position in these sectors and expects these to benefit from continued structural reforms, improved road, rail and air networks, and sustained increase in demand for real estate. For example, Interglobe Aviation (Indigo Airlines) is amongst the top 10 holdings in the portfolio – a stock whose price has risen by about 4x between 2020 and 2024. Digitisation – India’s digital revolution over the past decade has been a game-changer. The much-talked-about Unified Payments Interface (“UPI”, India’s real-time payment settlement system initiated by the RBI and banks’ association) is often referenced as a case study around the world. From fiscal 2018 to 2023, the volume of UPI transactions has increased from 0.92 bn to 131 bn transactions – an annual growth rate of about 138%. UPI has helped reduce the use of cash and cheques in India, significantly increased the adoption of digital payments, and improved access to financial services. Financial Inclusion – Another significant milestone in India’s digital revolution was the introduction of the “JAM” (Jan Dhan, Aadhar, and Mobile) trinity, designed to provide direct benefit transfers (straight to accounts) to citizens qualifying for subsidies. It was also a significant step to reduce (if not eliminate) leakages due to corruption and inefficiencies. As of this year, there are about 53 bn Jan Dhan account holders, and more than 90% of India’s population possesses an Aadhaar card, making JAM one of the largest financial inclusion initiatives in the world. UPI and JAM are among the key reforms that have contributed to the emergence of Non-Banking Financial Companies (NBFCs) over the past decade – these companies have leveraged digitization and financial inclusion to reach the mass rural, underserved markets to provide affordable, low cost, micro financial services. Some of the top holdings in the India Avenue Equity Fund include NBFCs such as Cholamandalam Investments, Shriram Finance & Bajaj Finance, all of which have seen strong business growth and stellar increase in share prices. Manufacturing – In addition to infrastructure, the Government has implemented incentive-based programs to encourage domestic manufacturing, provide tax breaks, lower land rates, and ensure access to capital for setting up factories. These “Production Linked Incentive” (PLI) schemes worth about 2 trillion Rupees (USD 24 bn) have been extended to 14 sectors such as electronics, pharmaceuticals, and textiles. The incentive scheme to promote global manufacturing in India has attracted global behemoths such as Apple, Foxconn and Samsung. Apple now ships about $6 billion worth of iPhones from India, which now accounts for about 14% of Apple’s global iPhone production. This marks a significant shift away from the previous monopoly of iPhone production in China and represents a major win for Indian manufacturing. Corporate Governance – The Indian government has made significant efforts to reduce red-tapism and increase transparency & ease of doing business. Goods and Services Tax (GST) rules have been simplified, making it easier for businesses to comply and file taxes. Initiatives have been taken to recapitalize banks and improve governance to alleviate concerns related to bank balance sheets and non-performing assets. Continued support is being provided for startups through tax benefits, easier regulations, and access to capital to drive innovation and entrepreneurship in the country. “Atmanirbhar” (self-reliant initiatives with focus on self-sufficiency) – policies aimed at reducing dependency on imports, particularly in key sectors like defence and pharmaceuticals, have been further strengthened. Incentives are being provided to drive renewable energy projects and sustainability initiatives that align with India’s global climate commitments. The government has relaxed the norms for Foreign Direct Investment (FDI) with changes to thresholds being made across a number of key sectors such as defence, telecoms and oil and gas. The amalgamation of these reforms creates a favourable environment for foreign companies such as Walmart, Ford, Apple, Amazon, Google and Meta, amongst others, to enter the Indian market and make investments more readily in the region. The India Avenue Equity portfolio has significant exposure

