India has been going through significant change under the Modi Government. Ratings agencies like Moodys view this as a positive medium to long-term to the economy. Investors with matching investment horizons should take note and look to accumulate their exposure to the capital markets of India accordingly. We hope you find value in our short note on Moody’s upgrade. Click Here To Download The Research Note

2017

Foreign Investment to Drive Growth in India

- admin

- November 13, 2017

- 0 Comments

The Make in India campaign was launched on 25th September 2014 by the Modi Government as an initiative to encourage both national and multinational companies to manufacture their products in India. The major objective behind the initiative was to focus on job creation and skill enhancement across various sectors in the economy. The Campaign is being led by the Department of Industrial Policy and Promotion (DIPP), Ministry of Commerce and Industry, Government of India. The end objective of the program is to promote and foster economic growth in India through increasing utilisation of the countriy’s young talent base and improving perception as a place to do business by eliminating bureaucratic processes and making governance more transparent, responsive and accountable… Click Here To Download The Research Note

Solving Emerging Market’s Growth Conundrum

- admin

- September 4, 2017

- 0 Comments

Whilst the world grapples with technological disruption, it seems many investors choose not to “disrupt” conventional investment practices despite several short comings. This is because investment thinking, which is fundamentally sound but unconventional, tends to be considered with greater discomfort, despite potentially being very rewarding. It is only when results have already been rewarding, that herd mentality follows. To take advantage of this, an investor needs to be open-minded and willing to tread off the beaten track to improve their portfolio’s risk-adjusted returns. One major issue facing investor portfolio’s today is the capital growth conundrum given low prospective returns. Whilst emerging markets have commonly been considered a solution to this conundrum, there has been a stark mismatch between expectations and reality. The theoretical prospect of high growth and uncorrelated returns has unfortunately not eventuated and is unlikely to do so going forward in its traditional construct. This paper looks to identify why the current emerging market approach has failed investors and identifies possible solutions to providethe desired growth and diversification one would expect from investing in emerging markets strategies. Click Here To Download The Research Paper

Socially Responsible Companies in India. It’s the law

- admin

- July 24, 2017

- 0 Comments

This may come as a surprise, but guess which country was the first to legislate social responsibility for corporations? India! Indian companies are engaged in several projects that are meaningfully impacting the lives of India’s poor and the surrounding environment. Unfortunately, you don’t hear about this in the Australian media. Corporate governance reforms in India have been primarily based on the “Anglo Saxon model” of governance, which adopts principles from the UK’s Cadbury Report, the OECD principles of corporate governance and the US’s Sarbanes Oxley. Corporate social responsibility is a significant part and the key requirements include; Companies meeting a certain size are required to spend at least 2% of their average net profits during their previous three financial years on socially impactful activities The Board’s annual report to shareholders is required to provide details on the company policy developed on corporate social responsibility activities undertaken during the year The Board shall appoint a Corporate Social Responsibility Committee of three or more directors, with at least one of them being independent A significant holding in our portfolio and prime example of corporate social responsibility is Hindustan Unilever. A merger between the Dutch-British consumer goods giant Unilever and two local players in India in 1933. It is the largest FMCG company in India by sales as it has the widest portfolio of products and the broadest distribution reach, with 8 million outlets. This reach means it is able to provide products for over 700 million Indian consumers who use their products, with over 40% of its sales coming from rural India, among the highest proportion for FMCG companies operating in India. The tailwinds for the India consumption story, particularly within the rural segment is substantial given inflation has receded from over 10% in 2012 to below 3% currently, a favourable monsoon environment last year and what is forecast for 2017 has also provided much impetus to the rural sector. Additionally, there are several government schemes which are aiding the consumption growth outlook as a greater sense of equality is sought across the nation. Furthermore the 2019 election is likely to see several pro-consumption, pro-rural policies, particularly in the FY18 budget given 70% of the Indian population are part of the rural economy. Source: Hindustan Unilever Company Reports The confluence of positive factors and significant reach to most of India, uniquely positions Hindustan Unilever to make a meaningful difference to society. The company has undertaken several sustainable initiatives which have long-term benefits for the economy and its population rather than focus purely on the wealthier segment of India. Several of these initiatives cover significant environmental and social matters and are described below. Empowerment of Women Women empowerment is a strong drive in India. (For example, the corporation act legislates that there must be at least one woman director on the board) Hindustan Unilever have commissioned a project called project Shakti (strength) which works towards changing lives of women in rural India. They have trained thousands of women across villages in a bid to develop an entrepreneurial mindset and make them financially independent and more empowered. Source: Hindustan Unilever Company Reports Sustainable living Hindustan Unilever has also created an urban water, hygiene and sanitation community centre in one of the largest slum areas in Mumbai. This includes toilets, clean showers and safe drinking water. Fresh water is used for brushing, bathing, handwashing and laundry while the waste water from these activities are used as input for flushing toilets. This is expected to save around 10 million litres of water per annum. Another example, is the development of a new process of manufacturing soap based on ‘Plough Share Mixer’ technology. This eliminates the need for steam in soap making and cuts carbon emissions by 15,000 tons per year. Clean India Furthermore, in partnership with the Bill & Melinda Gates Foundation, the company has used their leading toilet cleaning brand, Domex (which we know as Domestos here and globally) to help build over 70,000 toilets in rural households across India. They have also launched the Swachh Aadat, Swachh Bharat (Clean Habits, Clean India) programme in line with the Government of India’s Swachh Bharat Abhiyan (Clean India Mission) to promote health and good hygiene practices. In India, over 130 million people were reached by December 2016 through programmes on handwashing, safe drinking water and sanitation. Companies like Hindustan Unilever are very much part of the better livelihood for the broader population across India. Investing in businesses like this one are likely to provide India’s youthful and aspiring population an opportunity for inclusiveness in the transition and transformation of India. To find out more on Hindustan Unilever’s sustainable living plan visit https://www.hul.co.in/sustainable-living/ Click here to read this article on Live Wire.