How to Diversify your Portfolio with Indian Equities

- admin

- November 15, 2024

- 0 Comments

Typically, Investors today invest in a mix of Australian Shares/ETFs (listed on the ASX) / Australian Equity Funds and International Shares (Global Funds, EM Funds, ETFs) to gain exposure to capital growth in the portfolios. Returns over the last 10 years for equities have outstripped most other asset classes. The MSCI World has generated a return of 13.1% p.a. over this period in AUD terms. This has been predominantly driven by US Tech firms like Meta Platforms (Facebook), Microsoft, Netflix, Amazon, Apple, Google and more recently the likes of Nvidia. Australian shares have not fared as well, but still produced a respectable 8.2% p.a. over the last 10 years. The ASX 200 has lacked exposure to exciting thematics like Tech, Healthcare and Energy Transition, given its significant weighting to Banks and Commodities. Source: MSCI The chart above illustrates that over the last 10 years the MSCI World has led other major equity markets, driven by a significant weighting to US equities. Today, US Equities make up 65% of the All-Country World Index of the MSCI. The next highest is Japan with 4.8%, UK 3.1% and China 2.8%. Countries like Germany, India and Australia are all less than 2% weighting. From a sectoral perspective, IT and Financial Services dominate with 42% weighting, highlighting the success of those two industries over the last 10 years. However, it is easier to point out what has worked in the past (hindsight), but more difficult to identify what might be successful in the future (foresight). This introduces us to the need for diversification in building an investment portfolio. Diversification seeks to diversify your risk by combining assets with low correlation to each other’s returns. Ideally you want to identify assets whose returns have different drivers. For example, the US equity market returns have been driven by the Magnificent 7. These companies have experienced significant growth through the evolution of consumer tech and desire for digitisation. It wouldn’t make sense to invest in other companies also benefitting from the same trend as there would be a high correlation. Indian equities would have a lower correlation to US equities due to its demographics driving profitability more so than any other factor. This involves industries like consumption, financials, infrastructure as well as export-oriented manufacturing and services which benefit from lower cost and access to labour. Compare this to Australia’s equity market, where a significant part of the market capitalisation is Banks and Commodities. The economy is driven by the commodity cycle, real estate and construction and financial services. Its population is small, and ageing and it lacks scale benefits and operating leverage across various industries. Again, this is unique to India’s economy and equity markets. USA Australia India USA 1 0.72 0.54 Australia 1 0.56 India 1 Thus, the logic to include Indian equities in a portfolio is driven by higher economic growth in the country as well as lower correlation to other economies given a unique demographic profile. You can see in the table above that India has a lower correlation to Australia and the USA relative to the correlation between Australia and the USA. This can be attributed to India’s more unique demographics, regulations, political system, and currency. Remember that investing in different regions provides the additional diversity of exposure to other currencies which behave differently due to more varied economic influences.

The Power of Demographics: India’s Young Workforce as a Growth Driver

- admin

- November 8, 2024

- 0 Comments