Why You Don’t Invest in India

- admin

- July 17, 2017

- 0 Comments

Last week, Apple CEO Tim Cook told analysts that “India is moving fast. They are moving at a speed that I have not seen in any other country in the world.” Despite this and many other positive endorsements, investors often procrastinate and identify reasons not to invest in India’s growth. In this wire, we seek to dispel those reasons. 1: “INDIA IS A CORRUPT COUNTRY” “Not one single country, anywhere in the world, is corruption free”. This is the title of the first chapter in the Corruption Perception Index Report of 2015. India is not an exception, however, what is changing is the focus on reducing corruption. This is evident by the monumental support of Prime Minister Modi’s pledge against corruption. India’s focus has now moved on from pure enforcement of anti-corruption laws to prevention at the source, which is more effective at sustainably fighting corruption. One such successful strategy has been through the adoption of technology. We list some of the other initiatives and developments below: Over one billion Indian citizens have been issued unique identification numbers known as Aadhaar. This is not simply a tax file number, but it enables authentication of an individual using biometric and iris eye scanning technology! In fact, it has been used successfully in enabling the direct transfer of social benefits and thus eliminating the scope for corruption from middle men. Over 4 billion transactions have been completed using this platform. Physical inspections by enforcement agencies like customs are now being replaced by digital scanners and camera’s saving time and reducing the potential for corruption. Higher transparency through e-tendering is expected to reduce the scope for corruption in awarding of government contracts. The Reserve Bank of India (RBI) is pushing a move towards a cashless society by focusing on development of new electronic payment systems and issuing licenses for new payment banks. Payments through non-cash electronic channels have increased from AU$400 billion in 2011-12 to AU$1.3 trillion in 2014-15 The emergence of organised retail through Departmental stores, Hypermarkets and Online Retailing is helping reduce cash transactions, a source for “black money”(unaccounted for money) in the economy 2: “I MAY NOT GET MY MONEY BACK” The regulatory framework in India’s financial markets is in compliance with the OECD Principles, an international benchmark for securities markets regulation. The World Bank in its report titled “Doing Business 2015 Going Beyond Efficiency” has ranked India 8th in respect of minority investor protection ahead of countries like the US and Australia. Furthermore, the International Organisation of Securities Commissions (IOSCO) and the Bank for International Settlements (BIS) has rated India’s regulatory framework for financial market infrastructure at the highest score of ‘4’ for all eight parameters assessed on a scale of one to four along with only five other countries globally including Australia, Brazil, Hong Kong, Japan and Singapore. India has over 6000 companies, making the equity market the largest in the world in terms of number of listed companies. In fact, it has a settlement cycle of T+2 with average daily traded volumes of AU$4.5bn and a market cap larger than Australia at over AU$2tn. To put the size into perspective, we have compared the Indian stock market to the Australian Stock market below. India vs. Australia: Average Market Cap 3) “I HEARD THERE IS LACK OF REFORMS AND THE PACE OF DEVELOPMENT IS SLOW” India’s progress is quite often assessed by its “perceived” pace of reform execution. Note the word perceived, as the media is quite negative in its assessment of the pace of reform. Unfortunately, investors’ view on Modi can be tainted by this. However, given India is the world’s largest democracy, this is probably a hasty assessment. In fact, there is an interesting website, which tracks the progress on India’s reforms: (view link). The website tracks 30 of India’s reforms as either complete, in progress or incomplete. This transparency is unprecedented, even in developed markets. So is development in India really slow? Whilst the pace has certainly picked up, change needs to be considered long-term as the process of reforming such a large and heterogeneous economy is nuanced, involving a diverse set of states and industries. However, Modi’s Government is putting the right bricks in place, which should pave the way for handsome dividends over the next decade. One example is the implementation of GST, the country’s single biggest tax reform. Once rolled out, it will be driven by the principle of one nation, one tax doing away with multiple indirect taxes and economically unifying India by transforming it into a single market and a free trade economic zone for producers based inside the country. This is likely to add percentage points to GDP growth over the next few years. 4) “INDIAN MARKETS ARE TOO RISKY” During the global financial crisis, corporate earnings in India were resilient, even though price-earnings multiples fluctuated wildly due to global events. However, if we take a longer-term perspective, equity returns from India have rewarded investors who have ignored short-term volatility and not made irrational, myopic investment decisions. Those that choose to ignore short-term sentiment and focus on correctly identifying companies or markets that are experiencing strong and sustainable earnings growth can create significant wealth. Despite India’s higher price volatility, the US has experienced substantially higher volatility in its earnings (nearly 3x as much as India). Ignoring short-term price volatility, In Australian dollar terms, India has delivered returns of 12.7% p.a. compared to the S&P500’s 5.3% p.a. over the last 15 years which equates to 385% difference over the period. India is a prime example where companies have generated substantial and sustainable earnings growth over the long term. Indian corporates have consistently managed to maintain a high return on equity (RoE). In fact, the RoE of Indian companies was above 14% even during the crisis period as companies were able to capitalise on resilient local consumer demand to offset much of the weak global sentiment. Indian companies exhibit a very favourable combination of strong RoE and low earnings volatility compared with other markets

India’s Tryst with GST

- admin

- June 30, 2017

- 0 Comments

India’s wait for over 30 years to implement the country’s single biggest tax reform measure, the Goods and Services Tax (GST) will end on 1 July 2017, providing a big push to prime minister Narendra Modi’s reforms agenda. Indian GST will be driven by the principle of one nation, one tax and will replace multiple indirect taxes in India, the third largest economy in Asia. It will economically unify India by transforming it into a single market and a free trade economic zone for producers based inside the country. GST is a destination based tax that subsumes (Exhibit 1) various indirect taxes at the central and the state level including excise duty, service tax, value-added-tax, octroi, entertainment tax, luxury tax and other local taxes. GST is designed to remove the cascading impact of taxes (by making available input credit across the value chain), introducing uniform tax rates across states, simplifying tax administration by having minimal tax slabs and broadening tax base. Exhibit 1: Taxes to be subsumed Centre Level State Level Central Excise Duty State Value Added Tax Additional Excise Duty Entertainment Tax Central Sales Tax Octroi and Entry Tax Service Tax Purchase Tax Countervailing Customs Duty (CVD) Luxury Tax Special Additional Duty of Customs Taxes on Lottery, Betting and Gambling Central Surcharges and Cesses State Surcharges and Cesses Source: Antique GST will cover all goods and services, except alcohol. Currently, there will be no GST levy on petroleum products, real estate, and electricity. GST in India will comprise of four basic rates 5%, 12%, 18% and 28%. 81% of the items covered under GST will attract a tax rate of 18% or lower (Exhibit 2). The proposed tax rates under GST are either very close to or below the current tax incidence. Exhibit 2: Applicable tax rates and percentage of items in each slab Rate Slab % of items 0% / Exempt Slab 7 5% 14 12% 17 18% 43 28% 19 Source: MOSL The roll out of GST will benefit the economy, Indian corporates, the consumer and the Indian equity market. A National Council of Applied Economic Research (NCEAR) study suggests that GST could boost India’s GDP growth by 0.9-1.7 per cent. Dual monitoring and real-time matching of supplier and purchaser will reduce tax evasion. Withdrawal of various exemptions, presently offered on Central and State government taxes will reduce the annual tax revenue loss to the exchequer of up to approximately AU$66bn. The additional tax revenue will improve India’s tax to GDP ratio and fiscal health significantly. A uniform tax across the country will improve the ease of doing business in India and minimize the opportunity for corruption. Competitiveness of manufacturers will increase (will provide a boost to Make in India program) as the cascading effect of taxes will be eliminated and input tax credit will be available across the value chain. Further, lower tax rates will also lead to volume gains. India will be a single market wherein, companies will be able to move and sell their products freely (earlier a logistical nightmare) across states, increasing the overall activity in the economy. A study had shown that border checks, result in Indian trucks driving 280km a day, which is 35% of the 800km that a truck travels in the US. The dismantling of border checks (intra and inter-state) will remove one of the main sources of corruption in the movement of goods. The increase in average distance covered in a day, the reduction in corruption and the doing away of the requirement of multiple warehouses/depots will bring down the logistics cost in India significantly. Currently, logistics costs in India are 3 to 4 times the international benchmarks. With rates being near to the existing rates of tax incidence, GST will largely be non-inflationary. While there has been some divergence from expectations in terms of the final rates of GST, the divergence is non-disruptive. Some categories of products of mass consumption will benefit due to marginally lower rates of taxes, whereas most services including restaurant bills, mobile bills, travel, insurance premium, etc. will be subject to slightly higher than existing rates. The final impact of any increase in tax on prices though will depend on the degree to which input tax credit can be availed across the value chain. The rollout of GST will be a very positive development from the equity market perspective. The market will view the development as the ability of Prime Minister Modi led NDA government to push forward important reforms. In the short term though, companies and their distribution channels will face one-time costs in switching to the new system and there could be some interim disruption of activity. Additionally, there is likely to be a market share shift to the organised segment from unorganised. The previous economics of operating in cash carried an uneven playing field which supported businesses. Now on a level playing field, organised business which is more likely to be publicly listed should benefit through improving economics and market share. SECTORAL IMPACT: Sector Current GST Impact Consumers 22 to 26% GST rate of <=18% is positive to most companies; improving competitiveness from supply chain efficiency Auto 30-49% Neutral, tax rates @ 28% + cess are broadly same Construction Material 22-28% Neutral, tax rates @ 28% is broadly same Capital Goods 22% GST @ 18% will be beneficial for consumers Telecom / Insurance 15% GST @18% will increase the cost of service for consumers Logistics Organised logistics business is primarily export-import based Reduction in inter-state barriers will increase inter-state commerce and hence the requirement for logistics support Source: MOSL