India stands on the brink of a demographic revolution, poised to harness the power of one of the world’s largest and youngest populations. With over 65% of its 1.4 billion citizens under age 35, India has an enviable demographic dividend that promises to propel economic growth, boost consumer demand, and enhance corporate profitability. This dynamic workforce could reshape the nation’s economic landscape, positioning India as a global powerhouse in the coming decades. India’s Demographic Dividend: An Unmatched Opportunity The term “demographic dividend” refers to economic growth from shifts in a country’s age structure. When a nation has a larger working-age population relative to dependents, it can fuel higher productivity, innovation, and consumption. This phenomenon powered economic miracles in countries like China and South Korea, and India now stands at a similar crossroads. India’s working-age population (ages 15 to 64) comprises about 67% of the total population, nearly 1 billion people. This figure is expected to rise until 2050, giving India a unique opportunity. In contrast, developed economies such as Japan, Germany, and South Korea are grappling with aging populations, and even China’s workforce is shrinking. India’s demographic advantage positions it to drive global growth in the coming years. A growing working-age population can significantly boost GDP per capita. With a median age of 28, compared to 38 in China and 48 in Japan, India’s workforce is young and abundant. This energy catalyses innovation, entrepreneurship, and adaptability—all critical for a modern economy. The younger population is also more adaptable to technology and new working methods, crucial for India’s digital economy. Consumer Demand: A Generation of New Consumers India’s demographic dividend translates into a massive consumer base. Young people tend to spend more on technology, education, travel, entertainment, and goods. This trend will intensify as more Indians join the middle class. Currently, around 350 million Indians are considered middle class, a figure expected to swell to 500 million by 2030. Global companies see India as a key market for growth. Tech giants like Amazon, Walmart, and Google have invested heavily in India, betting on its digital and consumer potential. Similarly, automotive, apparel and luxury brands are expanding their presence, recognizing the long-term value of this market. Corporate Profitability: A Cost-Efficient Talent Pool India’s large, skilled, and relatively low-cost workforce is a major draw for businesses worldwide, especially in IT services, outsourcing, and manufacturing. The IT sector alone employs over 4.5 million Indians and contributes significantly to the economy, with Indian firms providing services globally. This talent pool enables companies to operate profitably while keeping costs low, which benefits both Indian and global corporations. The demand for skilled Indian professionals will only increase as industries digitize, further bolstering corporate profitability. A Global Comparison: India’s Workforce Versus the World In terms of size and youthfulness, India’s working-age population is unmatched. By 2030, India will have nearly 1 billion people in the workforce, compared to 750 million in China and 420 million in the United States. This highlights India's potential to drive global growth. Although India’s GDP per capita lags behind these countries, with investments in education, skill development, and infrastructure, India can enhance labour productivity. According to McKinsey, improved workforce participation and productivity could add $700 billion to India’s GDP by 2030. A Worker boom India’s working age population to total population ratio will be the highest of any large economy. India’s Demographic Dividend: A Global Opportunity India’s young workforce represents a global opportunity. As other economies face aging populations, India’s demographic advantage offers sustained growth potential. By investing in education, fostering entrepreneurship, and creating an environment conducive to business, India has the potential to drive economic growth, enhance consumer spending, and boost corporate profitability. As India harnesses its demographic dividend, the nation could redefine the global economic landscape, emerging as a central player on the world stage. For investors, businesses, and policymakers worldwide, India’s young and ambitious workforce is a unique growth opportunity with transformative potential.