Modi Government Leading India to Success

- admin

- March 13, 2017

- 0 Comments

Three years is a long time in politics. A lot can be achieved in that time despite being the ruling party in the world’s largest democracy with an underlying sentiment of cynicism on any change being implemented successfully. In fact, if you quiz India’s media on Modi’s success the response would be highly polarised. The latest measure of Modi’s success can be gauged through his party’s (BJP) landslide victory at the polls on the weekend. The BJP won approximately 325 of 403 assembly seats in a state election of significance in Uttar Pradesh (UP), India’s most populous state, with over 200 million people. UP sends 80 legislators to the 545-seat parliament, positioning Modi well at the next national election campaign in 2019.The result is a stunning endorsement of Modi’s popularity, reform initiative and hard-line towards addressing the issues India grapples with such as poverty, corruption and lack of a mandate to execute politically. It also indicates that Modi’s well discussed Demonetisation initiative launched late in 2016, cancelling 86% of India’s high value notes, did little to impact the growing sentiment towards Modi as the leader who can shape India’s future and improve global perception. Modi’s scorecard since being elected in 2014 showcases the following: Passing GST through the lower and upper house for implementation in 2H17 Reform initiatives such as Housing for all, Make-in-India, Smart Cities, Electrification, Swachh Bharat (cleaner India), Skill India, Digital India Demonetisation which focused on reducing the usage of cash for payments Increasing political popularity, particularly is significant states like UP. This should lead to a majority in both the Lower House (already in place) and the Upper House. It remains to be seen whether Modi Government now takes on the challenge of broader market reforms like labour laws and land ownership, which if it can be addressed, would really open the doors to more significant foreign investment. Given the likelihood of a second term increasing (2019-2024), it is expected that we could be in for more bold decision making and greater follow through on reforms already commenced. Whilst Indian equities may appear expensive to the naked eye at 18x FY18 earnings (12 months forward), we are likely to see a positive re-rating based on the fact that private investment and capex will benefit from improving sentiment and greater continuity from BJP’s execution. In our view this is likely to lead to an increase in the “e” component of the P/e, pushing prices upwards based on fundamental earnings growth – now that’s rare in a global equity market today that requires share buybacks and broader capital management to support its price. India Avenue’s view: We see the election victory by Modi’s BJP party as a clear sign that there is great belief on his political execution and moral authority. This sets the tone for another victory in 2019 at the National Elections, allowing the party a significant period to execute on its promises.Regardless of the starting point, we foresee three to five years of strong equity market returns henceforth given a more unified India under the Modi Government. Since Demonetisation local investors have also focused significantly on equity markets given the challenges of Property and Gold investing as well as falling interest rates.

Wealth Creation Through India’s Equity Market

- admin

- March 1, 2017

- 0 Comments

The positive macroeconomic environment and outlook for the Indian economy has attracted a lot of attention, particularly from large foreign investors like the Norwegian Sovereign Wealth Fund and Canada’s Pension Plan Investment Board. However, monetising this opportunity has largely been derived from sophisticated and well-informed investors. This has been primarily due to lack of awareness and information on India for most of the global investing community.The other requirement has been obtaining a Foreign Portfolio Investor (FPI) license to trade onshore Indian securities. This report attempts to familiarise Australian and NZ investors on the local equity markets in India: Breadth and depth of India’s equity markets; Historical performance; Key drivers of the Indian equity market; and Select corporate India success stories While most global investors look at India from a top down perspective, its true worth is not appreciated unless abottom up, fundamental approach is taken. This has been the optimal way for significant wealth creation. Click Here To Download The Research Paper

How Spicy is Your Portfolio

- admin

- February 3, 2017

- 0 Comments

Exposure to true growth investments is becoming scarce in today’s world. This makes wealth creation and meeting portfolio objectives that more challenging. We believe exposure to selective growth investments in an investment portfolio will become increasingly critical as these allocations drive the bulk of the returns going forward. Therefore, we encourage Australian and NZ investors to rethink their current portfolio by adding some spice to it. Click Here To Download The Research Note

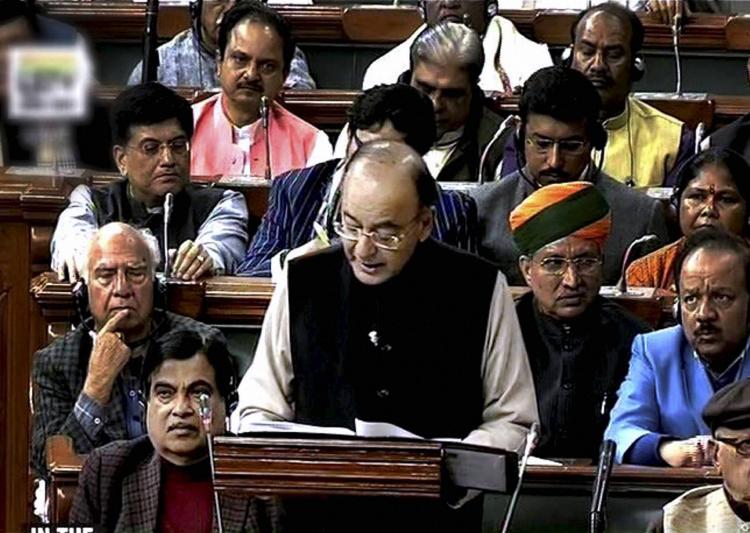

India Budget 2017-18: Many Firsts, A Move in the Direction of Transformed, Energised and Clean India