The Future of Indian Startups: Investment Opportunities in a Thriving Ecosystem

- admin

- November 6, 2024

- 0 Comments

India’s startup ecosystem has evolved into one of the fastest growing in the world, offering an array of investment opportunities across various sectors. With over 120,000 startups and a steady rise in unicorns 1 , India is now recognized as a global hub for innovation. Highlighting the success of India’s startups, there are now over 110 unicorns in India, collectively valued at over US$350bn – placing it third behind the US and China. Byju’s is currently the most successful unicorn, valued at over US$22bn. Other success stories have been Flipkart, Paytm, Zomato and Ola Cabs. From FinTech to HealthTech and EdTech, Indian startups are not only transforming their industries but also reshaping the economy. This wave of innovation, coupled with an increasingly digital consumer base and government support, makes India an attractive destination for investors. Growth Drivers of India’s Startup Ecosystem Digital Access: With over 700 million internet users, India’s digital reach has expanded tremendously. Affordable smartphones and data plans have allowed startups to access even remote regions, opening new markets and bringing services to underserved communities. Government Initiatives: Programs like Startup India and Digital India provide essential support to startups through simplified regulations, tax incentives, and funding programs. These initiatives have played a crucial role in reducing barriers to entry and fostering an environment conducive to entrepreneurial growth. Youth Demographic: India has one of the youngest populations in the world, with over 65% under the age of 35. This tech-savvy demographic not only fuels demand for digital services but also drives innovation as creators and consumers. The resulting culture of entrepreneurship has sparked fresh ideas across industries, leading to the rapid growth of the startup ecosystem. These factors have created fertile ground for investment in startups that are culturally relevant, technologically advanced, and geared for global expansion. While the startup landscape offers a broad range of opportunities, certain sectors are experiencing remarkable growth due to their unique alignment with India’s needs. FinTech: India’s FinTech sector is booming, with digital payments, lending, and financial inclusion at the forefront. Startups like Razorpay, Policy Bazaar, and BharatPe have capitalized on the government’s push for a cashless economy, driven by innovations like the Unified Payments Interface (UPI). Digital payment transactions in India are projected to surpass $1 trillion by 2025, making FinTech one of the most promising investment areas. HealthTech: India’s healthcare needs are vast, and HealthTech startups have made inroads by offering telemedicine, diagnostics, and digital health solutions. Startups like Practo, 1mg, and Pharmeasy are leveraging technology to make healthcare accessible across India, including underserved rural areas. With increasing healthcare awareness and demand, HealthTech provides investors with the dual appeal of significant growth and social impact. EdTech: The EdTech sector in India has experienced exponential growth, particularly during the pandemic. Byju’s, Unacademy, and Vedantu have become household names, offering digital learning platforms that cater to millions of students. India’s education market is projected to reach $225 billion by 2025, and EdTech is positioned as an essential tool in delivering accessible, quality education across diverse demographics. Seizing the Opportunity: India’s Startups on the Global Stage The rapid rise of India’s startup ecosystem is creating unprecedented opportunities for investors. By supporting startups in high-growth sectors, investors can be part of India’s transformative growth story. This ecosystem not only promises high returns but also enables meaningful impact, especially in areas that directly enhance quality of life, like healthcare, education, and sustainability. The momentum driving India’s startup landscape forward is not just economic—it’s cultural and societal. India is now not only a consumer of global innovations but also a creator. With its young, ambitious population and supportive policy environment, India’s startup ecosystem is well-positioned for continued growth. By strategically investing in this thriving market, investors have the chance to benefit financially while supporting initiatives that are reshaping India.From FinTech to EdTech, HealthTech to renewable energy, Indian startups are at the forefront of solving real problems with innovative solutions. As the startup ecosystem matures, it’s opening an exciting era of investment opportunities for those looking to be part of India’s transformative economic journey. Investors globally can participate in the aspirational and entrepreneurial nature of India’s growth story, by investing in equity funds. With several success stories being listed on Indian, stock exchanges, an actively managed equity fund, like the India Avenue Equity Fund and the India 2030 fund can provide a compelling financial proposition and a way to engage with India’s dynamic, rapidly evolving economy.