- admin

- February 2, 2017

- 0 Comments

India Budget 2017-18 contained many firsts. This was the first time the budget was presented on 1st February as compared to the conventional practise of presenting it on the last day of February, enabling Ministries to operationalise all activities from the commencement of the financial year. Second, the practise of presenting separate Railway budget was done away with and was merged with the general budget to bring Railways to the centre stage of Government’s Fiscal Policy and thirdly the complex and confusing classification of plan and non-plan expenditure was removed to facilitate a holistic view of allocations to different sectors and ministries. India’s Finance Minister Arun Jaitley’s (FM) agenda for 2017-18 has been to transform the quality of governance and quality of life in India, energize the youth to unleash their true potential and clean the country from the evils of corruption, black money and non-transparent political funding. To achieve this, the FM announced a series of measures, including: Increased spend in rural, agricultural and allied sectors (Allocation of AU$37.5 bn, up 24% YoY), Enhanced thrust on infrastructure build (AU$80 bn spend, up 25%), Learning outcome based skill building programs for youths, A thrust on the digital economy to rein in on the menace of corruption and A new path breaking clean direction for political funding in India. The FM has tried to achieve the above, while observing fiscal prudence and maintaining a lower market borrowing of AU$70 bn as against last year AU$85 bn. The fiscal deficit for 2017-18 is targeted at 3.2% of GDP with the government being committed to achieving 3% in the following year. Some of the key budget proposals are listed below. KEY BUDGET PROPOSALS: Agri & Rural ThrustProvided for record agricultural credit of AU$200 bn, increasing coverage of crop insurance and doubled the corpus of irrigation development fund to AU$8 bnIncreased Rural Employment Guarantee (MNREGA) allocation from AU$7.7 bn to AU$9.6 bnIncreased rural housing allocation from AU$3 bn to AU$4.6 bn for building 10 mn houses for poor Infrastructure Push Planned AU$26 bn (up 8%) of Capital and development expenditure by Indian Railways for modernising and upgrading its network, of which AU$11 bn will be provided as budgetary supportIncreased budgetary allocation for construction of highways from AU$11.5 bn to AU$13 bnInfrastructure status to affordable housing Relief to Foreign InvestorsBoost to Foreign investments by abolishing the Foreign Investment Promotion Board (FIPB)Concessional withholding rate of 5% charged on interest earnings by foreign entities on Indian bonds and government securities extended to 30.06.2017Foreign Portfolio Investors (FPI) category I & II exempted from indirect transfer provisions. Other Significant ProposalsSteps to increase digital transactions including a proposal to mandate all government receipts through digital means beyond a prescribed date and ban on cash transactions above AU$6,000.Political funding above AU$40 to be received only through digital mode, cheque or the newly proposed electoral bondsAllowable provision for non-performing assets (NPA) of banks increased from 7.5% to 8.5% and interest will now be taxed only on the actual receipt instead of accrual basis.Holding period for computing long-term capital gain on real estate reduced from 3 to 2 years and base year for indexation shifted from 1.4.1981 to 1.4.2001Reduced tax rate to 25% (earlier 30%) for companies with annual turnover of upto AU$10 mnPersonal income tax relief of 5% provided to lowest tax bracket (AU$ 5,000 to 10,000) of individual assesses and 10% surcharge imposed on higher tax bracket assesses between AU$100,000 and AU$200,000.No major changes in indirect taxes, ahead of GST rollout OUR VIEW: The budget strives a balance between government spend to accelerate growth (in the backdrop of the slowdown due to demonetisation) and fiscal prudence, while providing a roadmap to a transformed and clean India. Consumption driven growth has been provided a push by infusing a reasonable amount of allocations into rural India. The rural thrust in the budget though was quite pragmatic in its approach and was not populist to appease the voters in five election bound states, as was widely expected. The lower tax rates at the bottom of the pyramid should help provide a boost to consumption demand. Lower taxes on mid and small size companies should improve the health of these sector, which was severely impacted due to the economic slowdown as well as demonetisation. This should also increase the employment in the sector and provide a boost to consumption. The thrust on infrastructure will provide the necessary investment driven boost to the economy enabling it to grow comfortably in the range of 6.75% to 7.50% envisaged in the economic survey published a day prior to the budget. Doing away with bureaucratic hurdles like the FIPB and clarity on FPI taxation provides comfort that the government is serious about improving ease of doing business in India. The budget did take cognizance of the fact that Tax to GDP ratio is very low. Of the 37 million individuals filling tax only 2.4 million individuals show income of above AU$20,000, contrasting this data, over 3 million cars get sold annually in India and over 20 million individuals travelled overseas either on business or vacation. This implies that India is largely a tax non-compliant society. The government is planning to use the data availed from the demonetisation exercise to increase the tax base. Tax compliance will also be sought by reducing the level of cash transactions in the economy and adoption of digital modes of payment. Benefits arising of demonetisation and increased tax base will reduce the fiscal burden and at some stage will also enable the government to roll out further developmental and social security schemes like universal basic income scheme talked in the economic survey. For now, though the FM had to be contained with a 3.2% fiscal deficit as compared to the planned fiscal deficit of 3.0% fro FY2017-18 in last year’s budget. This increase in fiscal deficit though may not be viewed negatively, as it is on account of increased capital expenditure and amalgamation of the Indian Railways. The introduction of electoral bonds and

Categories

- Articles (45)

- Events (1)

- India Avenue in Media (1)

- Livewire Articles (9)

- Media (117)

- Our Research (103)

- podcast (4)

- Uncategorized (2)

- Videos (78)

- +61 2 9071 0124

- IA@indiaavenue.com.au

- India Avenue Investment Management Pty. Ltd. AFSL 478233 | ABN: 38 604 095 954 Level 4, 261 George Street, Sydney NSW 2000, Australia.

Quick Links

Subscribe

Get our monthly research and updates on our offerings that bring you valuable insights, opinion, and education.

© 2025 India Avenue Investment Management Australia Pty. Ltd. . All rights reserved.

Design and Developed by Aniktantra