Comparing Indian Investment Funds: Which One Suits Your Financial Goals?

- admin

- October 28, 2024

- 0 Comments

Investing in India has always offered a compelling opportunity to participate in one of the world’s fastest-growing economies, known for its entrepreneurial drive, robust consumer base, and rapid technological advancements. Whilst we acknowledge that the US markets have been the place to be as an investor over the last 15 years, India has certainty kept pace and excelled since the pandemic. Total return of India, EM and the US over four years That’s the idea done – now the way to implement it! Foreign investors require an FPI (foreign portfolio investor) License to buy Indian stocks directly. The process can be cumbersome and time consuming for a non-institutional investor. Thus, the path to investing alongside India’s growth story is often via a managed fund or an exchange traded fund (ETF). With numerous investment funds available, choosing the right one for your financial objectives can feel daunting. This note provides a comparative overview of the main types of exposure to India, helping investors make an informed choice based on their unique goals. 1. India-focused Equity Funds India-focused equity funds are funds that concentrate on Indian companies, giving investors focused exposure to India’s capital market. These funds aim to capture India’s economic growth and are generally diversified across a mix of large-cap, mid-cap, and small-cap companies. The underlying goal is to harness the growth momentum of India’s fast-growing industries. Actively managed, India-focused funds provide exposure to companies positioned to benefit from India’s economic expansion, by providing exposure not only to large, successful and well-managed companies, but also fast growing medium and small companies which are yet to reach their potential. Given India’s growth story, it is likely that several of these mid and small sized companies will dominate their segments in years to come as the addressable market they operate reaches maturity. By investing in India-only funds, foreign investors can benefit from exposure to a wider range of growth companies, specific to India, operating in industries like Pharmaceuticals, Aviation, Food, Textiles, Real Estate and Energy. These types of industries do not feature in other funds we will explore below which have a broader mandate to invest in other countries as well. However, some of these industries will drive India’s growth story over the next decade. 2. India-focused ETF’s ETF’s have become a simple, convenient way for investors to get exposure to India. Several ETFs today are based on market-cap weighted indices to provide clients with broad exposure to an asset class. India focused ETF’s provide exposure to several companies in a diversified manner and charge lower management fees than most actively managed funds. However, what a passive (index replication) or Smart beta (systematic/rules based) ETF does not do is take is a fundamental view on which companies will do better than others. It is our view that investing in India requires a fundamental overlay to be imparted on investments. We form this view based on our experience in investing in Indian equities and as evidenced by the long-term outperformance of fundamental stock pickers in India. 3. Emerging Markets/Asia Funds with India exposure Emerging markets (EM) or Asia-focused funds invest in a broader mix of companies across developing nations, including India. Typically, India comprises a portion of the fund’s overall allocation (10-25%), often alongside other fast-growing economies like China, South Korea, Indonesia, Saudi Arabia and Brazil. These funds offer a diversified portfolio, providing a way to gain exposure to emerging regions, like India. Risk Diversification: By spreading investments across multiple countries, these funds reduce the risk associated with investing solely in one country. Growth Potential Beyond India: Emerging markets, especially in Asia, offer growth potential. This allows investors to tap into the broader story of Asia’s economic transformation. Reduced Volatility: Diversification across various emerging markets can help temper and mitigate volatility. These funds tend to focus on the larger, more liquid stocks in most countries they invest in as they are quite often quite big in asset size and thus tend to focus on companies which they can exit if there is an issue. This type of fund provides broad exposure to many countries and companies in a simple unitised package. However, if you are specifically interested in India’s growth story, then this exposure can provide a “diluted” exposure to India’s growth story as it is likely to hold no more than 5-15 companies in the region. 4. Global Equity Funds with an India component Global equity funds offer a balanced approach, investing in companies worldwide, with a small allocation to India (0-3%). India is often underrepresented in these funds, which typically prioritise developed markets like the U.S., Europe, and Japan. However, many global funds are now seeking to include a few Indian companies due to the region’s growing international relevance and competitive advantage in sectors like IT, pharmaceuticals, and financial services. Choosing the right Fund for your Goals Understanding your investment goals, risk tolerance, and investment horizon is key to selecting the right Indian investment fund. Here’s a summary to help you decide: An interest in investing in India to capitalise on High Growth Potential: If you’re willing to endure some volatility for potentially higher returns and have a long-term horizon, then India-specific risk, India-Focused Equity Funds may be ideal. If you have a short-term positive view on India and would like to capitalise on this then an India-focused ETF is simple and convenient and allows you to capture most of the return profile available from investing in the region. Moderate Risk with Geographic Diversification: For investors seeking exposure to India without single-country risk, Emerging Markets or Asia Funds, with an India component offer a balanced approach to tap into broader regional growth. Global Exposure with Limited India Risk: If you want a globally diversified portfolio with a limited and highly liquid allocation to India, then Global Equity Funds may be more suitable, particularly if you prioritise a lower risk profile. Getting Started Investing in India’s growth story is increasingly accessible, with many platforms offering the structures discussed above. However, you should consult your financial adviser prior to doing so. Some of your options are: Invest via a financial adviser / investment platform or wrap Complete a Fund PDS (by visiting the issuing fund’s website) Invest via the stock exchange (ETF)

Marksans Pharma – A tiger in India’s emerging pharmaceutical industry

- admin

- October 15, 2024

- 0 Comments

Marksans Pharma is riding the wave of India’s pharmaceutical dominance and is emerging as a global powerhouse. As India cements its position as the “pharmacy of the world,” Marksans is leading the charge with cutting-edge R&D, cost-efficient manufacturing, and a strong international presence. Over the last 19 months Marksans Pharma’s stock price has risen by 318% which largely outweighs the MSCI Indian Index’s return of 56% over the same period in Rupee terms. The Indian Pharmaceutical industry Scale: The Indian Pharmaceutical industry is ripe for growth. Supportive factors include generating value through higher volumes, increased revenue and employment, and contributing to export trade. It is anticipated to achieve a market size of AUD $190 billion by 2030, and AUD $665 billion by 2047 (*IBEF). Low Cost: India has traditionally had a strong pharmaceutical sector, maintaining a low cost of manufacturing, cost-efficient research and development (R & D) programs, and cheap labour. Indian pharmaceutical companies can produce high quality medicines at a relatively low price. India’s pharmaceutical industry has become the medical hub of the world providing cost-effective treatments with the latest technology enabled by several pathbreaking reforms and provisions. R&D: There is a constant push towards innovation and invention for new or improved drugs. Companies that can leverage robust R & D capabilities and have advanced manufacturing facilities both domestically and internationally are benefitting through export markets, particularly where supply chain efficiencies can be maximised. Marksans Pharma – Experiencing Robust Growth Marksans Pharma is one of India’s leading pharmaceutical companies, experiencing rapid growth through their scale, low-cost and R&D. FY20 FY21 FY22 FY23 FY24 5-year Growth Revenue Rs. mn 11,342 13,762 14,908 18,521 21,774 13.9% EBITDA Rs.mn 1,922 3,396 2,589 3,393 4,586 19.0% Profit Rs. mn 1,207 2,385 1,868 2,653 3,149 21.1% EPS cps 2.86 5.76 4.51 6.40 6.92 19.3% Return on Capital Employed % 24.6 32.6 19.8 18.9 21.5 Showing 1 to 5 of 5 entries *Source: Marksans Pharma Annual Report FY24 Global Expansion – the UK/Europe, US and more Marksans Pharma is creating a competitive advantage over other Indian pharmaceutical businesses by expanding their product globally. The company is developing a strong market presence by expanding its business across key international markets. Contract manufacturing and active product registrations have allowed Marksans to implement strategic manufacturing facilities and R & D centres in India, the UK and the USA. International manufacturing units across multiple continents have also allowed for more efficient and capable distribution of supplies to over 50 countries around the world. Interestingly, Australia and New Zealand are now over 10% of annual revenue. The company has partnered with larger retailers and pharmacies to expand its distribution network. Marksans also acquired Nova Australasia in 2005, a company with a focus on marketing and specialising in Over the Counter (OTC) and pharmaceutical products in segments like Analgesics, Antihistamines, Anti-fungal, Anti-Allergy, Dermatology, Essential Oils and Gastrointestinal products. Marksans has a product portfolio skewed towards OTC segments and soft gel products, mainly in the US and UK. It generates 70% from OTC and the remainder from prescription medication. Marksans has a portfolio of over 300 generic products across 10 therapeutic areas and has a pipeline of over 120 products. New Products coming online The Marksans Pharma stock recently reached a 52-week high, following the announcement that its wholly owned UK subsidiary Relonchem Limited has secured Marketing Authorisation from Medicines and Healthcare products Regulatory Agency (UKMHRA) for three products in the Fluoxetine family, (Fluoxetine is an oral capsule used in the treatment of depression and related mood and mental disorders). Earlier this month, Marksans Pharma also announced that Relonchem Limited received Marketing Authorisation from UKMHRA for the product Levonorgestrel 1.5mg tablets. evonorgestrel is a first-line oral emergency contraceptive pill, commonly referred to as the morning-after-pill. Last month, Marksans Pharma announced marketing authorisation for Rasagiline Relonchem 1mg tablets, Olmesartan 10mg film-coated tablets, Olmesartan 20mg film-coated tablets, and Olmesartan 40mg film-coated tablets from UKMHRA. These recent additions to the product line in the UK will continue to bolster Marksans’ presence in the region and continue the company’s growth across international countries. Growth Momentum Marksans Pharma has built a highly scalable and expanding business in recent years, but a key focus now is on sustaining growth momentum. The company is taking advantage of global trends and adapting their positioning strategically to capitalise on opportunities. Three of these global trends are worth highlighting: There has been a growing acceptance of using pharmaceutical drugs manufactured and produced out of emerging and developing countries. Marksans has used this acceptance to geographically expand their business and grow their consumer base. To combat supply chain disruptions and the rising input costs for manufacturers. Marksans has developed a business model that is forward-integrated and now has manufacturin units in three different countries. This allows the company to achieve economies of scale and leverage enhanced cost inefficiencies, which counteracts increased input costs and supply chain disruptions. The need for a broad product line to serve a greater number of customers in the pharmaceutical industry. This has been addressed at Marksans by manufacturing a wide range of dosage forms of their products. This has allowed Marksans to serve a diverse customer base from the elderly to infants, without compromising drug efficacy. The India Avenue Equity Fund has benefitted from the share price growth of Marksans Pharma, investing almost 20 months ago at an average buy price of Rs.75. The stock now trades closer to Rs.300, supported by the increasing footprint of India’s Pharmaceutical sector on the world stage. Disclaimer This Note (‘Note’) has been produced by India Avenue Investment Management Limited (‘IAIM’) ABN 38 604 095 954, AFSL 478233 and has been prepared for informational and discussion purposes only. This does not constitute an offer to sell or a solicitation of an offer to purchase any security or financial product or service. Any such offer or solicitation shall be made only pursuant to a Product Disclosure Statement, Information Memorandum, or other offer document (collectively ‘Offer Document’) relating to an IAIM financial product or service. A copy of the relevant Offer Document relating to

Mid and Small Cap Opportunities in India: What Australian and New Zealand Investors need to know.

- admin

- October 13, 2024

- 0 Comments

Countries experiencing significant economic growth, generally have an entrepreneurial ecosystem. Strong growth allows more participants. Given the advancements being made in financialisation and digitisation in India, the environment is ripe for success in MSME’s (micro, small and medium enterprises) with most of the population having access to a bank account and financing as well as a smart phone and the internet. India has over 6,000 listed companies on the National Stock Exchange and is now the world’s fourth largest stock market by country (by market capitalisation). It trails only the US (NYSE + NASDAQ), China (Shanghai and Hong Kong) and Japan (Nikkei), with a market capitalisation of US$5.5 trillion. India also ranks 3rd in terms of the number of unicorns it has produced. A unicorn refers to the creation of a US$1bn company by valuation. India’s strong economic growth (over the last 30 years) and its entrepreneurial and aspirational corporate ecosystem provides the perfect melting pot for share market investors. According to Bloomberg’s analysis, over the decade ending 2021, one fifth of the NSE 500 (top 500 stocks by market cap in India) had risen by 10 times in local currency terms over 10 years. As a comparison over the same period the NASDAQ saw 10% of companies do the same and the S&P 500 saw 7%. Despite faster growth in China only 3% of stocks from the mainland saw the same growth. However, this was not just a one-decade phenomenon in India. It also led all markets in producing 10 “baggers” in the decade from 2001-2011. Thereby investing in a Fund, like the India 2030 Fund can provide investors with exposure to companies which can appreciate significantly. The chance of success improves when co-investing alongside some of India’s best fund managers when it comes to identifying good companies at an early stage in their growth cycle. Quite often these companies aren’t fighting for survival – they are in fact market leaders in their segment. Although the India 2030 Fund is relatively “young”, having been launched in January 2022, it has already seen 5 of the 15 stocks it holds in its portfolio today, more than double and in one case, increase by 5 times. “Partnering” with investment professionals who spend their working lifetime trawling through India’s listed companies for opportunities, is likely to increase success rate in identifying well performed companies. Quite often identifying successful companies early, benefitting from their “moat/IP” in a fast-growing industry, is likely to produce good results. This is particularly the case if these companies are identified before the onset of other institutional investors and being researched by stockbrokers. It is more likely to pay-off when you are invested before the broader investment community. The reason why a market leader can create a 10-bagger experience in India is because addressable market size can grow significantly due to the tailwinds of strong underlying economic growth, the ongoing need for infrastructure and rising wealth of the middle class. The opportunity of a youthful population of 1.4 billion getting collectively wealthier provides a great backdrop for share market investors.

How to get started with investing in India: A guide for Australian and New Zealand Investors

- admin

- October 9, 2024

- 0 Comments

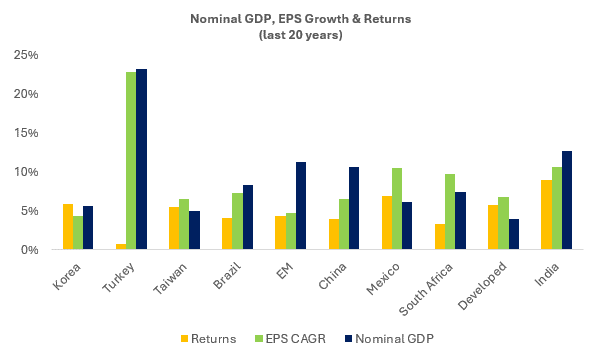

Whilst India, as the world fastest growing major economy, attracts a lot of headlines, it hasn’t yet led to significant investments from Australian and New Zealand based investors as yet. Investors have shied away from the region due to the following reasons: Fear of the unknown when investing in emerging markets, like India Fascination with US driven themes like AI, Renewable Energy, Commodities A lack of investment options A strong local property market However, while India has largely been ignored in Australia and New Zealand (with just over A$1 billion) invested in India-only equity funds and ETF’s, it is likely that interest will rise. Given world leading GDP growth and favourable demographics. So how exactly do you invest in India? There are multiple ways one can invest to benefit in the economic growth of a region. The most common method, due to simplicity, liquidity and transparency, is by investing in the region’s equity market. There is some relationship between a country’s economic growth, the corporate profit growth the companies listed on its stock market and investor returns from investing in its equity market, experience. This is generally more likely is an economy which is capitalist in nature and under a democratic regime. The chart below indicates economic growth (Nominal GDP) and its linkages to company earnings growth (EPS Growth) and equity market returns. Certain regions like India, Korea, Taiwan and Mexico as well as Developed Markets like the US, Europe, Japan have shown a greater relationship between growth and returns. To take advantage of a country’s economic growth, as we articulated above, the simplest way to get started is by investing in its equity market. The liquidity is the most attractive feature for investors some fear of the unknown. Using the example of investing and benefitting from India’s growth story, one can choose one of the following methods: Invest in the equity markets of the country like India (India focused Equity Fund or ETF) This provides exposure to a well-diversified portfolio of listed Indian companies, which should include a mix of already established companies as well as lesser-known names with significant potential. This will allow you to get exposure to more companies in the region and allow for a controlled approach on how much you allocate to India in your overall portfolio. Invest in a mix of growing economies, which may have a decent allocation to India (Emerging Markets or Asia Fund) This provides some exposure to listed companies in India and across other developing countries. However, investing in this broader region doesn’t necessarily allow a focused participation in the growth story of an economy like India. The exposure to India is likely to be limited to larger companies which have already been successful and are established. This method makes sense if you feel there are many other growth regions in developing countries than just India. Invest in a Global Fund which may hold some Indian stocks (Global Equities Fund) A global fund has a mandate of being able to invest in any region and usually allocates a significant component to the US, Europe and Japan as these regions are large economically and by size of their equity markets. However, allocations to stocks in countries like India tend to be limited to 1 or 2. This method would only be appropriate if you have no particular interest or view specifically on India. Once you have decided which Fund or ETF you would like to use, it’s pretty simple. You can fill out an application form directly from the firms website or if it’s an ETF, you use your broking account to place a trade via the exchange. If you receive advice from a Financial Adviser, then you should speak to them about how best to implement your investment view, if you want to do so. Financial Advisers quite often implement their financial advice via an investment platform, so the Fund or the ETF would need to be onboarded on that platform.

India 2030: A look into the future of the world’s fastest growing economy

- admin

- October 7, 2024

- 0 Comments

India’s GDP reached US$3.9 trillion as at the end of fiscal 2024 (March), placing it as the world’s 5th largest economy. Both Japan and Germany, which are slightly ahead of India are easily reachable over the next few years, which would carry India to the 3rd largest economy in the world, behind the US and China. India has the capacity to grow at a faster pace, with its GDP-per-capita currently below US$3,000, whilst the other economies in the top 5 all have a GDP-per-capita above US$30,000, except for China at US$13,000 – still a whopping 4.8x of India! At the current rate of GDP growth and inflation, it is expected India’s nominal GDP will top US$7 trillion by the end of the decade (around 5-6% of Global GDP). An increase in GDP-per-capita, as India dominates the world’s working age population, will lead to rising consumer spending and increased allocation to discretionary spending. The India 2030 Fund For investors, there are several sectors of the economy expected to participate significantly in India’s growth from here: India’s exports should lift from US$400 million per annum to close to US$1 billion by 2030. This will create significant employment, improve India’s economics, and build significant industry expertise and scale. It is expected that India’s component of high value manufacturing has been rising relative to its commoditised manufacturing. It is seeking to sit between China’s focus on technology and low-value manufacturing of the likes of Vietnam, Indonesia, Bangladesh and Philippines. Areas like the manufacture of Generic Pharmaceuticals is being dominated by India due to its expertise, scale, low-cost and skilled labour. INDIA 2030 FUND Energy transition will require significant investment (at a rate of US$600bn per annum to help India transition to net-zero by 2050. Significant investment is currently going into Solar, Wind, Hydro and Hydrogen. A shift towards a greater allocation of the household budget on premium goods and services as the middle class grows and household wealth rises. The shift is likely to be towards non-food and discretionary. Whilst rural India was deeply impacted by COVID-19 and remains weak, the potential for a recovery creates significant business opportunities – particularly given the digitisation and financialisation of India. Corporate earnings growth is more rapid and being driven by digitisation, M&A, exporting and capacity building. In this process resources are being allocated and leadership is being invested in. This growth is required to lift some 700 million people above the economic empowerment threshold, which means they will be able to participate fully in economic activities and make decisions on their financial well-being. The newly elected Government in 2024 (Narendra Modi led BJP) will need to focus on improving agriculture productivity, create jobs for young people as well as provide subsidies for Healthcare and Education to not place too big a burden on necessities for the bottom end of the pyramid. This will ease inflationary pressures for rural areas and will lead to increasing consumer spending on a larger consumer base.

- +61 2 9071 0124

- IA@indiaavenue.com.au

- India Avenue Investment Management Pty. Ltd. AFSL 478233 | ABN: 38 604 095 954 Level 4, 261 George Street, Sydney NSW 2000, Australia.

Quick Links

Subscribe

Get our monthly research and updates on our offerings that bring you valuable insights, opinion, and education.

© 2025 India Avenue Investment Management Australia Pty. Ltd. . All rights reserved.

Design and Developed by Aniktantra